NRC Corporation (NRC Corp., stock code: NRC) recently announced that it will finalize the list of shareholders attending the 2025 Extraordinary General Meeting of Shareholders on September 24th.

The time and venue of the meeting are yet to be disclosed. The agenda of the meeting will include discussions on adjusting the plan for private placement of shares to increase the charter capital.

Previously, at the 2025 Annual General Meeting of Shareholders held in June, NRC shareholders approved the cancellation of the private placement plan that was passed in 2024 due to economic uncertainties and unfavorable market conditions for implementing the issuance as planned.

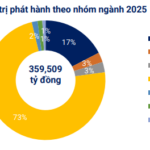

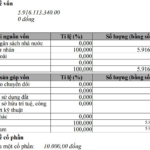

The meeting approved an alternative plan to privately place a maximum of nearly 92.6 million shares in 2025 at an offering price of VND 10,000/share. The offering targets are professional securities investors and eligible members of the Board of Directors.

Shares issued will be restricted from transfer for one year. If the issuance is successful at the maximum level, NRC’s charter capital will be raised to nearly VND 1,852 billion.

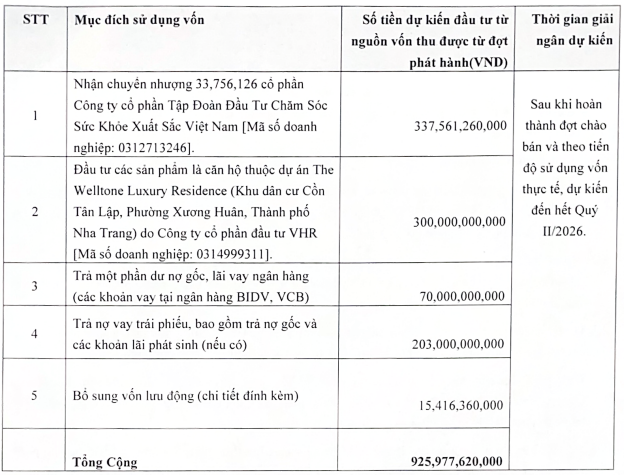

With a maximum of nearly VND 926 billion that can be mobilized from the offering, NRC plans to use nearly VND 338 billion to acquire shares of Excellent Vietnam Healthcare Investment Joint Stock Company; VND 300 billion to invest in apartments of The Weltone Luxury project; VND 70 billion to partially repay bank loans; VND 203 billion to repay bonds; and the remaining over VND 15 billion to supplement working capital.

Source: NRC

NRC Group is considering a capital increase after completing its name change and appointing a new CEO.

On August 15, NRC dismissed CEO Nguyen Huy Cuong for personal reasons. Despite stepping down as CEO, Mr. Cuong was appointed as Vice Chairman of the Board of Directors for the remaining term of 2022-2027.

In the opposite direction, the Group appointed Deputy General Director Trinh Van Bao as the new CEO of the Group from August 15.

Mr. Trinh Van Bao (born in 1988) holds a Master’s degree in Business Administration. He was recently appointed to the NRC Executive Board in January 2025.

In addition, Mr. Trinh Van Bao is also a leader at BTH Trading and Investment Co., Ltd. and Vietnam Carbon Agriculture Investment Joint Stock Company.

Earlier, NRC made a move to enter the pharmaceutical business by establishing NRC Pharma Co., Ltd.

The newly established entity has a charter capital of VND 50 billion, wholly owned by NRC, and is registered for 24 industries with the main activity of household goods wholesale, including cosmetics, pharmaceuticals, vaccines, medical supplies, groceries, personal items, etc.

Mr. Trinh Van Bao was appointed as the representative of NRC’s capital contribution at NRC Pharma.

NRC Group is the new name of Danh Khoi Group. According to the 17th Business Registration Certificate dated July 31, 2025, Danh Khoi Joint Stock Company officially changed its name to NRC Corporation (NRC Corp.).

The management board believed that “Danh Khoi” was a brand associated with the company’s real estate business. As the company is diversifying into new industries, a new brand is needed.

At the 2025 Annual General Meeting of Shareholders held on June 24, NRC shared its development orientation by continuing to strengthen the real estate sector while expanding into new business areas such as high-tech agriculture, pharmaceuticals, medical supplies, and healthcare.

The decision to expand into new business areas is based on the high potential and scalability that NRC foresees in leveraging the conveniences and advantages of the projects the company has invested in or collaborated on.

The NRC management team is confident that in the second half of the year, revenue will be generated from two new sectors: pharmaceuticals – medical supplies and grain – high-tech agriculture.

Binh Son Refinery Seeks to Boost Chartered Capital Past VND 50,000 Billion

The Binh Son Petrochemical Plant is seeking shareholder approval for a capital increase through the issuance of over 1.9 billion new shares to pay dividends and reward shareholders.

“Vietjet Completes Capital Increase to $246 Million, Expanding into Aircraft Maintenance and Repair”

On August 19th, Vietjet inaugurated its state-of-the-art Aircraft Maintenance Center in Long Thanh, comprising Hangars 3 and 4. With an impressive capacity to simultaneously accommodate up to ten aircraft, this new facility is set to revolutionize aircraft maintenance services, adhering to the most stringent international standards.