## WHA Corporation PCL (WHA Group): A Diversified Business Group Thriving in Thailand

Founded in 2003, WHA Corporation PCL (WHA Group) has transformed from a small company into a diversified business group with a strong presence in logistics, industrial estate development, utilities, energy, and digital platforms in Thailand.

|

WHA’s Main Business Areas

Source: WHA

|

The group listed on the Stock Exchange of Thailand (SET) in 2012. Three years later, the group acquired Hemaraj Land and Development Plc, renaming it WHA Industrial Development Plc, to venture into real estate, utilities, power, and property solutions, becoming one of the largest such ventures in the country.

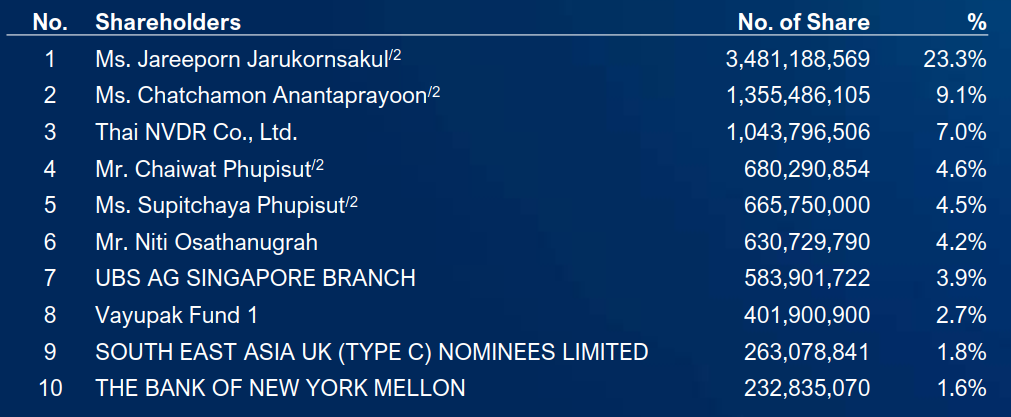

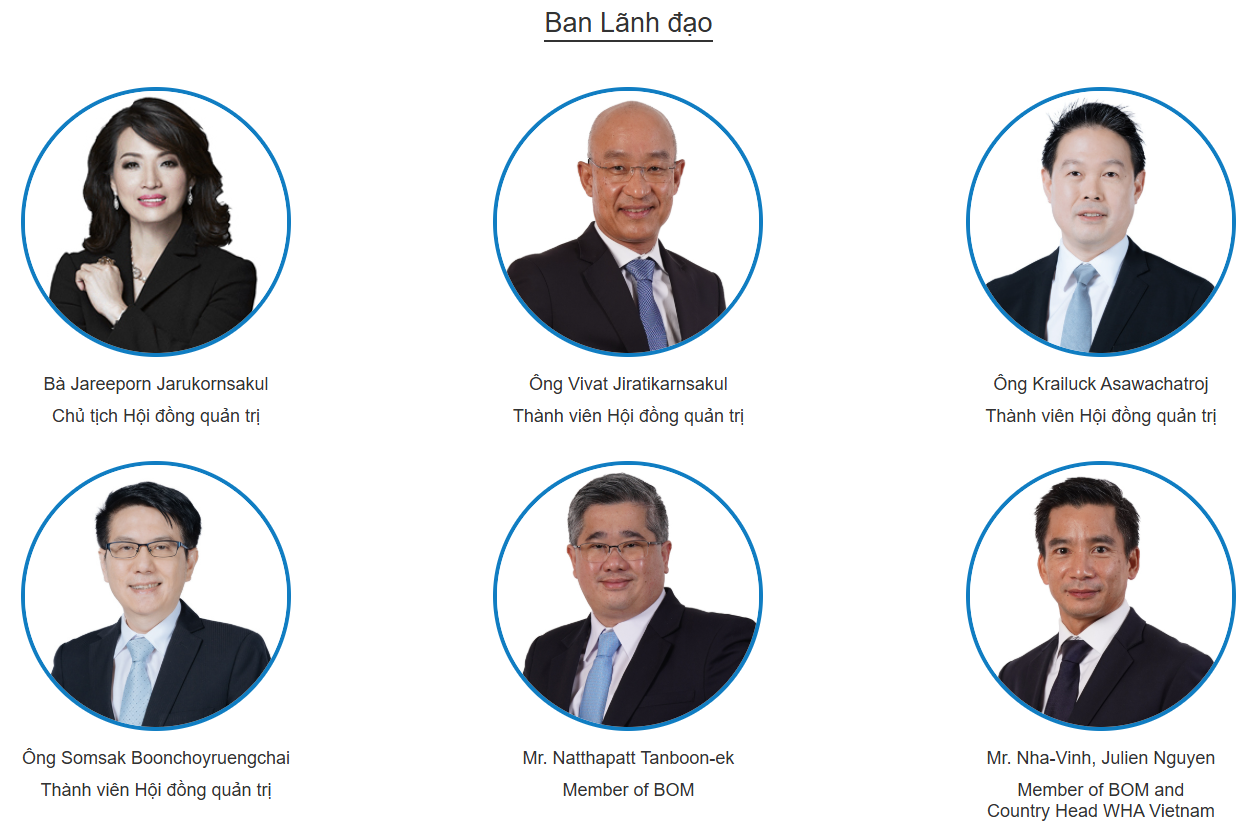

Currently, the group’s chairwoman, Jareeporn Jarukornsakul, is the largest shareholder, holding 23.29% of WHA Group’s shares.

|

WHA’s Shareholder Structure as of August 2025

Source: WHA

|

Source: whavietnam.com

