Bibica’s delisting plans spark interest as the company prepares to exit HOSE after nearly 24 years

CTCP Bibica (HOSE: BBC) is set to hold an extraordinary general meeting at the end of September 2025, with a notable agenda item being the proposal to cancel its public company status and delist its securities. This means that once the plan is approved, Bibica will officially depart from the HOSE after almost 24 years of listing.

It is worth mentioning that CTCP PAN Group (HoSE: PAN) currently holds a staggering 98.3% of Bibica’s shares, equivalent to over 18.4 million shares. This near-absolute ownership has resulted in Bibica failing to meet the minimum requirements to maintain its status as a public company, as per the amended Securities Law of 2024. Specifically, at least 10% of the voting shares must be held by a minimum of 100 small investors.

Due to the low proportion of freely transferable shares, BBC’s liquidity has been minimal for many years, with an average of just over 2,200 shares traded per session over the last ten sessions. Nonetheless, BBC’s share price has surged by more than 50% since the end of June, closing at 87,500 VND per share on September 9th.

In addition to its delisting plans, Bibica will also seek shareholder approval for other matters, including the removal of certain business lines from its business registration, amendments to its charter, and adjustments to its 2024 profit distribution plan.

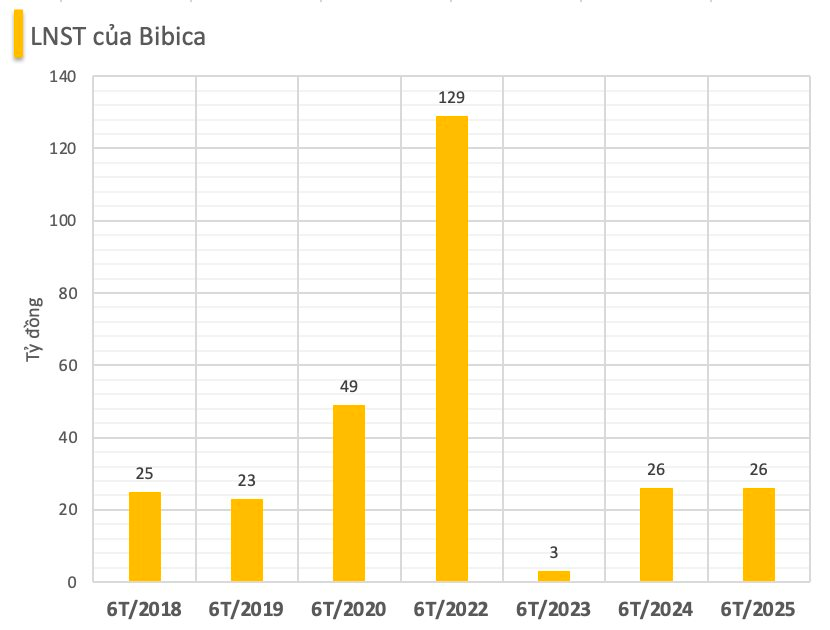

Regarding its financial performance, Bibica recorded a slight increase in revenue to 621 billion VND in the first half of 2025 but witnessed a decline in after-tax profit to 26.3 billion VND due to higher tax expenses. The company has set a target of 2,000 billion VND in revenue and 134 billion VND in pre-tax profit for the full year, of which it has achieved approximately 26% so far.

Bibica, a veteran in Vietnam’s confectionery industry, faces new challenges as it navigates changes in ownership and market dynamics.

Bibica, a veteran in Vietnam’s confectionery industry, was established in 1999 with an initial charter capital of 25 billion VND, which has since increased to over 187 billion VND. The company operates three factories in Hanoi, Dong Nai, and Tay Ninh. In 2001, Bibica became one of the first domestic enterprises to list on the HoSE.

Historically, the company underwent a notable shareholder dispute when Lotte (South Korea) attempted to change the company’s name to Lotte – Bibica in 2012, facing opposition from domestic shareholders. PAN Group’s intervention during this period, by acquiring 35% of the shares and gradually increasing its stake to a controlling position, played a significant role in shaping Bibica’s trajectory.

Earlier in August, Vinacafé Bien Hoa (HOSE: VCF) also announced its decision to cancel its public company status due to Masan Beverage’s 98.79% ownership, which failed to meet the requirements for small shareholder distribution.

As Bibica navigates its delisting process and adjusts to changes in ownership and market dynamics, investors and industry observers alike will be keenly watching the company’s next moves.

“Becamex IDC Secures an Additional 2,000 Billion VND in Bond Issuance at 10.5% Interest per Annum”

Becamex IDC has just released a new bond issue, BCM12502, successfully raising 2 trillion VND through this channel.