I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON 10/09/2025

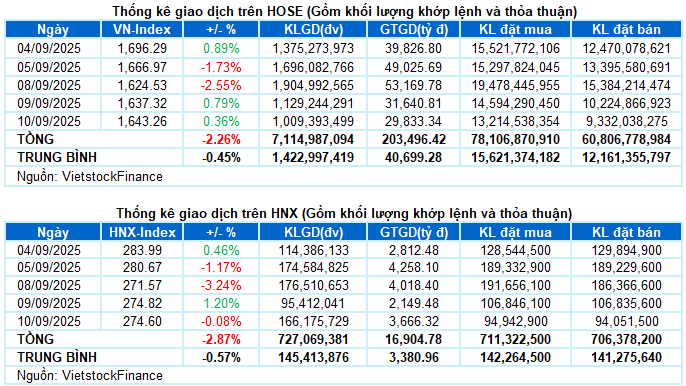

– Key indices showed mixed movements during the trading session on 10/09. Specifically, the VN-Index rose by 0.36%, reaching 1,643.26 points, while the HNX-Index closed just below the reference level at 274.6 points.

– Market liquidity remained weak. The order-matching volume on the HOSE decreased by 17.7%, totaling 833 million units. Similarly, the HNX recorded 80 million matched units, a 14.3% decline compared to the previous session.

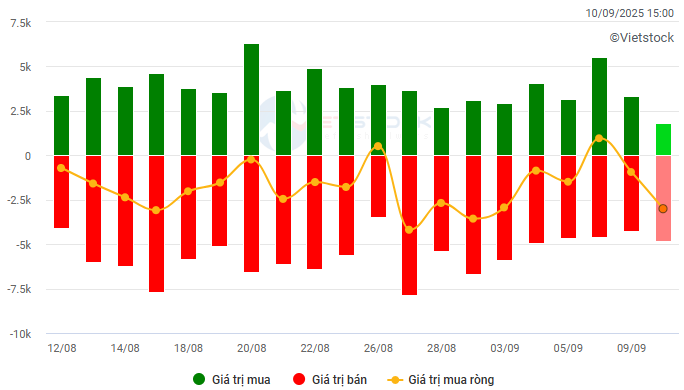

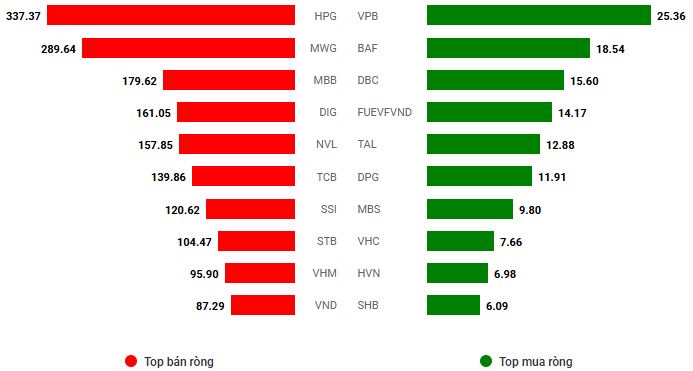

– Foreign investors intensified net selling, with values nearing 3 trillion VND on the HOSE and 70 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market continued to oscillate on low liquidity during the 10/09 session. The VN-Index traded around the 1,645-point mark for over an hour in the early session, then gradually succumbed to selling pressure, turning red. Cautious buying and increased foreign selling pressure weighed on the index. In the afternoon session, the VN-Index stabilized around 1,630 points and gradually recovered, though market divergence persisted. Strong late-session buying helped the index close up nearly 6 points at 1,643.26.

– In terms of influence, VCB, VIC, and CTG were the top contributors, adding a combined 4.5 points to the VN-Index. Conversely, FPT and GVR led the decline, reducing the index by over half a point.

– The VN30-Index closed slightly up by 0.19%, at 1,828.63 points. The basket’s breadth was balanced, with 14 gainers, 13 losers, and 3 unchanged stocks. CTG and SSB topped the list with gains over 1.5%, while TPB and GVR lagged with adjustments exceeding 1%.

Among sectors, energy led with a notable 2.41% increase. Green dominated large-cap stocks like BSR (+4.84%), PVS (+1.48%), PVD (+2.48%), OIL (+0.87%), PVT (+0.84%), PVC (+4.31%), POS (+2.94%), and AAH (+2.44%).

Industrial and financial sectors also contributed significantly, with strong demand for stocks like GEX (+3.14%), CII (+1.57%), VSC (+5.17%), HVN (+1.59%), HAH (+1.05%), PC1 (+1.55%); SSI (+1.07%), TCB (+1.3%), MBB (+1.13%), VCB (+1.39%), CTG (+1.81%), SHB (+1.14%), and SSB (+1.53%).

Meanwhile, the IT sector lagged with a 0.81% decline, pressured by leaders like FPT (-0.88%), CMG (-0.13%), and ELC (-0.23%). Other sectors showed mixed trends, with green and red alternating, and indices fluctuating below 0.5%.

