Despite some recovery, the HNX-Index and UPCoM-Index failed to regain the green zone like the VN-Index. At the close, the HNX-Index fell 0.42 points to 274.18, and the UPCoM-Index dropped 0.27 points to 110.1.

|

Source: VietstockFinance

|

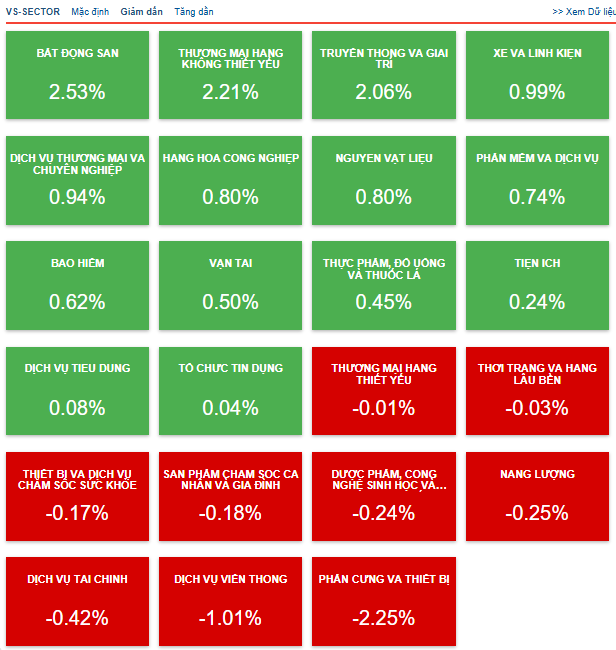

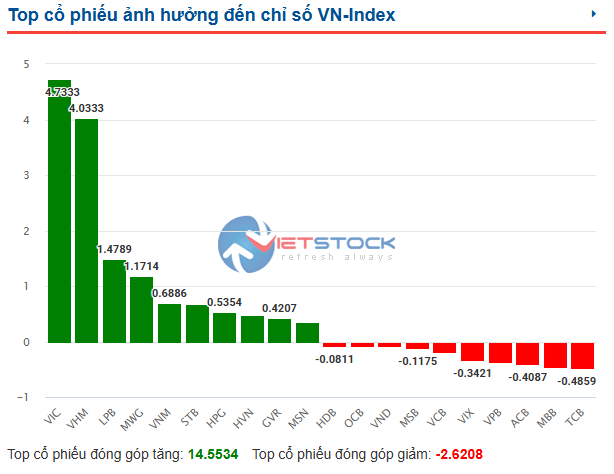

Real estate stocks rebounded, closing with a 2.53% gain, the highest in the market, significantly boosting overall market performance. Green dominated various sectors, from retail to industrial zones, with stocks like BCM, KBC, DXG, TAL, DXS, and CRE rising. Notably, the trio of VIC (+3.9%), VHM (+4.03%), and VRE (+1.63%) stood out.

VIC and VHM were the top contributors to the VN-Index, adding over 4.7 points and 4 points, respectively.

Source: VietstockFinance

|

Essential retail stocks also performed well, rising 2.21%, led by retail giants like MWG (+4.37%), FRT (+0.31%), and distributors such as DGW (+2.7%) and PET (+0.5%).

The media and entertainment sector also saw a 2.06% increase, with VNZ (+2.24%) and YEG (+5.17%) leading the way.

Raw materials stocks had a positive session, with “steel king” HPG (+1.04%), NKG (ceiling), and HSG (+2.83%) all advancing.

Despite gains, only 361 stocks rose (26 ceiling), compared to 362 falling (11 floor), with 880 unchanged. Thus, while the market rose, many portfolios remained in the red, a phenomenon known as “green on the outside, red on the inside.”

Nine sectors underperformed, led by hardware and equipment (-2.25%) and telecom services (-1.01%). Other declines were minimal, but financial services (mainly securities) fell 0.42%, impacting both the market and investor portfolios due to their capitalization and recent popularity.

Many stocks narrowed losses by the close but still ended significantly down, including VIX (-2.79%), SHS (-2.26%), and AAS (-10.07%). However, some bucked the trend, with DSE and VDS hitting ceilings.

|

Sector divergence on September 11

Source: VietstockFinance

|

Liquidity reached nearly 1.46 billion shares, worth almost 40.3 trillion VND. The VN-Index accounted for over 36.3 trillion VND, up from the previous session.

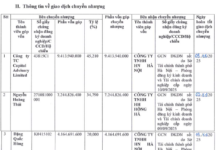

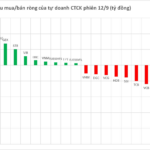

Foreign investors traded more actively, buying nearly 3.5 trillion VND and selling nearly 4.8 trillion VND, resulting in a net sell of nearly 1.3 trillion VND, their third consecutive net sell session.

SSI led net sells with 246 billion VND, followed by MSB (165 billion VND), MWG (164 billion VND), and SHB (109 billion VND).

On the buy side, VHM and TCB led with 131 billion VND and 117 billion VND, respectively.

| Top foreign net buys/sells on September 11 |

Morning Session: Recovery Efforts

With significant recovery efforts, especially in Vingroup stocks, the market rebounded. By midday, the VN-Index narrowed losses to 13.79 points, closing at 1,629.47. The HNX-Index fell 4.47% to 270.13, and the UPCoM-Index dropped 0.29 points to 110.08.

Most sectors fell, led by hardware and equipment (-3.03%), pressured by DLG (-2.4%), VEC (-6.82%), and POT (-0.5%).

