Amata Industrial Park (former Bien Hoa City). Image: N. Lien Bao Dong Nai

In early September 2025, Amata VN Corporation (Amata VN) made a significant decision, approving its subsidiary, Amata Long Thanh Urban JSC (ACLT), to transfer the remaining 51% stake in two entities: Amata Long Thanh 1 Urban Service LLC (ASCLT1) and Amata Long Thanh 2 Urban Service LLC (ASCLT2).

According to the official announcement, the buyers are a consortium of Nova Rivergate LLC and Nha Rong Investment and Trading JSC. The total transaction value is $46.14 million (approximately VND 1,176 billion).

Previously, Amata had sold 49% of the shares in these two companies. With this latest transfer of the remaining 51%, ASCLT1 and ASCLT2 will no longer be subsidiaries of Amata VN. The transaction is expected to be completed in 2026.

This divestment comes as the Amata Long Thanh 1 Urban Service project, developed by ASCLT1, is set to be inspected by the Government Inspectorate in Dong Nai. The project spans 55.4 hectares with a registered investment capital of nearly VND 6,600 billion.

In its statement, Amata VN explained that the divestment aims to collaborate with companies specializing in residential and commercial real estate in Vietnam, enhance liquidity, and focus on long-term strategies.

Notably, Amata VN confirmed that Nova Rivergate is a member of Novaland (NVL).

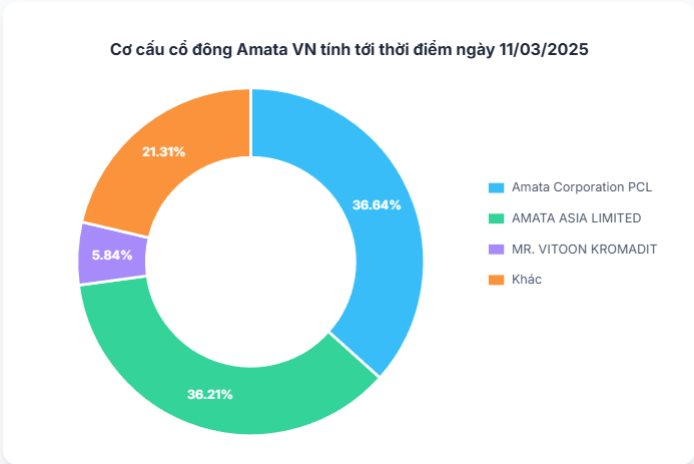

Operating in Vietnam since 1994, Amata manages a structured system centered around Amata VN Corporation (AMATAV). This system oversees key industrial park projects such as Amata City Bien Hoa (513 ha), Amata City Long Thanh (410 ha), and Amata City Ha Long (714 ha), which are the core business areas of the group.

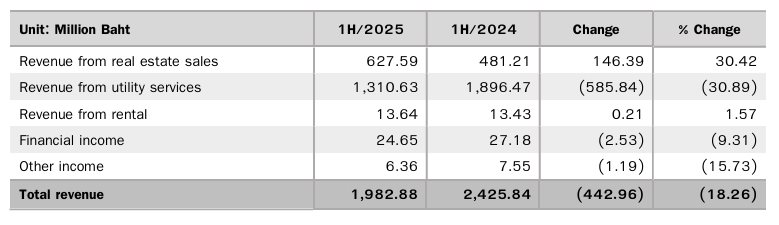

Amata VN’s 6M2025 Financial Results (Unit: Million Baht). Source: Amata VN

However, recent financial results show a decline. Amata VN’s 2025 H1 financial report indicates revenue of 1.9 billion baht (approximately VND 1,400 billion), an 18% decrease year-on-year. Net profit also dropped by 6% to nearly 93.4 million baht (approximately VND 65 billion).

The primary cause of this decline is the weakening revenue from utility services, which accounts for the largest share. This segment generated over 1.3 billion baht (approximately VND 910 billion). In contrast, real estate sales remained a bright spot, contributing nearly 628 million baht (approximately VND 440 billion), primarily from the successful transfer of 6.4 ha in Amata City Ha Long and 4.1 ha in Amata City Long Thanh.

Financially, as of June 2025, Amata VN’s total assets reached nearly 13.6 billion baht (approximately VND 9,520 billion), an 8% decrease from the beginning of the year. Total liabilities also decreased by 10% to nearly 7.7 billion baht (approximately VND 5,390 billion).

Amata City Ha Long Industrial Park (Song Khoai) – Source: Amata VN

Despite short-term financial declines, Amata VN continues to expand investments in core areas. Earlier this year, Amata invested nearly VND 26 billion to increase its stake in Amata B.Grimm Power Vietnam, a rooftop solar power company. Most recently, in August 2025, Amata partnered with Marubeni Green Power Vietnam to develop a rooftop solar power project at Amata City Ha Long Industrial Park.

Additionally, industrial land development activities are being accelerated. In May 2025, Amata City Ha Long signed a land lease agreement with CapitaLand SEA Logistics Fund (CSLF) to develop a large-scale ready-built factory project. Simultaneously, Amata VN signed a memorandum of understanding with the People’s Committee of Phu Tho Province to explore investments in industrial and smart urban projects there.

In contrast to its operations in Vietnam, the financial performance of the parent company, Amata Corporation PCL (Thailand), is remarkably positive.

In the first half of 2025, the group’s consolidated revenue reached nearly 5.8 billion baht (approximately VND 4,060 billion), a 6% increase year-on-year. Notably, net profit surged by 39% to nearly 1 billion baht (approximately VND 700 billion).

The main growth driver was the real estate segment, which generated over 2.9 billion baht (approximately VND 2,030 billion), a 41% increase from the successful transfer of 72 hectares. The land leasing segment, though small in revenue share, maintained a high gross profit margin of 77%.

The Stock Market’s Volatile Week: What’s Next?

Today (September 12th) marks the fourth consecutive session of stock market gains, propelled by Vingroup stocks, real estate, and steel sectors. While the market extended its positive momentum, trading liquidity weakened as foreign investors continued to offload holdings. Amid this upbeat performance, the market also received a boost from positive news on potential upgrades.

Profitable Yet Modest: Unraveling HQC’s Billion-Dollar Receivables Tangle

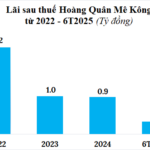

In the first half of 2025, Hoang Quan Mekong reported a modest profit of over VND 315 million. However, with a hefty VND 500 billion bond burden and cash flow pressures, the company’s business outlook remains challenging.

“My Khanh Development Investment Records a Staggering 600 Billion Profit in H1, Freed from Bond Debt”

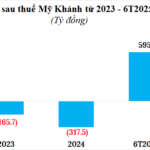

After suffering losses of over VND 480 billion for two consecutive years, My Khanh Investment and Development turned their fortunes around, reporting a remarkable profit of nearly VND 600 billion in the first half of 2025. The company also repurchased bonds worth over VND 2,800 billion before maturity.

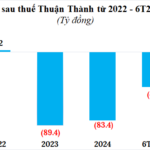

“May – Diêm Sài Gòn Raises Nearly 2.5 Trillion VND in Bond Sale in Less Than a Month”

The Ho Chi Minh City Garment and Cigarette Joint Stock Company has successfully issued its third bond lot within a month, raising nearly VND 2.5 trillion.