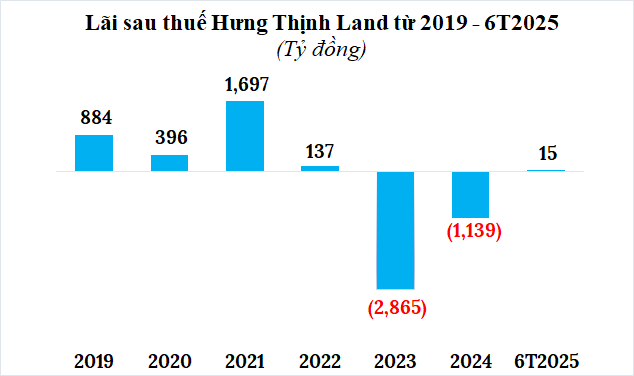

Hung Thinh Land JSC (H79C) announced its business results for the first half of 2025 with a net profit of nearly VND 15 billion, compared to a loss of over VND 632 billion in the same period last year. Although the figure is not impressive, it is still a positive sign after two years of 2023 and 2024 recording losses of over VND 4,000 billion.

Source: Author’s compilation

|

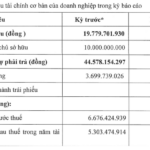

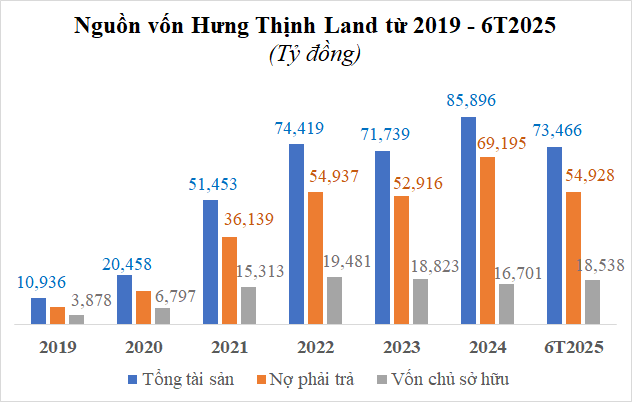

As of the end of June, Hung Thinh Land’s total assets exceeded VND 73,466 billion, down 14% from the beginning of the year. Meanwhile, owner’s equity increased by 11% to over VND 18,538 billion, including over VND 367 billion in undistributed post-tax profits.

Total liabilities decreased by 21% to over VND 54,928 billion; of which more than VND 15,477 billion in bond debt; bank loans of over VND 2,663 billion and other payables of VND 36,787 billion.

Most of the company’s other payables, according to the report, are advances and deposits from customers and partners, valued at VND 20,688 billion, accounting for 38% of total liabilities.

Source: Author’s compilation

|

According to the plan, Hung Thinh Land has to pay more than VND 7.3 trillion in principal and interest for 19 lots of bonds in the first half of 2025, but the enterprise has only paid nearly VND 466 billion. Hung Thinh Land said that due to the unfavorable financial and real estate market conditions, the company has not been able to arrange funds in time to pay the bonds as planned, so it is negotiating with bondholders to adjust the payment schedule.

Data from the Hanoi Stock Exchange (HNX) shows that the company still has two outstanding bond lots, H79CH2124018 and H79CH2124019, with the same interest rate of 11%/year, issuance value of VND 1.5 trillion and VND 1.8 trillion, respectively, which will mature on 07/07/2026 and 18/08/2026.

In August, the company’s subsidiary, Hung Thinh Quy Nhon Entertainment Services JSC, fully repaid two bond packages totaling VND 4,000 billion. At the same time, the company also reported a post-tax profit of nearly VND 703 billion, bringing the accumulated loss as of the end of June/2025 to VND 189 billion.

Hung Thinh Land requests bond payment extension again

– 12:14 09/09/2025

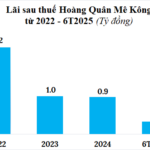

Profitable Yet Modest: Unraveling HQC’s Billion-Dollar Receivables Tangle

In the first half of 2025, Hoang Quan Mekong reported a modest profit of over VND 315 million. However, with a hefty VND 500 billion bond burden and cash flow pressures, the company’s business outlook remains challenging.

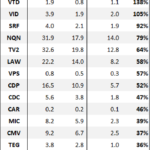

What’s the Bottom Line Impact of Half-Year Audit on Listed Companies?

According to statistics from VietstockFinance, 1,006 listed companies on the HOSE, HNX, and UPCoM exchanges experienced a collective loss of over VND 473 billion in net profit after audits, leaving them with just under VND 285 trillion. This decrease equates to nearly 0.2% of their pre-audit profits.

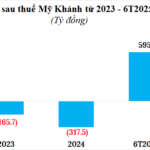

“My Khanh Development Investment Records a Staggering 600 Billion Profit in H1, Freed from Bond Debt”

After suffering losses of over VND 480 billion for two consecutive years, My Khanh Investment and Development turned their fortunes around, reporting a remarkable profit of nearly VND 600 billion in the first half of 2025. The company also repurchased bonds worth over VND 2,800 billion before maturity.