|

Revenue Growth with a Slight Compression in Profit Margins

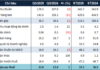

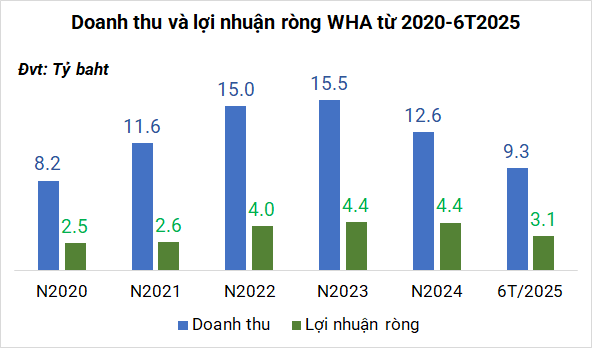

In the first half of 2025, WHA recorded consolidated revenue of over THB 9.3 billion (USD 288 million), a 32% increase year-on-year, with a net profit of over THB 3.1 billion (USD 97 million), a 24% increase.

In Q2 alone, revenue exceeded THB 4 billion (nearly USD 125 million), a 23% increase, but the gross profit margin decreased from 53% to 47% due to higher costs. The net profit was nearly THB 1.3 billion (over USD 39 million), a 15% increase.

Source: Author’s Compilation

|

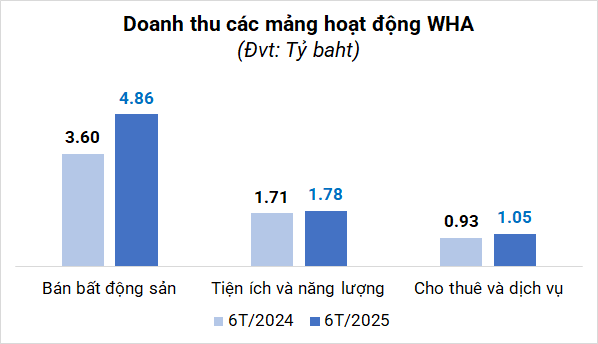

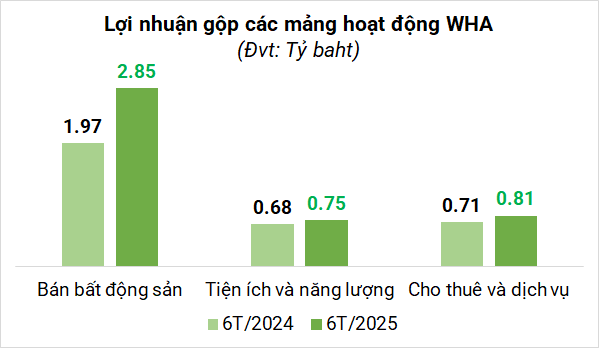

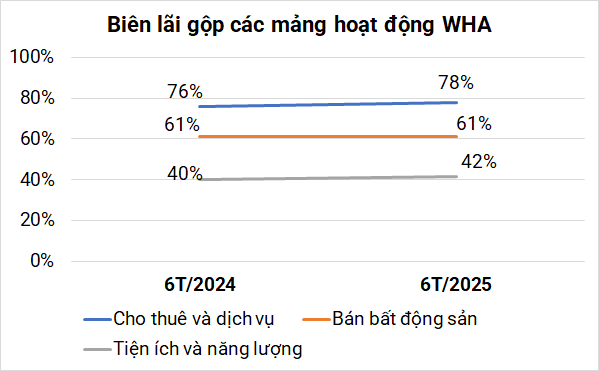

The industrial real estate segment contributed the most in the first half, with nearly 52% of total revenue, or nearly THB 4.9 billion (USD 150 million), a 35% increase year-on-year, and a gross profit margin of over 61%.

