U.S. Energy Secretary Chris Wright stated earlier this month that the European Union could entirely phase out Russian natural gas purchases within a year. He claimed the EU could transition from Russian gas to U.S. LNG in just six months. However, a significant hurdle stands in the way: cost.

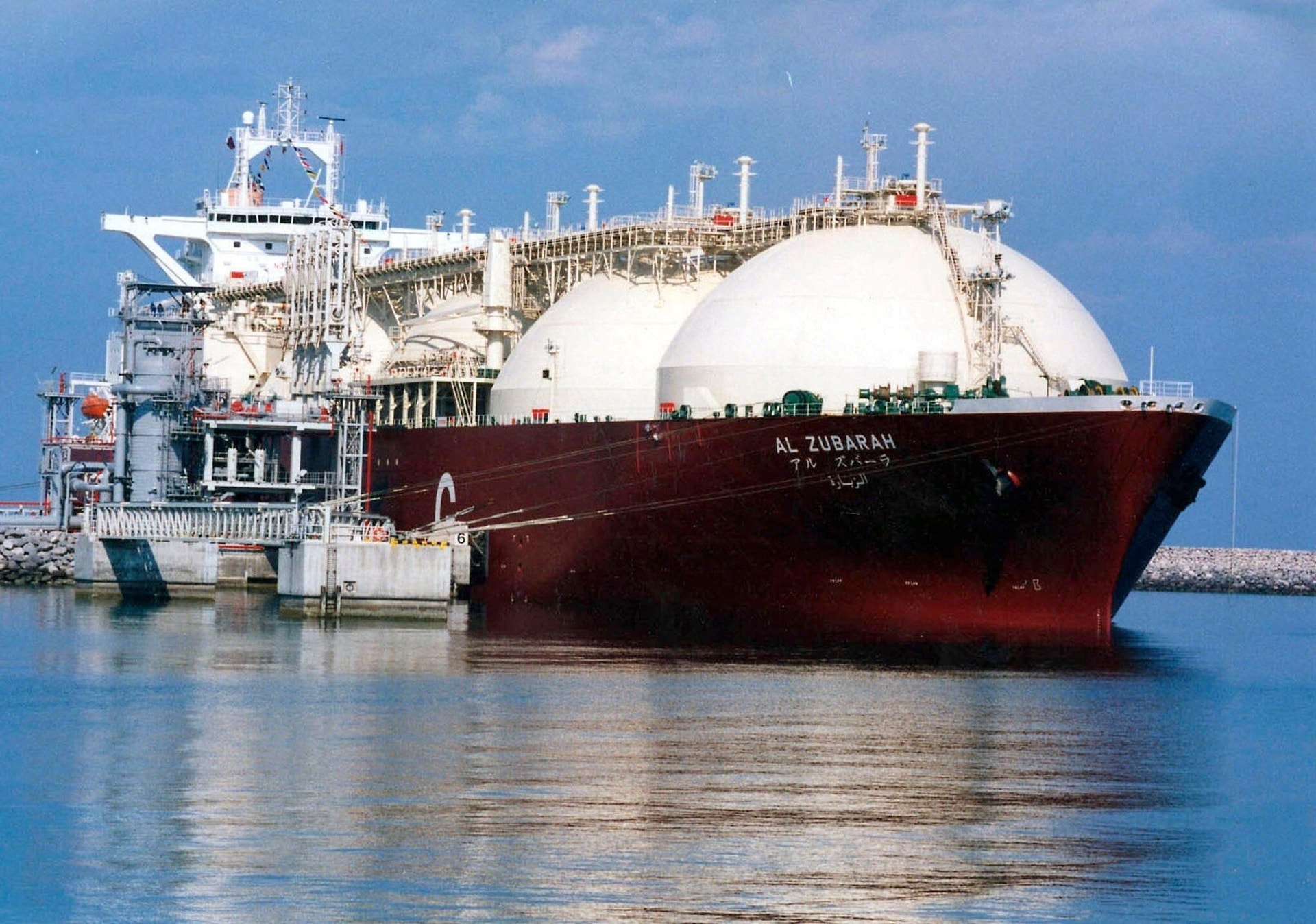

In 2024, the EU faced an unwelcome milestone: its imports of Russian liquefied natural gas (LNG) reached an all-time high, despite sanctions on Russia’s energy sector and repeated pledges to eliminate Russian gas imports following the crude oil embargo.

The reason is straightforward. As a Rystad Energy analyst told the Financial Times late last year, Russian LNG is priced “significantly lower” than U.S. liquefied gas. EU leaders are eager to reduce energy imports from Russia. Earlier this year, they even discussed terminating long-term contracts without penalties.

Yet, these efforts have fallen short. In the first half of this year, import values actually increased. Total Russian LNG imports from January to June reached €4.4 billion (approximately $5.16 billion), up from €3.47 billion (around $4.1 billion) in the first half of 2024.

Unsurprisingly, Secretary Wright aims to redirect these funds to U.S. LNG producers. After all, the Trump administration has openly pursued an agenda of U.S. energy dominance—an agenda that’s proving successful.

In the first half of the year, total EU LNG imports surged 25% year-over-year, reaching record highs. Of these imports, 55% came from the U.S., compared to 14% from Russia.

The EU is now the largest market for U.S. LNG. Paradoxically, it’s also Russia’s top LNG buyer. The EU imported roughly two-thirds of U.S. LNG in the first eight months of 2025. During the same period, it purchased 51% of Russia’s LNG exports—more than China, Russia’s new top energy client.

Furthermore, according to the Finland-based Centre for Research on Energy and Clean Air, the EU remains the largest foreign buyer of Russian pipeline gas, though volumes are a fraction of pre-2022 levels.

Despite this, the EU’s Energy Commissioner insists the bloc will uphold its 2028 deadline to fully phase out Russian energy imports. The Commissioner stressed the need to balance sanctions with price stability and supply security, warning that abrupt cuts could severely disrupt markets.

Secretary Wright isn’t exaggerating when he says the EU could rapidly increase U.S. LNG imports. However, larger U.S. volumes come at a higher cost, leaving the EU desperate for cheaper alternatives to avoid replacing one major dependency with an even larger one.

As a result, the EU is caught between competing priorities: tightening sanctions on Russian energy revenues, aligning with the Trump administration’s push for U.S. energy sales, and securing affordable energy to prevent industrial decline.

“After India, the US Sets Its Sights on the Second Largest Oil Importer: Who’s Next on the List?”

This country risks facing similar repercussions to those imposed on India, as these nations continue to purchase oil from Russia despite sanctions.

“EVFTA: A Half-Decade Trade Triumph for Vietnam and the EU, with Nearly $300 Billion in Commerce”

After 5 years in effect, the EVFTA has facilitated trade between Vietnam and the EU, totaling nearly $300 billion. This has elevated Vietnam’s standing in ASEAN and on the global stage. The agreement has also driven institutional reforms, promoted the adoption of international standards, and fostered stronger business connections.