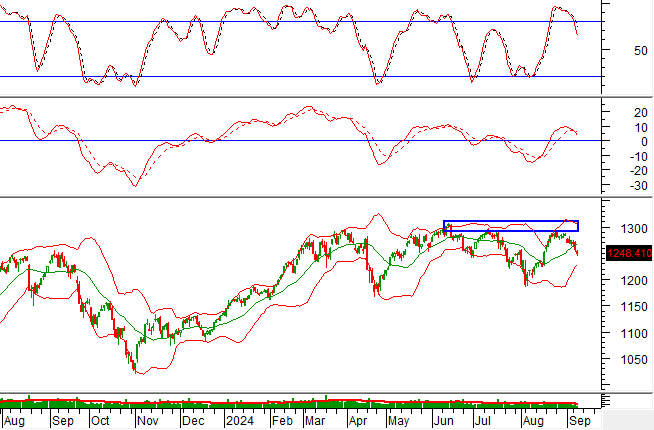

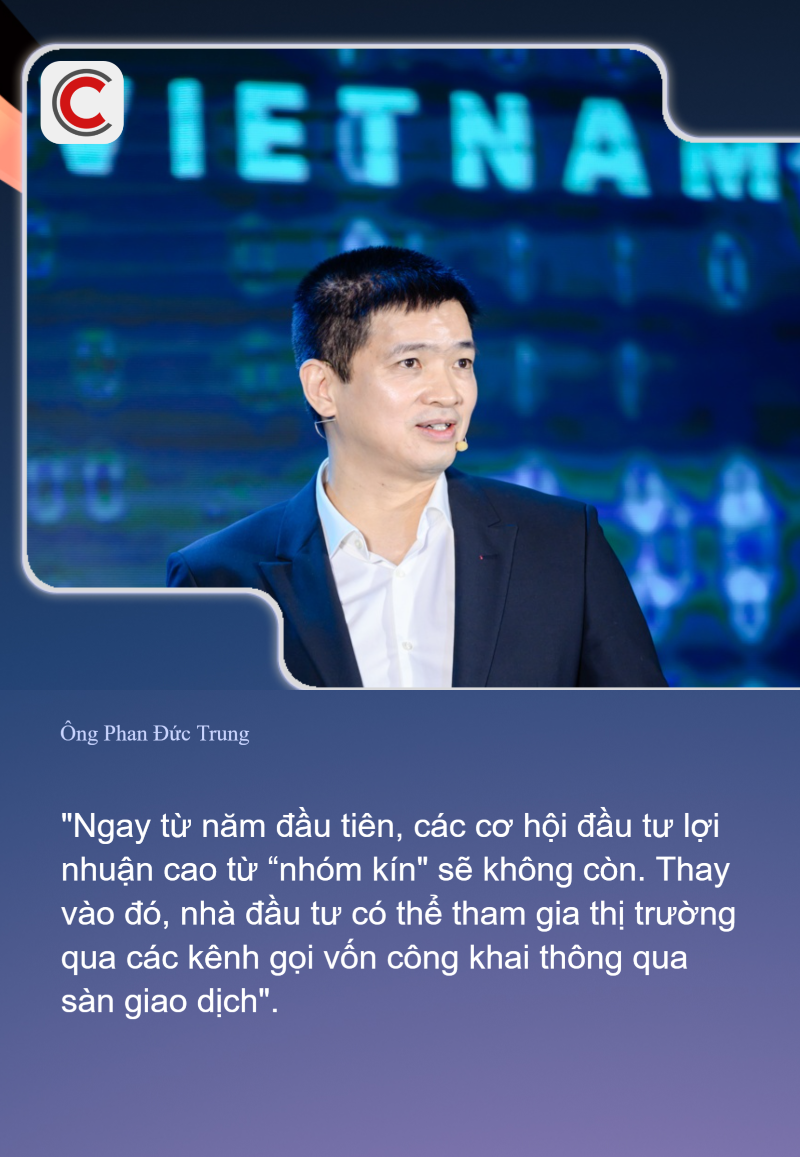

Mr. Phan Đức Trung, Chairman of the Vietnam Blockchain and Digital Assets Association (VBA), Chairman of Joint Stock Company 1Matrix

The market is mostly dominated by individual investors

Resolution No. 05/2025/NQ-CP dated September 9, 2025, on the pilot program for the digital asset market marks the first implementation milestone under the law after the Law on Digital Technology Industry was passed in June 2025.

