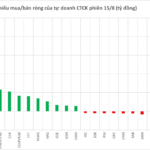

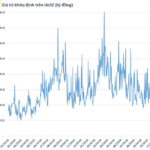

The stock market is experiencing some volatility as it hovers around historic highs. In this context, many stocks are facing strong selling pressure, especially those that had previously seen sharp increases. Notably, the shares of AAS of SmartInvest Securities JSC continued their steep decline, falling over 10% at the opening of the September 11 session, with the market price dropping to 13,100 VND per share. This stock also recorded the sharpest decline among securities companies on that day.

Prior to this decline, AAS had experienced a strong rally, with its share price surging from the 7,000 VND per share range in April 2025 to a historic peak of 23,000 VND per share on August 28, representing an increase of nearly 230% over a four-month period. However, in less than two weeks, this stock has lost more than 40% of its value. Trading volume has also been pushed up to over 3 million matched orders on several occasions.

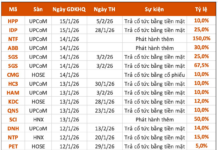

SmartInvest Securities, formerly known as Gia Anh Securities JSC, was established on December 26, 2006, with a charter capital of 22 billion VND. The company operates in the fields of securities investment consulting, securities brokerage, and securities investment. In 2020, AAS was approved by HNX for trading on the UPCoM market. Currently, the charter capital of this securities company has reached 2,300 billion VND.

In terms of business results, for the first six months of 2025, SmartInvest Securities recorded operating revenue of 238 billion VND, a 4% decrease compared to the same period last year. Consequently, after-tax profit decreased by 15% to 48 billion VND, a reduction of 14%.

For the full year 2025, SmartInvest Securities set a target of 520 billion VND in operating revenue and 82 billion VND in after-tax profit, representing increases of 13% and 11%, respectively, compared to the previous year. Thus, the company has accomplished 59% of its annual profit target so far.

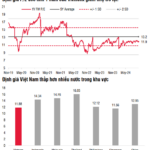

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”