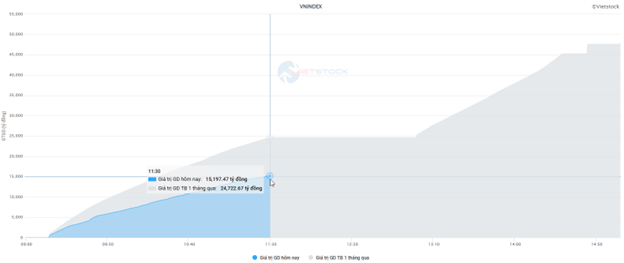

Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 833 million shares, equivalent to a value of more than 24.5 trillion VND; the HNX-Index reached over 80 million shares, equivalent to a value of more than 1.8 trillion VND.

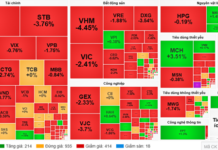

The VN-Index opened the afternoon session with a tug-of-war dynamic, but buyers gradually regained control, helping the index quickly recover to the reference level and close in the green at the end of the session. In terms of influence, VCB, VIC, CTG, and BSR were the most positively impactful stocks on the VN-Index, contributing 5.4 points of growth. Conversely, FPT, GVR, LPB, and VNM faced selling pressure, reducing the index by 1.1 points.

| Stocks with significant influence on the VN-Index |

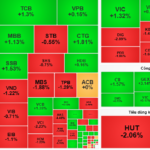

In contrast, the HNX-Index showed a pessimistic trend, negatively impacted by stocks such as MBS (-1.88%), HUT (-2.06%), CEO (-1.66%), and SHS (-0.75%).

| Stocks influencing the HNX-Index |

At the close, the market rose by 0.37%, with contrasting green and red sectors. The energy sector led the gains with a 2.41% increase, primarily driven by BSR (+4.84%), PVS (+1.48%), PVD (+2.48%), and OIL (+0.87%). The industrial and financial sectors followed with gains of 0.79% and 0.51%, respectively. Conversely, the information technology sector saw a significant decline of 0.81%, mainly due to FPT (-0.88%), CMG (-0.13%), and ELC (-0.23%).

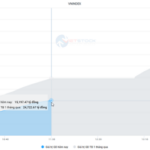

Foreign investors continued to net sell over 2,927 billion VND on the HOSE, focusing on stocks like HPG (337.37 billion), MWG (289.64 billion), MBB (179.62 billion), and DIG (161.05 billion). On the HNX, they net sold over 70 billion VND, concentrated in CEO (28 billion), PVS (18.85 billion), IDC (16.33 billion), and SHS (10.34 billion).

| Net buying/selling value of foreign investors across all three exchanges |

11:30: Sluggish liquidity, increased foreign selling pressure

Increased selling pressure from foreign investors amid sluggish liquidity challenged the market. At the mid-session break, the VN-Index fell by 3.78 points to 1,633.54 points, while the HNX-Index remained at the reference level, reaching 274.55 points. Sellers dominated with 331 declining stocks and 297 advancing stocks.

Market liquidity showed no signs of improvement compared to the previous session’s low levels. The HOSE trading value this morning reached over 15 trillion VND, down 38.5% from the one-month average. The HNX recorded a volume of nearly 40 million units, equivalent to over 955 billion VND.

Source: VietstockFinance

|

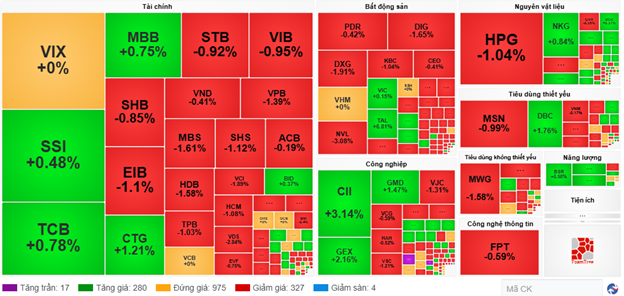

In terms of influence on the VN-Index, VPB was the most negatively impactful stock, reducing the index by 0.8 points. This was followed by HPG, LPB, MWG, and HDB, which collectively pulled the index down by 1.8 points. Conversely, CTG was a bright spot, contributing 0.7 points of growth.

Divergent trends continued to dominate, with all sectors fluctuating within narrow ranges. The non-essential consumer sector temporarily lagged, adjusting by 0.78% due to negative performances from VPL (-0.75%), FRT (-0.7%), MWG (-1.45%), HHS (-2.35%), and PET (-2.47%).

The information technology sector followed with a 0.54% decline, primarily influenced by large-cap stocks such as FPT (-0.59%), CMG (-0.25%), ELC (-0.69%), and DLG (-1.35%).

Conversely, the healthcare sector led the gains with a 0.49% increase, thanks to positive contributions from stocks like DHT (+1.78%), DBD (+1.13%), TRA (+1.2%), DMC (+0.78%), JVC (+1.69%), and CNC (+2.05%).

