Amidst the vibrant Vietnamese retail market, a captivating battle for market share is unfolding between the two largest supermarket chains in Vietnam: Wincommerce (WCM), a subsidiary of Masan Group, and Bách Hóa Xanh (BHX) under Thế giới Di động. Since the beginning of 2025, both chains have been aggressively expanding their networks, accompanied by impressive revenue growth rates.

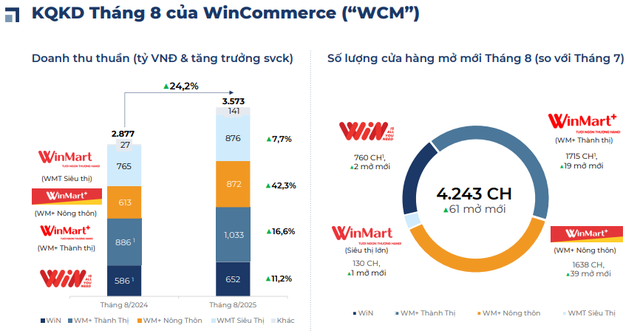

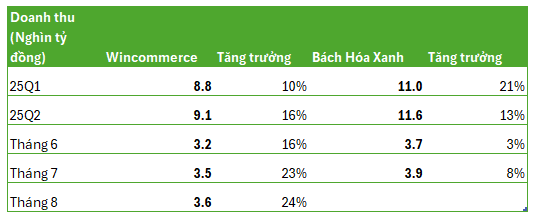

WCM’s growth trajectory has been increasingly positive quarter after quarter. In Q1/2025, revenue reached 8.785 trillion VND, a 10.4% increase compared to the same period in 2024. By Q2, this figure soared to 9.130 trillion VND, with a 16.4% growth. Notably, the first two months of Q3 witnessed a significant leap: July recorded 3.486 trillion VND (up 23%), and August continued to rise by 24.2% to 3.573 trillion VND.

In the first eight months, WCM’s cumulative revenue hit 25 trillion VND, a 16% increase year-on-year, surpassing the annual plan’s expectations (8-12%).

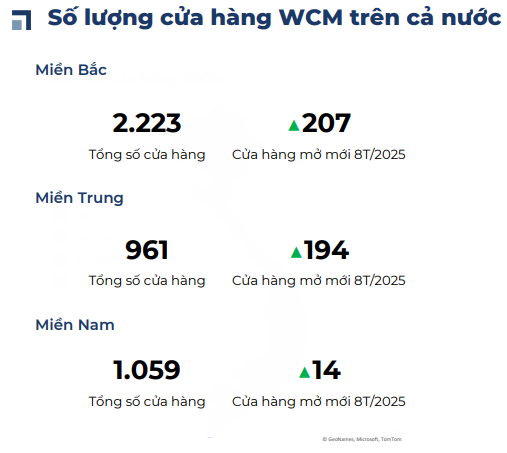

Masan attributes this breakthrough to an effective store expansion strategy. In eight months, WCM opened 415 new stores, bringing the total to 4,243 nationwide. Same-store sales growth (LFL) reached 12% in August, reflecting improved operational efficiency.

With the current momentum, WCM is poised to meet its 2025 target of 400-700 new stores and exceed revenue goals. This rapid growth not only solidifies WCM’s position but also puts significant pressure on its direct competitor, Bách Hóa Xanh.

After a strong start in early 2025, BHX shows signs of slowing growth. In Q1/2025, BHX achieved 11 trillion VND in revenue, a 20.9% increase year-on-year. However, Q2 growth dropped to 12.6%, with 11.6 trillion VND. Notably, June saw only a 3% increase before rebounding to 8.3% in July.

Thanks to the initial acceleration, BHX’s seven-month cumulative revenue still grew by 15% to 26.5 trillion VND. The chain has yet to release August figures.

In terms of store count, BHX opened 434 new locations since the beginning of the year, totaling 2,204. However, expansion has slowed, with only 20 new stores in the first two months of Q3, compared to 232 in Q1 and 182 in Q2. In the second half, BHX will focus on selective expansion in provinces where it already has a presence while maintaining operational efficiency.

As WCM expands southward and BHX northward, both chains are heavily investing in the Central region to increase their influence. BHX opened 55% of its new stores here, while WCM added 194 stores in the region.

Currently, WCM is optimizing existing stores and expanding into rural areas—a high-potential market. Meanwhile, BHX is adjusting costs after a period of rapid expansion, impacted by heavy rainfall. BHX maintains an advantage in average store revenue due to its convenient, neighborhood-focused model.