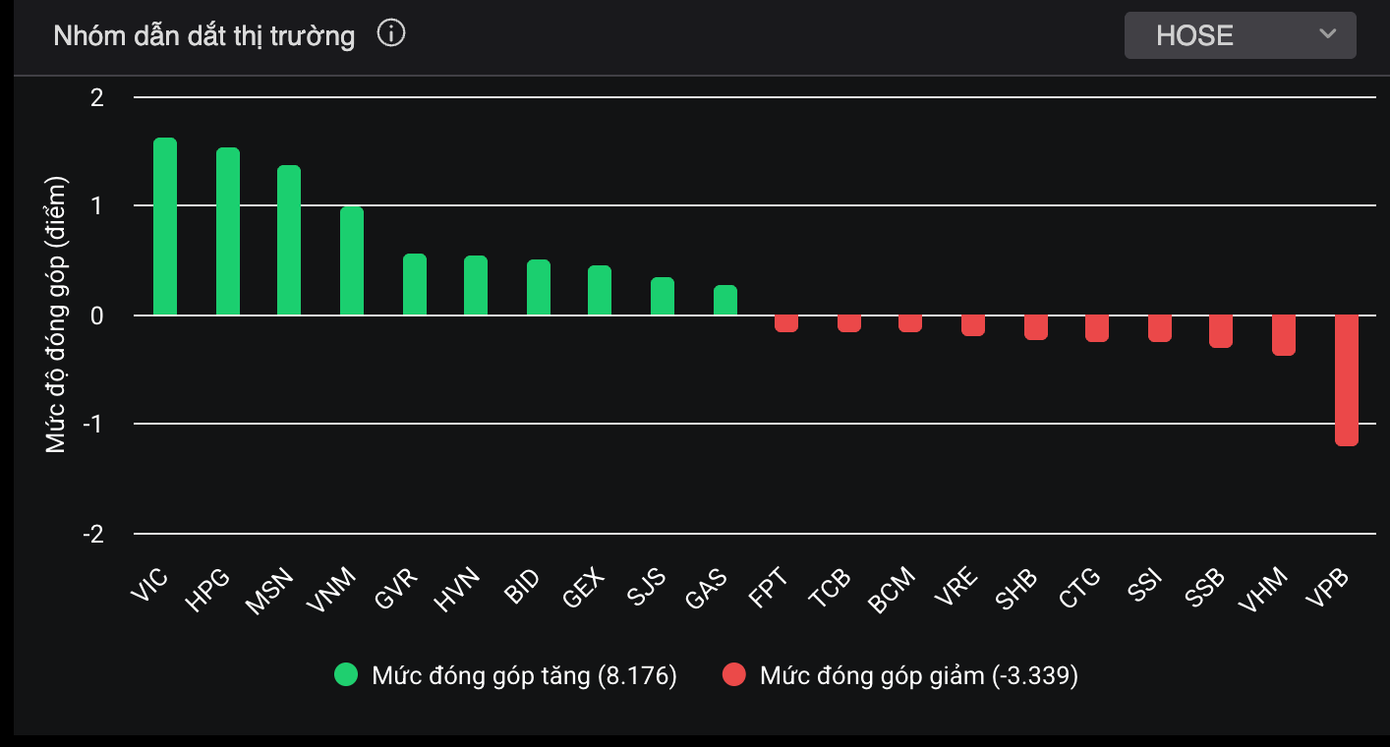

The market witnessed a green spread across various sectors, with real estate, steel, and consumer stocks being the main drivers. Leading the indices today was VIC, making the most positive contribution due to strong demand in the real estate sector. Following closely were HPG, MSN, and VNM as funds flowed into steel and consumer sectors. MSN broke out with a nearly 5% gain, the highest increase within the VN30 basket.

Steel stocks HPG, NKG, HSG, and POM rose in unison. HPG climbed 2.91% to 30,000 VND per share with the highest liquidity on the exchange, surpassing 3,100 billion VND, nearly double that of MSN in second place.

VIC leads the market drivers.

On the other hand, VPB exerted the most significant downward pressure after a long streak of gains. Additionally, SSB, SSI, and VHM were among those restraining the index’s upward momentum. However, the divergence within the banking sector wasn’t overly negative as VCB, ACB, and MSB managed to stay in positive territory.

Apart from the positive performance of stocks, the market also received crucial supportive information from the legal framework. The government has issued Decree 245/2025/ND-CP, amending and supplementing Decree 155/2020/ND-CP, to concretize the revised Securities Law (Law No. 56/2024/QH15). This move is seen as a decisive step to unblock foreign capital, enhance transparency, and lay the foundation for market upgrade.

The procedures for recognizing the qualifications of professional securities investors have been adjusted to align with the legal documents of foreign countries, making it more convenient for them to participate in private placements. The decree also ensures clearer protection of foreign shareholders’ rights by abolishing the provision allowing the general meeting of shareholders or the company’s charter to set a foreign ownership cap lower than that prescribed by law, thus gradually approaching the maximum openness committed internationally. Public companies have 12 months to complete the procedure for notifying the maximum foreign ownership ratio.

The process of assigning transaction codes to foreign investors has been simplified, allowing them to trade immediately upon confirmation by the electronic system, instead of waiting for a certificate as before. The State Bank has also reformed the procedures for opening capital and payment accounts, reducing the time and cost of market access.

Notably, foreign fund management companies are permitted to hold two separate transaction codes for proprietary trading and client asset management, in line with international practices and providing the basis for implementing the Omnibus Trading Account (OTA) model according to international standards.

Additionally, the legal framework for the central counterparty (CCP) mechanism has been improved and is expected to be operational from early 2027, bolstering the confidence of foreign investors in the market.

As per the plan, FTSE Russell will announce the annual market classification results on the morning of October 8, Vietnam time. With the legal framework gradually falling into place, investors anticipate that Vietnam will soon make progress in the market upgrade process, thereby broadening the gateway for foreign capital inflows.

At the close of the trading session, the VN-Index rose 9.51 points (0.57%) to 1,667.26, the HNX-Index climbed 2.33 points (0.85%) to 276.51, and the UPCoM-Index was almost unchanged, edging down 0.01 points (0.01%) to 110.09. Liquidity eased slightly, with the trading value on HoSE exceeding 33,720 billion VND.

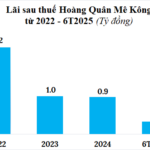

Profitable Yet Modest: Unraveling HQC’s Billion-Dollar Receivables Tangle

In the first half of 2025, Hoang Quan Mekong reported a modest profit of over VND 315 million. However, with a hefty VND 500 billion bond burden and cash flow pressures, the company’s business outlook remains challenging.

Unveiling the 3 Major Real Estate Tycoons in Ho Chi Minh City with Outstanding Tax Debts

In the latest list of major tax debtors revealed by Ho Chi Minh City’s Tax Department, three real estate businesses top the chart with a combined debt of over 100 billion VND. These companies, all operating in the realm of real estate investment and development, now face public scrutiny as their substantial tax liabilities come to light.

“Hoà Phát’s Profit Forecast for H2 2025: A Bullish Outlook with Expected 42% Growth”

SSI maintains a positive outlook for HPG’s net profit growth for the second half of 2025 and full-year 2026, projecting increases of 42% and 29%, respectively, compared to the same periods last year. This optimistic forecast is attributed to the contribution of the new capacity from the Dung Quat 2 plant, as well as improved prospects for steel prices.