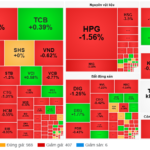

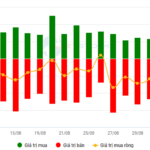

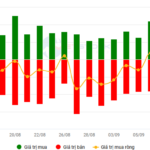

The stock market on September 10 headed towards the 1,650-point range after a low-liquidity recovery session. Liquidity continued to decline sharply, and the main index faced adjustment pressure to 1,630 points before recovering. The VN-Index closed up 5.94 points (+0.36%) to 1,643.26. Foreign exchange trading became a downside, with a sudden net sell-off of VND 3,016 billion.

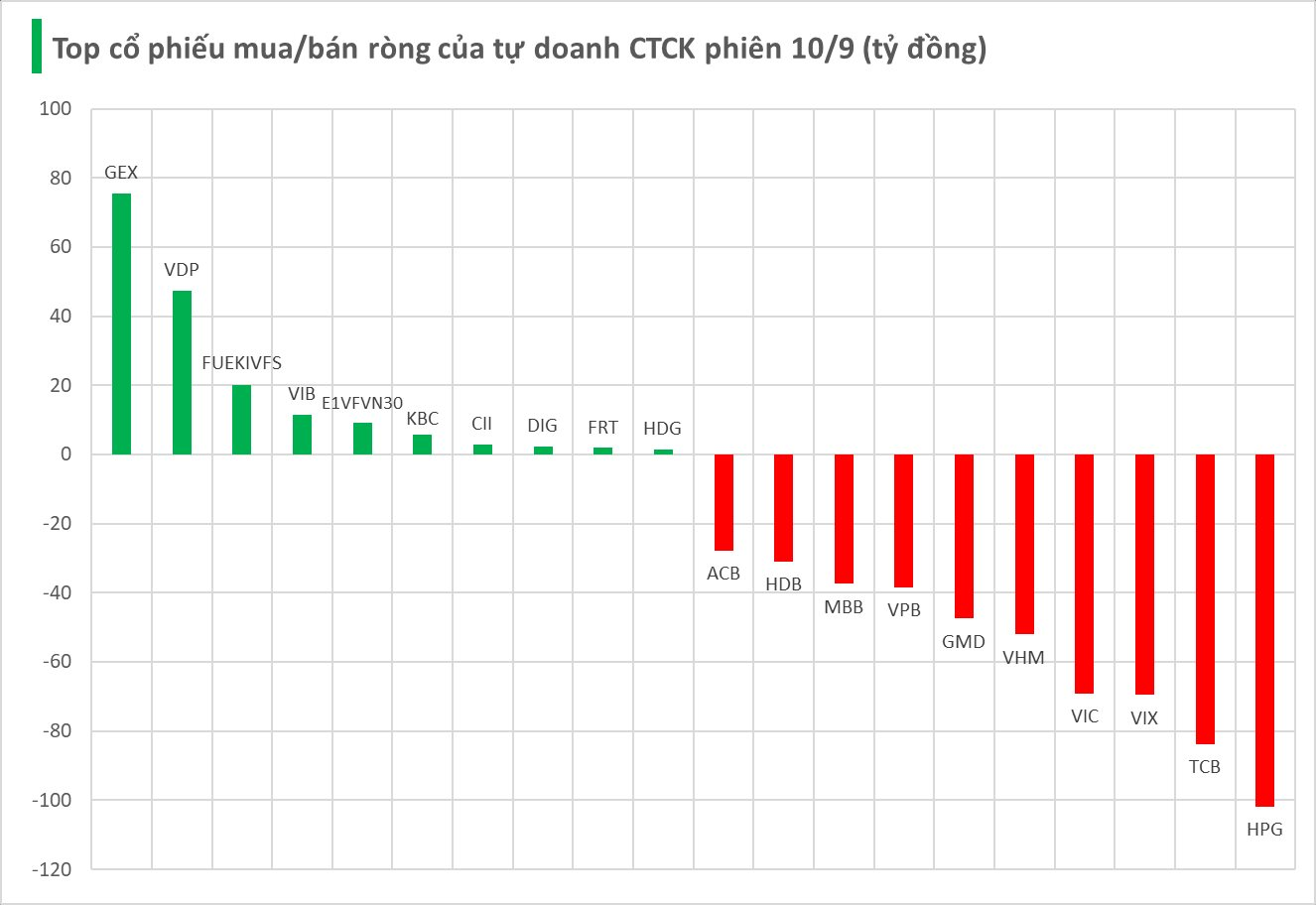

Securities companies’ proprietary trading net sold VND 688 billion on the HoSE.

Specifically, securities companies sold HPG with a value of -102 billion VND, followed by TCB (-84 billion VND), VIX (-69 billion VND), VIC (-69 billion VND), and VHM (-52 billion VND). Several other stocks also witnessed significant net selling, including GMD (-47 billion VND), VPB (-38 billion VND), MBB (-37 billion VND), HDB (-31 billion VND), and ACB (-28 billion VND).

On the buying side, GEX was the most net bought stock with 75 billion VND. VDP ranked second in the securities companies’ proprietary trading buying list with 47 billion VND, followed by FUEKIVFS (20 billion VND), VIB (12 billion VND), E1VFVN30 (9 billion VND), KBC (6 billion VND), CII (3 billion VND), DIG (2 billion VND), FRT (2 billion VND), and HDG (1 billion VND).

The Vingroup Stock Surge: Legal Action Against 68 Entities Takes Center Stage

The stock market witnessed a notable rebound after a brief corrective phase, with Vingroup’s stocks playing a pivotal role in this recovery.

Market Pulse, September 12: VN-Index Surges Nearly 10 Points Despite Foreign Outflows

The trading session concluded with significant gains, as the VN-Index rose by 9.51 points (+0.57%), closing at 1,667.26. Meanwhile, the HNX-Index also witnessed a notable increase of 2.33 points (+0.85%), ending the day at 276.51. The market breadth was strongly positive, with 581 advancing stocks against 216 declining ones. Similarly, the VN30 basket saw a slight edge for gainers, as 16 stocks climbed, 12 stocks dipped, and 2 stocks remained unchanged.

Cautious Optimism: Vietstock Daily’s Take on the Market Recovery

The VN-Index surged towards the end of the trading session, forming a prominent Hammer candlestick pattern. This indicates that the index remains firmly above the short-term trendline, which corresponds to the 1,615-1,625 range. However, a sharp decline in trading volume below the 20-session average suggests that investors are exercising caution. Meanwhile, the Stochastic Oscillator continues its downward trajectory after issuing a sell signal, departing from the overbought territory.

Stock Market Week Sept 08-12, 2025: The Roaring Comeback

The VN-Index extended its gains in the final session of the week, recovering all losses incurred during the week’s initial downturn with four consecutive rebound sessions. While the index staged a strong comeback, trading volume remained below the 20-day average, and persistent net selling pressure from foreign investors remains a concern in the near term.