This growth was mainly due to improved land prices and continued high volumes of transfers from FDI investors, especially those relocating and expanding their businesses to Southeast Asia.

Source: WHA

|

The logistics segment generated revenue of over THB 1 billion (USD 32.4 million) due to high demand from customers. The group signed new built-to-suit and ready-built factory and warehouse leasing contracts totaling over 123,000 square meters, valued at nearly THB 2.2 billion (USD 66.5 million), along with short-term leasing contracts for over 46,500 square meters. Additionally, logistics service providers signed contracts to lease over 32,000 square meters of warehouse space, valued at over THB 1.3 billion (USD 40 million).

The utilities and energy (power and water) segment contributed nearly THB 1.8 billion (USD 55 million) in revenue, a 5% increase, with a gross profit margin of 42%. Specifically, in the water business, WHA recorded a total water sales volume in Vietnam (based on ownership stakes) of 18.6 million cubic meters in the first six months, thanks to increased sales from the Duong River project.

|

Source: Author’s Compilation

|

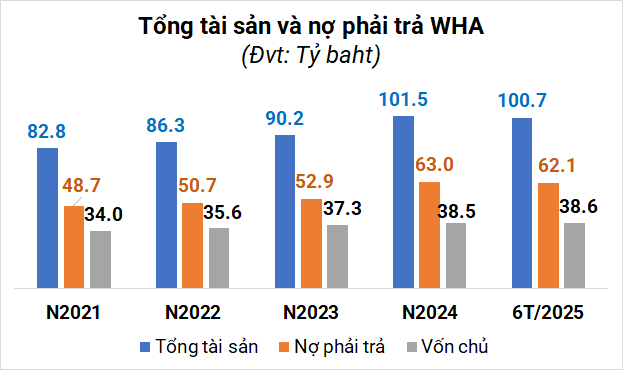

As of the end of June 2025, WHA’s consolidated total assets exceeded THB 100.7 billion (over USD 3.1 billion), a slight decrease of 1% from the beginning of the year. Of this, equity was over THB 38.6 billion (nearly USD 1.2 billion), debt was THB 62.1 billion (USD 1.9 billion), and capital was nearly THB 1.5 billion (USD 46 million).

Source: Author’s Compilation

|

Expanding Operations in Vietnam

As of the end of Q2, WHA operated 15 industrial estates in Thailand and one in Vietnam. The group is also developing seven industrial estate projects in Thailand, totaling over 1,400 hectares. The latest project, WHA Eastern Seaboard 5 (phase 1 and 2), spanning about 800 hectares, is being developed as an eco-smart industrial estate to support new-generation industries. The first land transfers are expected in Q1 2026.

In Vietnam, the group has developed 500 hectares of industrial land in WHA Industrial Zone 1 – Nghe An. Additionally, three supplementary projects totaling approximately 537 hectares are expected to be implemented in 2025-2026. WHA has also signed memorandums of understanding (MOUs) with Thanh Hoa, Danang, and Hung Yen provinces to develop industrial estates in the future.

In 2025, WHA aims to sell 376 hectares of industrial land. As of the end of June, the group had sold nearly 177 hectares, including 22 hectares in Vietnam.

Additionally, the group has nearly 235 hectares of land awaiting transfer and a pipeline of approximately 228 hectares in LOIs/MOUs. WHA has signed a land purchase agreement with Beijing Haoyang to build the largest data center in ASEAN, valued at nearly THB 72.7 billion.

In the logistics segment, the group’s first logistics center in Vietnam, spanning 37,500 square meters in the Minh Quang Industrial Zone (Hung Yen province), has signed leasing contracts. WHA has also signed an MOU with Thanh Hoa province to explore developing a logistics project on a 48-hectare site.

A 120-Year-Old Foreign Fund Makes Its First Logistics Investment in Vietnam: Betting on Airport Cargo Handling at Noi Bai, Processing 250,000 Tons of Cargo Annually

This transaction was facilitated by the Emerging Markets Infrastructure Fund III (EMIF III), with VinaCapital’s logistics-focused fund, LogiVest, playing a pivotal role in the process.