On the morning of September 19th, shares of Vinacafé Bien Hoa Joint Stock Company (VCF) surged to their ceiling price, reaching 358,400 VND per share with no sellers, solidifying its position as the most expensive stock on the HOSE. The company’s market capitalization soared to over 9.5 trillion VND, marking a historic high.

The dramatic rise in VCF’s stock price followed the announcement of a 480% cash dividend for 2024, equivalent to 48,000 VND per share. The final registration date is October 1st, with payment expected on October 8th.

With over 26.6 million shares outstanding, the company is set to distribute approximately 1.3 trillion VND in dividends. The majority of this amount will go to its parent company, Masan Beverage LLC, which holds 98.79% of VCF’s capital, expected to receive around 1.26 trillion VND in this dividend payout.

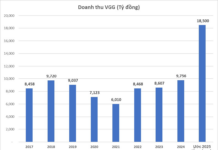

Vinacafé Bien Hoa is renowned as one of the “dividend kings” on the stock market, consistently offering substantial cash dividends. From 2017 to present, VCF has regularly paid cash dividends ranging from 250% to over 400%. Notably, in 2017, the company paid an impressive dividend of 66,000 VND per share.

Originally established in 1969 as the Coronel Coffee Factory, later renamed Bien Hoa Coffee Factory, Vinacafé Bien Hoa was equitized in 2004. Since 2012, VCF has been a member of the Masan Group after a Masan Consumer subsidiary acquired a majority stake.

In the first six months of the year, Vinacafé Bien Hoa reported net revenue of over 1.03 trillion VND, a 19% increase compared to the same period in 2024. After-tax profit reached 249 billion VND, up 34%.

PNJ Announces 14% Dividend Payout for Second Tranche of 2024

PNJ is set to distribute nearly VND 473.1 billion in dividends for the second tranche of 2024, offering a 14% cash payout to shareholders. The final registration date for eligibility is September 29, 2025.

Digital Transformation: The New Growth Lever for Vietnam’s Retail Sector

Amid Vietnam’s robust economic growth, marked by an 8% GDP increase in Q2/2025 and a resurgence in domestic consumption, digital transformation has emerged as a strategic priority for many Vietnamese businesses. For Masan, technology is not merely a supportive tool but a cornerstone that directly drives financial value and enhances operational efficiency in a sustainable manner.

The Evolution of Vietnam’s Consumer Stock Group: Unveiling the Prospects

Vietnam is approaching an important market reclassification, presenting a significant opportunity for global capital to penetrate deeper into its economy. With a market capitalization of nearly USD 4.8 billion, high liquidity, and ample room for foreign investment, the Masan Group (HOSE: MSN) is poised to be a prime target for international investors. The company’s solid business foundation further enhances its appeal to foreign capital seeking strategic investments in the country.

“A Lucrative Payout: Pharmaceutical Company Offers Nearly 39% Dividend, Pushing 2024 Cash Dividend to an Impressive 172%”

Our company is proud to announce that we have executed two rounds of cash dividend payments, derived from the post-tax profits of our 2024 business operations. With a total distribution rate of 24%, we are thrilled to share the success of our endeavors with our valued shareholders.

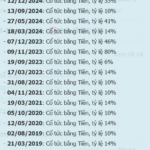

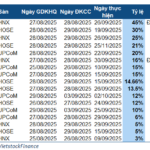

The Ultimate Dividend Stock for the Week of August 25-29: PV GAS Shines Bright with a Massive $200 Million Payout Ahead of the Long Weekend

“This week, leading up to the National Day holiday on September 2nd, a total of 17 companies will be finalizing their cash dividend distributions. The highest rate among these businesses stands at an impressive 45%, equating to VND 4,500 per share owned. A substantial return for shareholders as we head into the holiday period.”