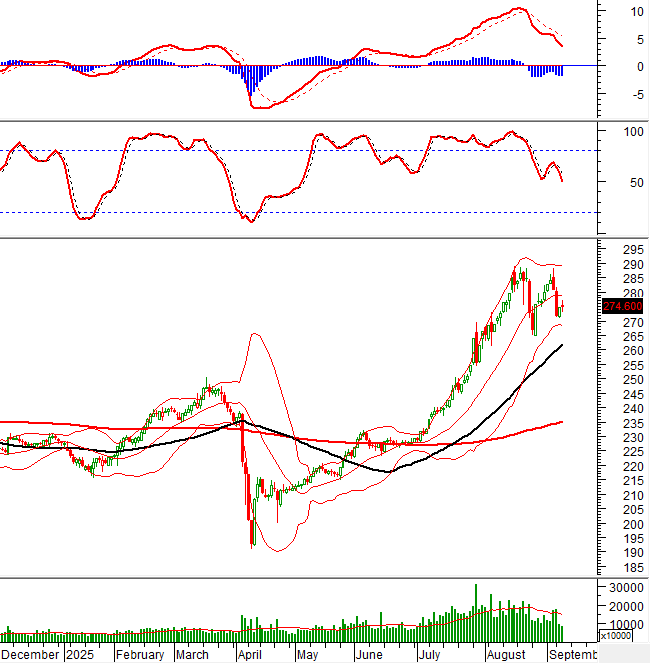

The VN-Index regained green after a volatile session. However, declining trading volume, below the 20-day average, indicates prevailing caution. In upcoming sessions, the index must surpass the Bollinger Bands’ Middle line with improved liquidity to strengthen the uptrend. If declines resume, the short-term trendline (1,620-1,630 points) will serve as critical support.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Trading Volume Below 20-Day Average

The VN-Index regained green after a volatile session. However, declining trading volume, below the 20-day average, indicates prevailing caution.

In upcoming sessions, the index must surpass the Bollinger Bands’ Middle line with improved liquidity to strengthen the uptrend. If declines resume, the short-term trendline (1,620-1,630 points) will serve as critical support.

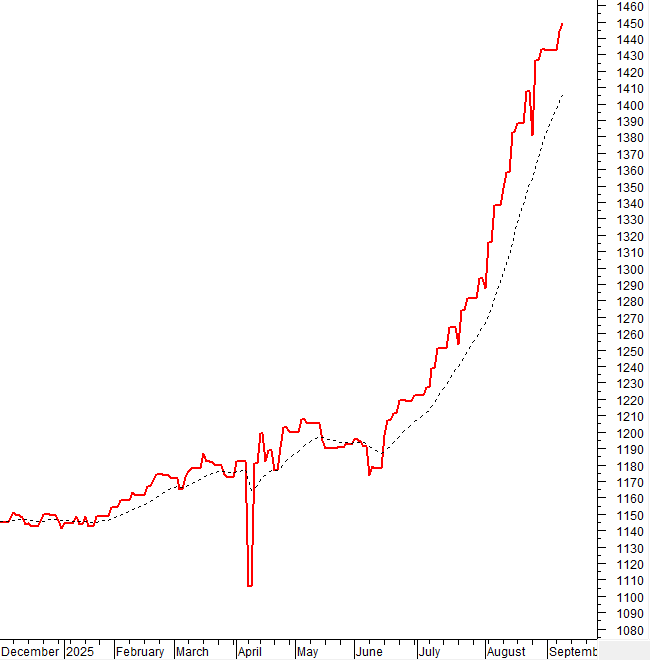

HNX-Index – Spinning Top Candlestick Pattern Emerges

The HNX-Index formed a Spinning Top pattern, with trading volume remaining below the 20-session average, reflecting investor indecision.

Short-term volatility risks persist as the Stochastic Oscillator and MACD continue downward after sell signals.

Capital Flow Analysis

Smart Money Movement: The VN-Index’s Negative Volume Index remains above the 20-day EMA. If this continues in the next session, sudden downside risks (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors net-sold on 10/09/2025. Continued selling in upcoming sessions would worsen the outlook.

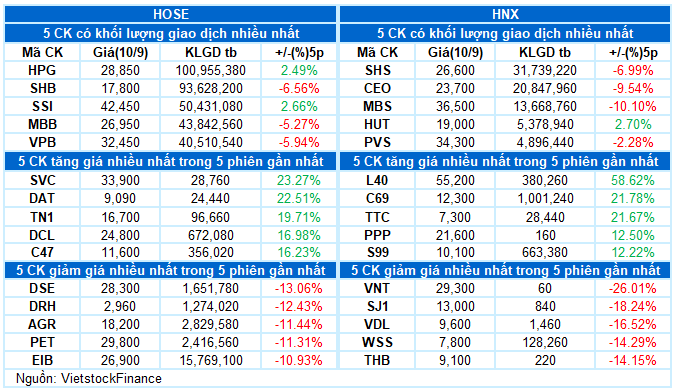

III. MARKET STATISTICS ON 10/09/2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:11 10/09/2025

Unlocking the Potential: Removing Barriers to Foreign Investment in the Stock Market

Introducing a transformative initiative: the proposal to abolish the regulation permitting general shareholder meetings to lower foreign ownership ratios below the statutory limit. This move empowers shareholders, fostering a dynamic and inclusive business environment. By removing this regulation, we unlock the potential for greater foreign investment, driving innovation and growth.

The Stock Market’s Cash Crunch: A Capital Conundrum

The VN-Index witnessed yet another volatile trading session, with the benchmark index swinging back and forth before closing slightly lower on September 10th. Trading activity waned, as the value of transactions on the Ho Chi Minh Stock Exchange dipped below the VND 30 trillion mark.