On the morning of September 19th, shares of Vinacafé Bien Hoa Joint Stock Company (VCF) surged to their ceiling price, reaching VND 358,400 per share with no sellers, solidifying its position as the most expensive stock on the HOSE. The company’s market capitalization soared to over VND 9.5 trillion, marking a historic high.

The dramatic rise in VCF’s stock price followed the announcement of a 480% cash dividend for 2024, equivalent to VND 48,000 per share. The final registration date is October 1st, with payment expected on October 8th.

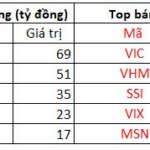

With over 26.6 million shares outstanding, the company is set to distribute approximately VND 1.3 trillion in dividends. The majority of this amount will go to its parent company, Masan Beverage LLC, which holds 98.79% of VCF’s capital, expected to receive around VND 1.26 trillion.

Vinacafé Bien Hoa is renowned as one of the “dividend kings” on the stock market, consistently offering substantial cash dividends. From 2017 to present, VCF has maintained dividend payouts ranging from 250% to over 400%. Notably, in 2017, the company paid an impressive VND 66,000 per share in dividends.

Originally established in 1969 as the Coronel Coffee Factory, later renamed Bien Hoa Coffee Factory, Vinacafé Bien Hoa was equitized in 2004. Since 2012, it has been part of the Masan Group after a Masan Consumer subsidiary acquired a majority stake.

In the first six months of the year, Vinacafé Bien Hoa reported net revenue of over VND 1.03 trillion, a 19% increase year-on-year. After-tax profit reached VND 249 billion, up 34%.

“480% Cash Dividend Announced: Stock Surges to Record High, Turning Deep Purple in Trading”

Stock prices surged following the announcement that the company has approved a 2024 cash dividend of 480% per share, payable on October 8th.

SMC Chairman’s Relative Fined for Unauthorized Share Sale

Mr. Nguyen Nghia Dung, brother of Mrs. Nguyen Thi Ngoc Loan—Chairperson of SMC’s Board of Directors—has been fined 100 million VND by the State Securities Commission (SSC). The penalty stems from his sale of 780,000 SMC shares without prior transaction disclosure as required.