A paradigm shift in the card market, transforming the traditional payment card, which was once solely used for basic transactions and withdrawals, into a smart spending tool that optimizes benefits for customers’ daily transactions, starting with their payment accounts.

“Today’s consumers are embracing a new trend, striking a balance between experiences and lifestyle, and effective personal financial management to achieve bigger goals,” shared Ms. Tuong Nguyen, Vice President of VIB. “The launch of our new international payment card portfolio further emphasizes our strategy to lead the card market. We are not just offering basic payment functions but are also providing our debit card users with exceptional cashback benefits, diverse options catering to different customer segments, and easy accessibility. By maximizing our customers’ benefits directly from their payment accounts, we aim to pioneer a new trend in spending.”

Elevating the Payment Card Experience

While the market heavily focuses on credit cards or QR codes, payment cards have received less attention and are often associated only with ATM cash withdrawals and basic management needs, limiting customers’ choices. With our vision to lead the card market, VIB is not just asserting its position in the credit card segment but also elevating the status of payment cards with the introduction of an entirely new product line, catering to the diverse needs of all customer segments:

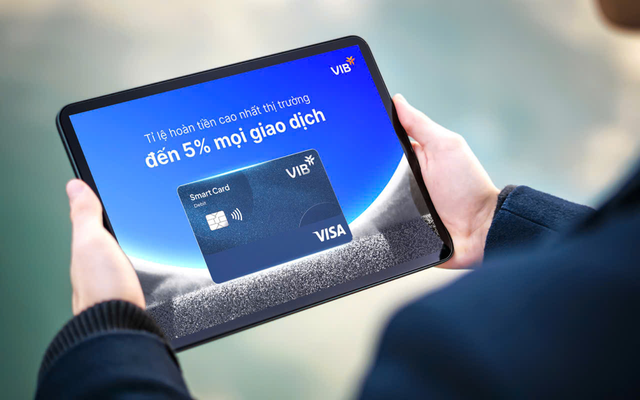

Smart Card: Offers up to 5% cashback on online shopping and the exclusive privilege of unlimited supplementary cards linked to multiple payment platforms.

Junior Smart Card: A pioneering card that allows children as young as six years old to own their first payment card.

Platinum Card: Provides up to 5% cashback on international transactions, along with the privilege of two complimentary business lounge accesses and additional unlimited accesses based on spending.

VIB Premier Signature and VIB Priority Signature Cards: Exclusive cards for our priority customers, offering exceptional privileges with up to 5% cashback on dining, travel, and shopping, four complimentary business lounge accesses per year, and unlimited additional accesses based on spending.

Each card is tailored to meet the distinct spending needs and lifestyles of different customer segments, enabling users to optimize their payment account benefits without requiring income verification or complicated registration processes.

Unparalleled Privileges with VIB Payment Cards

With five distinct card options, the VIB international payment card portfolio offers a modern spending solution for all customer segments, from children to dynamic youth and premium customers, featuring several breakthrough advantages:

Privileges on par with credit cards: Top-tier cashback rates of up to 5%, airport lounge access, and other premium benefits without requiring income proof or waiting for credit approval.

Competitive and flexible cashback mechanism: Unlike other payment cards that often require a minimum spending threshold to unlock privileges, VIB’s new international payment cards offer cashback benefits directly linked to customers’ payment account balances. The higher the balance, the greater the cashback percentage, reaching up to 5%. Every transaction, no matter how small, is recognized and rewarded, accumulating up to VND 900,000 per month or VND 10.8 million per year, providing practical benefits for daily expenses.

Cumulative privileges: With an intriguing expense management mechanism, customers can easily accumulate benefits from various VIB products and services, such as the Super Interest Account, which offers a competitive interest rate of up to 4.3% p.a., transforming the payment account into a dual-benefit center.

Integration of advanced payment technologies: All VIB payment cards are integrated with state-of-the-art payment technologies, enabling convenient one-touch transactions through Apple Pay, Google Wallet, Samsung Pay, Garmin, or quick QR code payments.

Completing the Personalized Financial Ecosystem of VIB

The launch of the new international payment card portfolio not only introduces a convenient product but also serves as a crucial component in VIB’s personalized financial ecosystem. This means that customers can optimize their benefits rather than using individual accounts or cards separately.

For young customers who do not yet meet the requirements for a credit card or those who do not wish to use one, the international payment card serves as the first step into VIB’s ecosystem, offering top-tier cashback benefits without a minimum spending requirement and high applicability when linked to popular e-wallets and international payment gateways, something that QR codes cannot achieve.

For existing payment cardholders, VIB offers automatic upgrade programs and complimentary credit card issuance, providing customers with the option to “buy now, pay later” with interest-free periods of up to 55-57 days and the flexibility to convert large transactions into installments.

By combining payment cards with credit cards, the Super Interest Account, and other products like Super Cash – a flexible online unsecured consumer loan of up to VND 1 billion, customers can easily balance their expenses, intelligently manage their cash flow, and fully utilize the privileges offered by VIB’s ecosystem.

With a fully digitized card application process through the MyVIB digital banking application or Max Powered by VIB, customers can obtain a virtual card for immediate use just five minutes after registration.

To celebrate the launch, VIB is offering an attractive promotion: Waiving the first-year annual fee for all new customers who spend at least VND 1 million and providing a complimentary VIB Cashback credit card, doubling the benefits for users. Apply for your card here to experience and enjoy exclusive promotions.

The Golden Contrast: A Tale of Soaring Prices

The gold price surge has left small jewelry shops in a peculiar predicament. While a rise in gold prices typically signals prosperity for gold businesses, smaller retailers are facing a unique challenge. Their primary focus on jewelry sales becomes a double-edged sword when customers flock to purchase gold bars and coins instead. This shift in demand dynamics has small jewelry retailers struggling to adapt, witnessing a stagnant business despite the favorable market conditions.

“MSB Mastercard Family Card Wins at the London Design Awards 2025”

Introducing the MSB Mastercard Family card – a unique and innovative financial product that goes beyond just being a payment tool. This card is designed to be a powerful ally for families in managing their finances and making smart spending decisions. But it’s also so much more – it’s a celebration of Vietnamese family values and a source of inspiration. With its distinctive design, the MSB Mastercard Family card becomes a symbol of the modern Vietnamese family, helping them navigate their financial journey with ease and style.

“Back to School with Sacombank: Get Cashback on Tuition Fees, Amazing Deals, and Explosive Gifts”

From now until October 31, 2025, Sacombank is offering a special back-to-school promotion, “Back to School with Sacombank Card – Pay,” for customers who use their Sacombank Pay app or Sacombank credit card to pay school fees and shop for back-to-school essentials. This exciting program is designed to help parents, students, and young customers alike, offering a range of valuable benefits and discounts to ease the financial burden of the new academic year.

Has the Era of the Livestreaming ‘Battle God’ Ended?

Once a money-making machine that turned KOCs into “order-closing gods”, raking in billions in sales within hours of going live, the golden age of livestreaming is showing signs of decline. With viewer fatigue, changing algorithms, and a shift in shopping behavior towards shorter content, what’s the new path for sellers and brands to keep up?