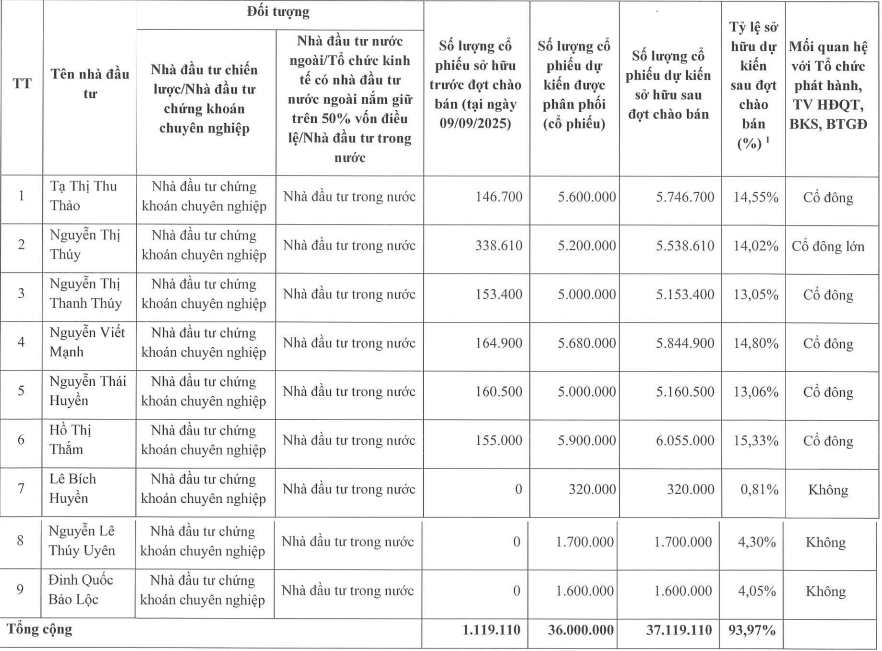

ATS Investment Group Corporation (Atesco, stock code: ATS, listed on HNX) recently approved a private placement plan to issue 36 million shares to nine individual investors.

Among the nine investors, six already hold ATS shares, while the remaining three are new to the company’s shareholder list.

According to the list, Hồ Thị Thắm is the largest buyer, planning to acquire 5.9 million shares, followed by Nguyễn Viết Mạnh with 5.68 million shares.

Post-issuance, these nine shareholders are expected to collectively own 93.97% of ATS’s capital.

Source: ATS

The offering price is set at VND 10,000 per share, half of ATS’s current market price. Upon completion, Atesco will raise VND 360 billion, increasing its chartered capital from VND 350 billion to VND 710 billion.

The proceeds are earmarked for acquiring a 90% stake in Hoang Quan Binh Thuan Real Estate Consulting – Trading – Service JSC from three shareholders.

Trương Anh Tuấn, Chairman of Hoang Quan Binh Thuan and Hoang Quan Real Estate Consulting – Trading – Service JSC (stock code: HQC), will transfer 21 million shares. Phan Lê Thùy Trang and Nguyễn Trần Thùy Trang will sell 11.76 million and 3.2 million shares, respectively.

Established in 2004, Hoang Quan Binh Thuan operates in real estate under Trương Anh Tuấn’s chairmanship since its inception. By November 2024, the company’s chartered capital reached VND 400 billion.

Notable projects include the Nam Phan Thiet New Urban Area (13.5 ha, VND 905 billion investment) and Ham Kiem 1 Industrial Park (132 ha, VND 273 billion investment).

ATS, originally founded in 1998 as Autumn Entertainment Service and Trading Co., Ltd., later rebranded as Atesco Industrial Catering JSC. The company currently operates a food processing plant in Dai An Industrial Zone, Hai Duong.

Billion-Dollar Deal in Dong Nai: Thai Industrial Park Giant Sells Project to Novaland-Affiliated Entity

The sale of a 51% stake in two subsidiary companies developing urban service projects in Long Thanh not only secured over $46 million for Amata VN but also marked a strategic partnership with experts in residential real estate, including entities affiliated with Novaland.

Nam Long (NLG): Pioneering Sustainable Development and Visionary Integrated Urban Creation

With over 30 years of establishment and growth, Nam Long Group (HOSE:NLG) has consistently crafted living environments and value-driven products for the community, committing to sustainable development (ESG) while contributing to the national economy and aligning with Vietnam’s strategic development vision through the creation of integrated urban areas.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.

The Stock Market’s Volatile Week: What’s Next?

Today (September 12th) marks the fourth consecutive session of stock market gains, propelled by Vingroup stocks, real estate, and steel sectors. While the market extended its positive momentum, trading liquidity weakened as foreign investors continued to offload holdings. Amid this upbeat performance, the market also received a boost from positive news on potential upgrades.