Mr. Phan Đức Trung, Chairman of the Vietnam Blockchain and Digital Assets Association (VBA) and Chairman of Joint Stock Company 1Matrix, stated that VBA was a member of the drafting team and worked with inter-ministerial agencies (State Securities Commission, Ministry of Finance, Ministry of Public Security) to refer to the experiences of countries with developed digital asset markets, notably Hong Kong.

Currently, Vietnam categorizes digital assets into two types: those linked to tangible assets (tokenization) and those not linked to tangible assets. Vietnam’s orientation is to develop the digital asset market to attract capital and increase liquidity for other markets. Especially when Boston Consulting Group (BCG) forecasts that the tokenized asset market will account for 10% of global GDP by 2033, equivalent to a scale of nearly $19 trillion.

Mr. Trung emphasized that the issuance of Resolution 05 will curb financial fraud and create a transparent market.

“Right from the first year, high-profit investment opportunities from ‘closed groups’ will no longer exist. Instead, investors can participate in the market through public capital mobilization channels via exchanges,” he said.

However, the Chairman of VBA assessed that the biggest challenge at present is human resources. The market is currently dominated by individual investors, and there is a shortage of human resources to operate the market, from state management agencies, service providers to training knowledge for participants.

“The maturity of the market needs to keep up with the current law. Especially, we lack personnel in anti-money laundering according to international standards such as ACAMS – The internationally recognized Anti-Money Laundering Certificate. A person who wants to obtain this certificate must invest 2-3 years with a minimum cost of $18,000,” he illustrated.

According to Mr. Trung, the government’s desire to promote the issuance of digital assets is to attract foreign capital (through regulations that only allow foreigners to buy digital assets). However, the question is whether these assets will attract international investors and whether the market’s maturity will create a large enough playing field.

“The global digital asset market is still young compared to the stock market, which has a history of hundreds of years. This is both an opportunity and a challenge. It will take us a minimum of 3-5 years for the market to mature and learn from the experience of more than a decade of the global digital asset market,” VBA Chairman analyzed.

Operating a digital currency exchange is not easy

Chairman Phan Đức Trung said that within a maximum of 3 years, with the right direction, we can learn from the history of more than 10 years of the global digital asset market.

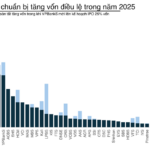

Resolution 05 sets out stringent standards for enterprises licensed to establish digital asset exchanges. A minimum chartered capital of VND 10,000 billion is one of the main requirements. According to Mr. Trung, this is a difference compared to many other countries, where they focus more on investment standards in technology, insurance, and anti-money laundering. In Vietnam, the focus on capital scale in the first pilot phase is to ensure safety.

However, the expert said that there are still many issues that need to be clarified, such as regulations on custody, separation of proprietary trading and customer trading, or hot wallets – cold wallets.

According to the objective assessment of the VBA leader, to be effective in the pilot phase, no more than 3 exchanges have the capacity. Even for licensed units, operating efficiently (serving investors, generating revenue, and contributing to the common goal) is not easy.

Regarding information security regulations, the requirement that the information technology system must meet the safety standard of level 4 demonstrates the seriousness that companies need to implement when establishing an exchange. Mr. Trung also said that this is not a concern for companies with a chartered capital of VND 10,000 billion. The important thing is whether this investment will bring value and meet the government’s expectations.

In addition, according to Mr. Trung, the requirement for investors to transfer their accounts from abroad to Vietnam shows that the market has professional participants rather than newcomers.

“People with experience in foreign markets will enter the Vietnamese market and will naturally make comparisons. If trading on foreign exchanges is considered ‘risky’, then Vietnam will be safer when recognized by law. This benefits investors, service providers, and tax authorities,” he said.

In addition, the regulation that digital assets are only offered and issued to foreign investors is a special point in the drafting process. Chairman Phan Đức Trung said that this separation has the advantage of protecting the foreign exchange market as there is no interconnection with the domestic market, but it may reduce the attractiveness of the market in the initial phase.

This is also a challenge for creators and businesses to have plans to enhance the attractiveness of Vietnam’s digital asset market compared to other domestic and international investment markets. Mr. Trung said that during the trial process, policies need to balance the interests of management agencies and investors and market participants.

The Fintech Revolution: Banks and Brokerages Embrace the Digital Asset Arena

The recent passage of the Digital Technology Industry Law by the National Assembly at its ninth session in mid-June has paved the way for a robust development of the digital asset sector in Vietnam.

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

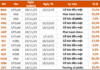

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.