Improved Gold Supply on the Horizon

Mr. Pham Quang Thang, Deputy General Director of Techcombank, applauds the government’s Decree 232, amending and supplementing Decree 24, as a timely and prudent decision.

According to Mr. Thang, the new regulations enable financially strong credit institutions and gold companies to participate in gold bar import and production, increasing supply and fostering a more transparent market.

Techcombank, with its prior experience in the gold industry, is poised to re-enter the market, having prepared in multiple aspects. The bank has sought international partners for gold material imports and is capable of crafting gold bars bearing the Techcombank brand. Additionally, they have readied domestic infrastructure, including personnel, import-supply procedures, warehouses, weighing equipment, and distribution channels.

Furthermore, the bank is set to expand its distribution system through both branches and digital platforms, enabling convenient online gold trading services for customers.

The market will soon offer gold bar brands beyond SJC.

Regarding production, Mr. Thang acknowledges that establishing a gold bar crafting facility takes time and depends on market demand. However, Techcombank is prepared to initiate production when the market justifies it, emphasizing that “proactive production can reduce costs and narrow the gap between global and domestic gold prices.”

Mr. Dao Cong Thang, Acting General Director of Saigon Jewelry Company (SJC), welcomes Decree 232 as it provides favorable conditions for the company to be more proactive in gold bar production and market supply.

SJC will be able to recycle gold that does not meet circulation standards, such as bent, scratched, or damaged gold bars. By melting and recasting them, the company can reintroduce standard gold into the market to meet customer demand.

Additionally, the company will apply for permits from the State Bank to import gold materials for gold bar production. Mr. Thang assures that SJC, with its experience in producing gold bars for the State Bank, is ready to commence production once import procedures are finalized. Their current production line has a capacity of 5,000 taels per day.

The State Bank Outlines Permit Procedures

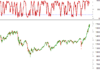

Mr. Dao Xuan Tuan, Director of the Foreign Exchange Management Department of the State Bank, noted that at the Government meeting on September 6, Prime Minister Pham Minh Chinh instructed relevant agencies to promptly address the “noteworthy” volatility in the gold market.

On August 26, the Government issued Decree 232, amending Decree 24, ending the State’s monopoly on gold bar production and introducing a licensing mechanism for qualified enterprises and commercial banks.

These entities are permitted to import and export gold bars and raw gold. Additionally, transactions involving gold worth VND 20 million and above must now be conducted via bank transfers.

Mr. Tuan outlined the eligibility criteria for enterprises, including a gold bar business license, a minimum charter capital of VND 1,000 billion, no administrative penalties, and well-defined internal processes for importing raw materials, production, and quality control.

For commercial banks, the requirements include a gold bar business license, a minimum charter capital of VND 50,000 billion, no administrative penalties, and comprehensive internal procedures similar to those of enterprises.

The State Bank has also provided detailed guidance on permit application processes, amendments, and termination of gold bar production activities.

Governor Requests the State Bank to Increase Gold Supply to Stabilize the Market Without Exploiting Policies

Are there any other adjustments you would like to make to this text? I can perform additional edits if you wish.

“The Prime Minister has instructed the State Bank to closely monitor global and domestic gold price fluctuations and, within its authority, promptly employ the necessary solutions and tools as stipulated to stabilize the gold market and reduce the gap between international and domestic gold prices.”

“Billions of Dongs in Contributions: Top Banks Honored Among Vietnam’s Largest Tax-Paying Enterprises.”

The 2025 Enterprise Budget Honors ceremony was a resounding success, celebrating the role and contributions of the vibrant Vietnamese business community. Numerous banks were named in the prestigious PRIVATE 100 and VNTAX 200 listings, solidifying their leadership in the financial and banking sectors.

The Golden Opportunity: Mapping the Route to a Vibrant Gold Exchange

Introducing the visionary initiative to revolutionize the gold trade in our nation: the proposal to establish a National Gold Exchange or enable gold trading on the Commodity Exchange, including the formation of a dedicated Gold Trading Floor. This ambitious endeavor aims to create a transformative platform that elevates the gold market to new heights, offering unparalleled opportunities for investors and traders alike. With a focus on innovation, transparency, and security, this exchange promises to be a game-changer, fostering a vibrant and robust gold trading ecosystem.

Unlocking Golden Opportunities: The Central Bank’s Imminent Move to Grant Gold Import and Bar Manufacturing Licenses to Businesses and Banks

The State Bank of Vietnam is expediting the release of guidelines for the implementation of Decree 232/2025/ND-CP. According to Vice Governor Pham Quang Dung, these guidelines will provide detailed instructions on the registration process for enterprises and commercial banks to obtain licenses for gold imports and gold bar production. The aim is to ensure a swift entry into the gold market for these entities.

“Techcombank: Leading the Way in Vietnam’s Private Banking Sector with Unparalleled Fiscal Contributions”

Techcombank, Vietnam’s leading private bank, has once again proven its formidable stature at the 2025 Top Budget-Contributing Enterprises Ceremony held on September 9. For the third consecutive year, the bank has been hailed as the top private bank in terms of budget contribution to the country. This remarkable achievement cements Techcombank’s position as a pivotal financial institution in Vietnam’s thriving economy.