PetroVietnam Power Corporation (PV Power, Stock Code: POW, HoSE) has announced the materials for its Extraordinary General Meeting of Shareholders (EGM) scheduled for September 25, 2025, in Hanoi.

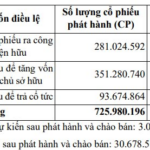

A key highlight is PV Power’s proposal to increase its chartered capital through the issuance of nearly 726 million shares for dividends, public offerings, and shareholder bonuses.

Specifically, the company plans to offer over 281 million shares to existing shareholders at VND 10,000 per share. The rights ratio is 12%, meaning shareholders holding 100 shares can purchase an additional 12 shares.

The expected proceeds from this offering, totaling over VND 2,810.2 billion, will fund the Nhon Trach 3 and Nhon Trach 4 Power Plant projects.

Illustrative image

The offering will commence immediately upon receiving the Public Offering Registration Certificate from the State Securities Commission, expected in Q1/2026.

Additionally, PV Power will issue nearly 351.3 million bonus shares to shareholders at a 15% rights ratio, allowing shareholders with 100 shares to receive 15 new shares.

The total issuance value, based on par value, is over VND 3,512.8 billion, funded from the development investment fund in PV Power’s 2024 audited financial report.

The company also plans to issue approximately 93.7 million shares as dividends, with a 4% rights ratio, enabling shareholders with 100 shares to receive 4 new shares.

The total issuance value, based on par value, exceeds VND 936.7 billion, sourced from undistributed after-tax profits in the 2024 audited financial report.

Both bonus share and dividend share issuances are scheduled for 2025, pending approval from the State Securities Commission.

Upon completion of these issuances, PV Power’s chartered capital will rise from over VND 23,418.7 billion to more than VND 30,678.5 billion.

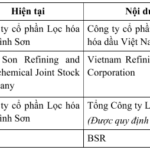

Beyond capital increase plans, PV Power will also present proposals to amend its business lines and update its headquarters address.

PV Power’s leadership noted that, per regulations, the company must notify the maximum foreign ownership ratio (FOR) before increasing capital through share issuances. However, some of PV Power’s current business lines have an FOR below 50%.

Consequently, PV Power must adjust by removing activities restricted to foreign investors. Specifically, the company will not engage in multi-purpose hydropower and nuclear power projects of significant socio-economic importance; labor export services; or national power grid transmission and dispatch.

“VPS Securities Plans to Issue 710 Million Bonus Shares to Boost Chartered Capital”

At the upcoming Extraordinary General Meeting, VPS Securities will propose to its shareholders a plan to issue 710 million bonus shares, thereby increasing its charter capital to VND 12,800 billion.

Why One Capital Hospitality’s OCH Stock Is Not Allowed for Margin Trading?

The Hanoi Stock Exchange (HNX) has placed a trading ban on margin trading for OCH shares due to the company’s negative net profit for the first half of 2025. The company’s poor financial performance has resulted in its shares being placed on a warning list, and subsequently, the HNX has taken the necessary steps to restrict trading activities to protect investors.