Vietnam Simplifies Procedures for Foreign Investors in its Stock Market

On September 12, 2025, the State Securities Commission of Vietnam announced Decree No. 245/2025/ND-CP, issued by the government, amending and supplementing Decree No. 155/2020/ND-CP detailing the implementation of the Securities Law. This is considered a significant reform to remove obstacles and facilitate foreign investors’ access to the Vietnamese stock market.

The decree includes provisions that make it easier for foreign investors to prove their qualifications as professional investors through valid documents from their home countries. Additionally, the time frame for listing IPO shares on the stock exchange has been reduced from 90 to 30 days, enabling faster listing and protecting investors’ interests.

Another notable change is the abolition of the regulation allowing the general meeting of shareholders to reduce the maximum foreign ownership ratio below the legal limit. The new regulation opens the door wider for foreign capital and requires public companies to complete the procedure for notifying the foreign ownership ratio within 12 months from the effective date of the decree.

Moreover, the procedure for issuing securities trading codes for foreign investors has been simplified. Investors can now trade immediately after receiving their electronic codes without having to submit paper documents, in line with international practices. In parallel, the State Bank of Vietnam has issued circulars facilitating the opening of indirect investment capital accounts, reducing costs and time for market entry.

The decree also paves the way for the implementation of the Central Counterparty (CCP) mechanism, expected to be applied from 2027, to enhance system safety and limit risks. Additionally, foreign fund management companies will be granted two trading codes to separate their activities, preparing for the international practice of omnibus accounts.

Information transparency and investor protection are also key focuses of these amendments. Listed companies are now required to disclose information in English, and corporate bonds issued to the public must be rated by reputable international organizations. The scope of organizations eligible for payment guarantee has also been expanded. The decree includes various clauses related to corporate governance, dividend payments, and information disclosure on capital use to protect the legitimate rights and interests of domestic and foreign investors.

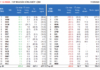

The Great Blue Chip Stock Sell-Off: A Hundred Billion Dollar Exodus

The domestic securities companies turned net sellers on the Ho Chi Minh Stock Exchange (HoSE), offloading a total of VND688 billion ($29.4 million) worth of shares.

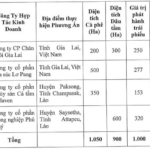

“HAGL’s Subsidiary Reworks Bond Terms to Venture into Sericulture and Coffee Cultivation”

HGLC, a prominent agricultural enterprise majority-owned by Hoang Anh Gia Lai (HAGL), has refinanced its bond offering of 1,000 billion VND. This strategic move will redirect capital allocation towards an ambitious endeavor: expanding silkworm and coffee cultivation projects across Vietnam and Laos.