In accordance with Resolution No. 174/2024/QH15 dated November 30, 2024, by the National Assembly, Resolution No. 110/NQ-CP dated April 26, 2025, by the Government, and the approval from the Ministry of Finance in Official Dispatch No. 14195/BTC-DNNN dated September 12, 2025, the State Capital Investment Corporation (SCIC) has successfully disbursed VND 7,770 billion to invest in shares of Vietnam Airlines (stock code HVN, HOSE).

This investment bolsters Vietnam Airlines’ chartered capital, ensuring long-term financial stability and achieving a critical milestone: the company has emerged from negative equity, gained resources to settle debts, and is poised to expand its fleet. This lays a robust foundation for Vietnam Airlines’ comprehensive recovery and sustainable growth.

Previously, on September 13, 2021, SCIC executed its first investment tranche of VND 6,894.88 billion, aiding Vietnam Airlines in enhancing liquidity and sustaining operations during the severe impact of the COVID-19 pandemic.

Following these two disbursements, SCIC now holds 47.09% of Vietnam Airlines’ chartered capital. This initiative transcends financial investment, fulfilling directives from the Party, National Assembly, Government, and competent authorities to support state-owned enterprises as pillars of the economy.

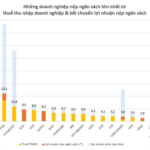

Over nearly 20 years, SCIC has maintained strong performance: total pre-tax profit reached VND 108,830 billion, with VND 108,145 billion contributed to the state budget (ranking SCIC among the top 20 largest state budget contributors in 2025 with VND 9,567.9 billion). The average return on equity (ROE) stands at approximately 13% annually. With a chartered capital exceeding VND 50,000 billion, SCIC’s investment portfolio spans over 100 enterprises across key sectors such as finance, banking, telecommunications, energy, infrastructure, and public services.

Drawing on international best practices and nearly two decades of operational experience, SCIC is proposing a plan to consolidate and enhance its model as a professional capital management corporation, evolving toward a National Investment Fund. This aims to restructure and improve the efficiency of state-owned enterprises through market mechanisms, concentrating resources from capital restructuring in non-strategic enterprises and other state-allocated funds to develop large-scale, high-performing state-owned enterprises.

The proposal also recommends transferring the representation of state ownership in all enterprise types from ministries, sectors, and localities to SCIC, continuing the restructuring of state-owned enterprises. This includes large-scale enterprises, excluding those in critical sectors already managed by major conglomerates (e.g., energy, petroleum, minerals, electricity) and those in defense, security, and purely public service domains.

Through this investment decision, SCIC reaffirms its commitment to partnering with Vietnam Airlines in its robust recovery, fleet modernization, service quality enhancement, and promotion of Vietnam’s image on the global stage.

Vietnam Airlines’ Subsidiary Wins a $27.5 Million Aircraft Maintenance Project at Long Thanh Airport

Let me know if you would like me to provide any additional revisions or transformations to this headline to better suit your needs.

Vietnam Airlines’ subsidiary, VAECO – a leading aircraft engineering company, has been entrusted with an important project. With a substantial investment of 645 billion VND, VAECO will undertake the ‘Project for Construction and Business of Aircraft Maintenance Services No. 2’ at Long Thanh International Airport.

Viettel: Forging Ahead with Record-Breaking Contributions to the National Coffers

Let me know if you would like me to tweak this title or provide additional suggestions.

“CafeF has recently unveiled the VNTAX 200 list, comprising the top businesses contributing an impressive 200 billion VND and above to the state budget in the latest fiscal year. Notably, a significant number of these enterprises boast substantial budget contributions derived from their profit margins.”