Financial services (mainly securities) fell nearly 3%, with SSI (-3.89%), VIX (-5.31%), VND (-2.89%), SHS (-3.76%), MBS (-2.74%), HCM (-2%), FTS (-2.79%), and BSI (-3.56%) all declining. DSE was a rare gainer (+1.94%).

Banks fell 1.64%, with VCB (-1.22%), BID (-1.35%), TCB (-1.41%), CTG (-1.98%), and ACB (-2.07%) all down. Exceptions included LPB (+1.79%) and KLB (+0.42%).

Real estate rebounded 0.25%, with VIC, VHM, and VRE rising 1.53%, 0.98%, and 1.14%, respectively, contributing to the market’s recovery.

Other morning gainers included automobiles and components (+0.67%), software and services (+0.29%, led by FPT +0.4%), and essential retail (+0.07%, with SRC hitting the ceiling).

Foreign investors net sold nearly 1,322 billion VND, with SSI (397 billion VND), MSB (178 billion VND), and SHB (107 billion VND) leading. VHM led net buys with just over 63 billion VND.

10:40 AM: Red Dominates

By 10:30 AM, losses deepened, with the VN-Index down 30.47 points to 1,612.79, the HNX-Index down 5.32 points to 269.28, and the UPCoM-Index down 0.45 points to 109.92.

Selling intensified as liquidity surged, with nearly 637 million shares traded, worth almost 16.9 trillion VND.

535 stocks fell (7 to the floor), 937 were unchanged, and 131 rose (19 to the ceiling).

Large-caps (-1.92%) pressured the market, with banks, securities, and real estate all declining. Mid-caps (-1.28%), small-caps (-0.62%), and micro-caps (-2.82%) also fell.

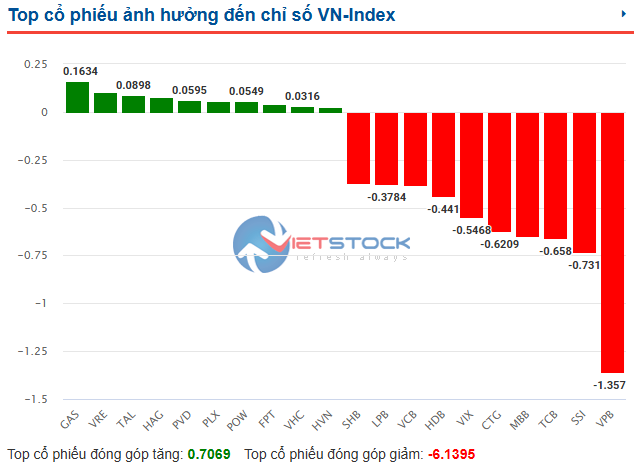

The top 10 negative contributors to the VN-Index were all banks and securities, led by VPB (-1.4 points), SSI (-0.7 points), and TCB (-0.7 points).

Source: VietstockFinance

|

Opening: Contrasting Global Trends

Contrary to positive global markets, Vietnamese indices opened September 11 on a challenging note.

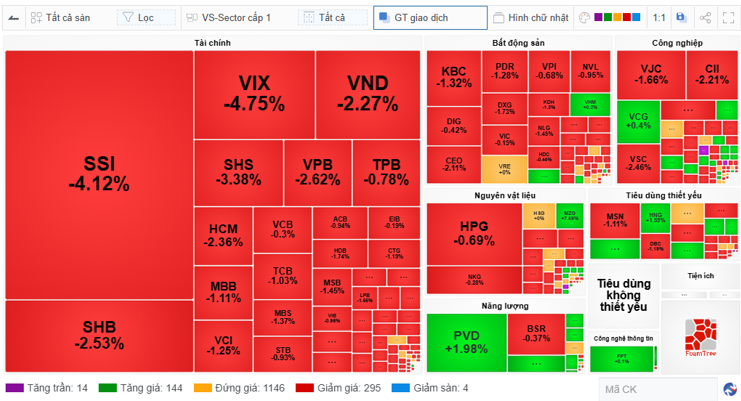

Red spread to 295 stocks, with 4 hitting the floor early. Only 144 stocks rose, including 14 ceilings. Liquidity was modest, with 108 million shares traded, worth nearly 3 trillion VND.

Key sectors like securities, banks, real estate, materials, and industrials all fell. By 9:30 AM, the VN-Index was down 11.85 points to 1,631.41, the HNX-Index down 1.95 points to 272.65, and the UPCoM-Index down 0.2 points to 110.07.

|

Early red spread

Source: VietstockFinance

|

Vietnamese markets contrasted with global positivity. In the U.S., the S&P 500 hit a new high as wholesale prices unexpectedly fell, boosting hopes for a Fed rate cut next week.

The S&P 500 rose 0.3% to 6,532.04, a record close. The Nasdaq Composite edged up 0.03% to 21,886.06, also a record. The Dow Jones fell 0.48% to 45,490.92, weighed down by Apple’s underwhelming iPhone announcement.

|

Wall Street’s performance

Source: VietstockFinance

|

In Asia, Japan’s Nikkei 225 led gains, hitting a new high of 44,251.65 by 9:20 AM (Vietnam time). SoftBank Group, a key Nikkei component, surged nearly 10%.

South Korea’s Kospi rose 0.65%, and the Kosdaq gained 0.39%.

– 16:10 11/09/2025

September Market: Where Should Investors Focus Their Attention?

The VN-Index is predicted to sustain its upward trajectory, aiming for the 1700 – 1800 point range, presenting an attractive investment prospect for September. With a focus on securities, port, and steel sectors, this presents a fresh opportunity for investors to capitalize on.