Source: VietstockFinance

|

Foreign investors intensified their net selling, reaching 1.9 trillion VND across all three exchanges. Selling pressure concentrated on HPG, with a value of 242.57 billion VND, far surpassing other stocks. Meanwhile, FUEVFVND led the net buying with a value of only 13.73 billion VND.

| Foreign investors’ net buying and selling trends (as of the morning session on 10/09/2025) |

10:35: Contrasting green and red, VN-Index in a tug-of-war

Balanced buying and selling forces prevented the main indices from breaking out. As of 10:30, the VN-Index entered a tug-of-war around the reference level, declining slightly by over 1 point. The HNX-Index also experienced a tug-of-war but with buyers gaining a slight edge, maintaining a nearly 1-point increase and trading around 275 points.

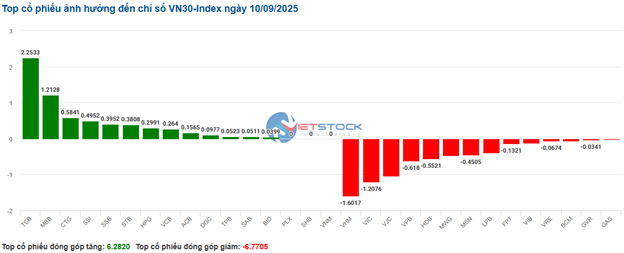

Stocks in the VN30 basket showed a slight green dominance. Specifically, TCB, MBB, CTG, and SSI contributed 2.25 points, 1.21 points, 0.58 points, and 0.5 points, respectively, to the overall index. Conversely, VHM, VIC, VJC, and VPB faced strong selling pressure, reducing the VN30-Index by over 4.4 points.

Source: VietstockFinance

|

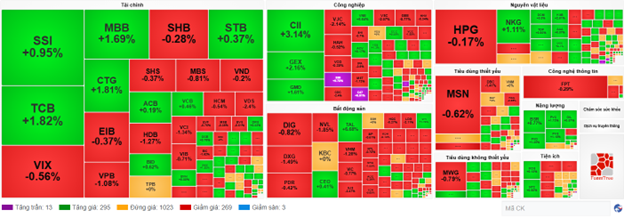

The financial sector continued its strong upward trend, supporting the overall market with notable performances from VCB (+0.62%), BID (+0.62%), TCB (+1.69%), and CTG (+1.81%).

Additionally, energy stocks showed impressive gains. Notable performers included BSR (+0.97%), PVS (+1.18%), PVD (+1.58%), OIL (+0.87%), and PVT (+0.56%).

Conversely, the real estate and non-essential consumer sectors faced strong selling pressure, with major players like VIC (-0.85%), VHM (-1.18%), BCM (-1.62%), VRE (-0.33%), MWG (-0.79%), PNJ (-0.58%), and FRT (-0.7%) declining.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks remaining unchanged. Buyers gained a slight edge, with 295 advancing stocks (13 at the upper limit) and 269 declining stocks (3 at the lower limit).

Source: VietstockFinance

|

Opening: Energy stocks surge at the start of the session

At the start of the session on 10/09, as of 9:30, the VN-Index rose by over 7 points, trading around 1,643 points. The HNX-Index also increased slightly by over 1 point, around 276 points.

The financial sector was among the top performers in the early session, continuing its role as a pillar supporting the index. Leading stocks included TCB (+3.12%), VCB (+1.23%), VPB (+0.46%), and MBB (+2.81%).

The energy sector showed the strongest growth, driven by oil and gas stocks influenced by global oil prices following news of Israel’s strike on Hamas leaders in Qatar. Notable gainers included BSR (+1.74%), PLX (+0.71%), PVS (+1.78%), and PVD (+1.35%).

In addition to these sectors, several large-cap stocks also performed positively, including TCB, MBB, SSI, and FPT, contributing to the index’s support.

– 11:55 10/09/2025

Vietstock Daily 11/09/2025: Market Polarization Amid Low Liquidity

The VN-Index swiftly rebounded into positive territory after a volatile trading session. However, trading volume continued to decline, falling below the 20-day average, indicating prevailing caution among investors. In the upcoming sessions, the index must break above the Middle Bollinger Band while accompanied by improved liquidity to solidify its upward trajectory. Should selling pressure return, the short-term trendline (around 1,620–1,630 points) will serve as a critical support level.

Market Pulse 10/09: VN-Index Rebounds in Afternoon Session as Foreign Investors Ramp Up Net Selling

At the close of trading, the VN-Index rose 5.94 points (+0.36%) to 1,643.26, while the HNX-Index dipped 0.22 points (-0.08%) to 274.6. Market breadth favored the bulls, with 381 gainers outpacing 332 decliners. The VN30 basket showed a near-even split, with 14 advancers, 13 decliners, and 3 unchanged stocks.

Market Pulse 11/09: An Exciting Afternoon Session, VN-Index Rebounds 52 Points from Lows

In stark contrast to the morning session’s struggles, which saw the VN-Index dip below 1,606 points, the afternoon session painted an entirely different picture. The index staged a robust comeback, closing at 1,657.75, marking a significant gain of 14.49 points. The real estate sector, particularly Vingroup-related stocks, emerged as the driving force behind today’s impressive rally.

September 11th Stock Market: Opportunities to Invest in Banking, Retail, and Energy Stocks?

The trading session on September 10th witnessed several stocks attracting robust buying interest, presenting investors with a strategic opportunity to selectively allocate funds during the September 11th session.