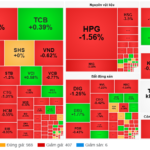

Despite a slight recovery in the VN-Index, the overall market liquidity continued to decline, indicating investors’ cautious sentiment. The market witnessed a broad-based differentiation, with a majority of 171 stocks on the HoSE falling.

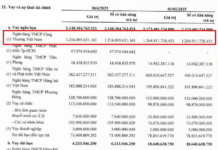

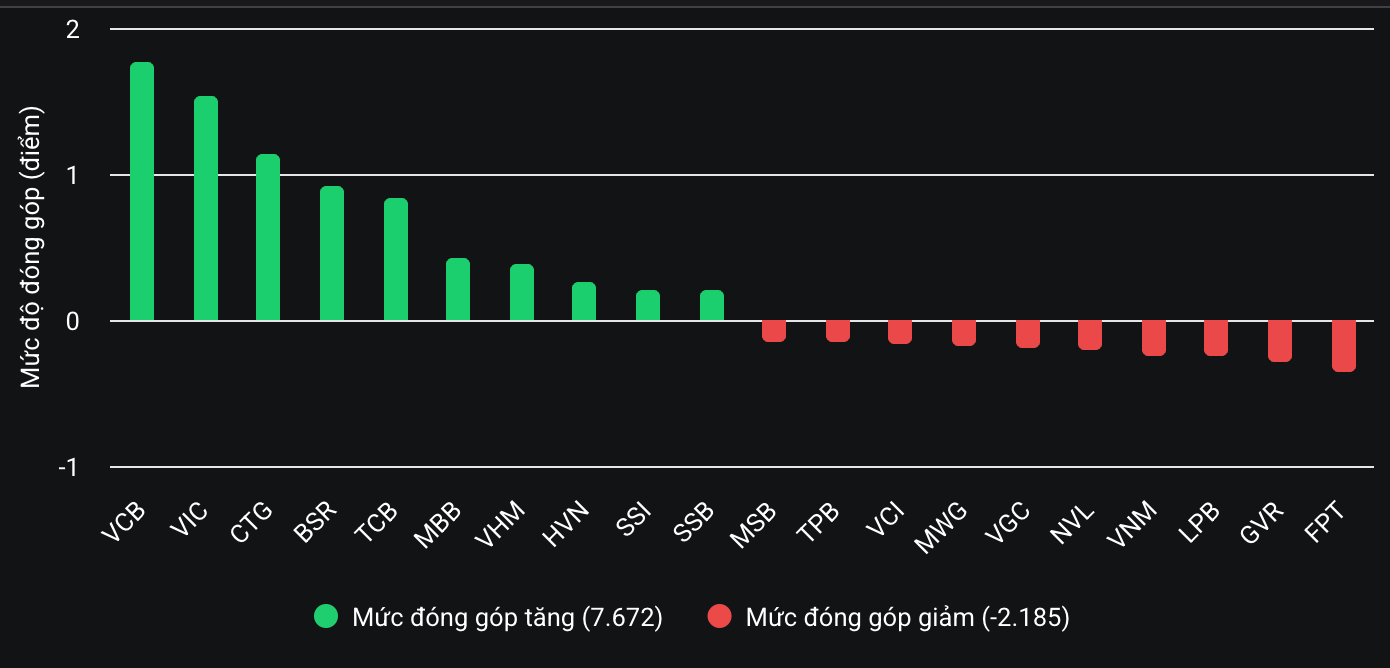

The banking sector pillars maintained their gains but did not create a breakthrough. CTG, VCB, TCB, MBB, and VPB all rose by around 1%, pacing the VN-Index. However, the increment was modest, and capital concentration remained narrow.

The banking sector pillars maintained their gains but fell short of a breakthrough performance.

Securities stocks witnessed more active trading, with SSI, VND, and HCM rising over 1%. SSI’s liquidity surpassed 43 million units, the highest on the exchange, with a corresponding value of over VND 1,800 billion. In the context of declining liquidity, only four stocks traded in the thousand-billion range: SSI, HPG, VIX, and TCB…

Real estate and construction stocks experienced strong differentiation. The Vingroup trio of VIC, VHM, and VRE posted slight gains, while many midcap stocks declined. DIG, NVL, DXG, PDR, CEO, KBC, and TCH underwent adjustments.

In contrast, oil and gas stocks outperformed the broader market, with BSR, PVC, PVD, and PVS all rising.

At the close, the VN-Index climbed 5.94 points (0.36%) to 1,643.26. The HNX-Index fell 0.22 points (0.08%) to 274.6, while the UPCoM-Index rose 0.48 points (0.44%) to 110.37.

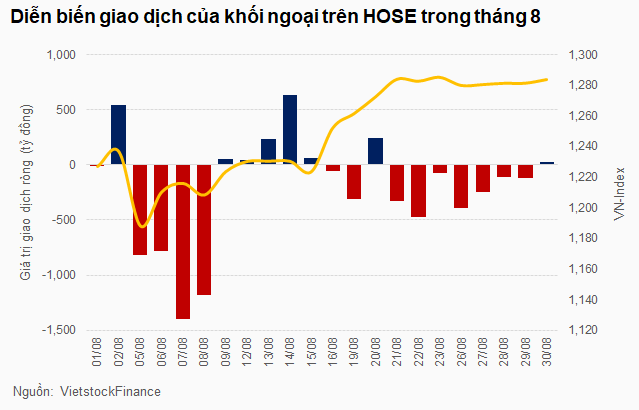

According to SGI Capital, the VN-Index has risen for five consecutive months since April, surging nearly 60% without a significant correction (over 10%). This is one of the fastest and most robust rallies in the history of Vietnam’s stock market, primarily driven by domestic capital.

This scorching rally reflects heightened expectations and supportive information, suggesting a potential 10-15% correction in the VN-Index. Investors are advised to prioritize portfolio restructuring and risk management during this phase to prepare for future significant opportunities.

Market Pulse September 9: Late Session Surge Fueled by Real Estate and Financial Stocks

The stock market witnessed a volatile session today, but a strong rally in the final 5 minutes of trading firmly established the day’s gains. At the closing bell, the VN-Index surged by nearly 13 points, finishing at 1,637.32, while the HNX-Index climbed over 3 points to reach 274.80.

Market Pulse, September 12: VN-Index Surges Nearly 10 Points Despite Foreign Outflows

The trading session concluded with significant gains, as the VN-Index rose by 9.51 points (+0.57%), closing at 1,667.26. Meanwhile, the HNX-Index also witnessed a notable increase of 2.33 points (+0.85%), ending the day at 276.51. The market breadth was strongly positive, with 581 advancing stocks against 216 declining ones. Similarly, the VN30 basket saw a slight edge for gainers, as 16 stocks climbed, 12 stocks dipped, and 2 stocks remained unchanged.

Cautious Optimism: Vietstock Daily’s Take on the Market Recovery

The VN-Index surged towards the end of the trading session, forming a prominent Hammer candlestick pattern. This indicates that the index remains firmly above the short-term trendline, which corresponds to the 1,615-1,625 range. However, a sharp decline in trading volume below the 20-session average suggests that investors are exercising caution. Meanwhile, the Stochastic Oscillator continues its downward trajectory after issuing a sell signal, departing from the overbought territory.