|

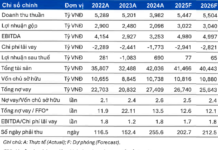

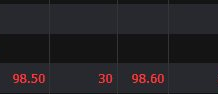

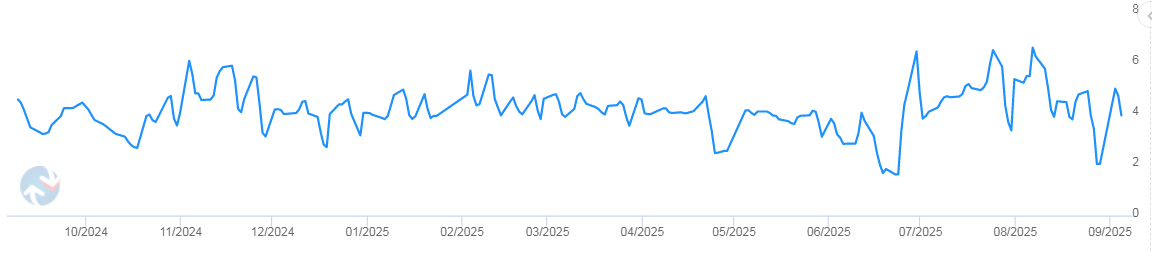

OMO Operations Net Pumping Trends Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Specifically, 85,505 billion VND was newly injected through term purchases at a 4% annual interest rate, while 97,599 billion VND matured. As a result, the regulator net withdrew 12,094 billion VND, reducing the outstanding volume on this channel to 187,668 billion VND as of September 8.

|

Overnight Interbank Interest Rate Trends Over the Past Year. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the overnight interest rate rose by 191 basis points compared to late August, reaching 3.94%/year on September 5. Trading volume also became more vibrant, with an average daily value of 495 trillion VND, a 12% increase from the previous week.

|

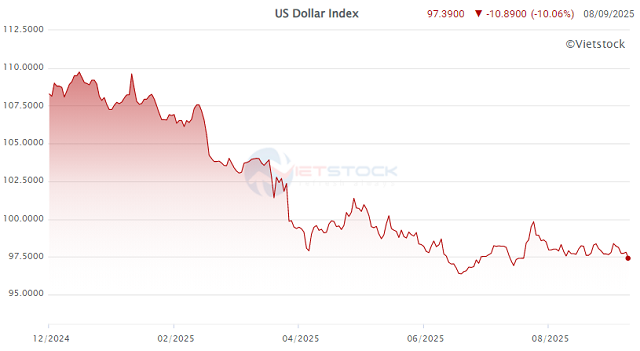

DXY Trends from the Beginning of 2025 to September 8

Source: VietstockFinance

|

In the international market, the USD Index (DXY) dipped by 0.12 points to 97.74 after disappointing U.S. employment data for August, reinforcing expectations that the Federal Reserve will cut interest rates by 0.25% at its September 17 meeting. Consequently, the USD has gradually lost its appeal.

Domestically, the USD/VND exchange rate at Vietcombank on September 5 was quoted at 26,160 – 26,510 VND/USD (buy – sell), 28 dong and 8 dong higher, respectively, compared to the previous week.

– 11:13 09/09/2025

Maintaining Exchange Rate Stability

“With the busiest season for trade fast approaching, businesses are yearning for stable exchange rates to ease their financial worries. As the markets gear up for the frenzied festive period, a consistent currency value could be the difference between a prosperous year-end and a stressful scramble for many companies.”

Is There Room for Further Cuts in VND Interest Rates by the End of the Year?

“The UOB experts’ take on the high USD interest rates putting pressure on VND rates is an interesting perspective. In an optimistic scenario, a Fed rate cut and favorable market conditions could see VND rates drop further by 0.5-0.75% by the end of this year.”