|

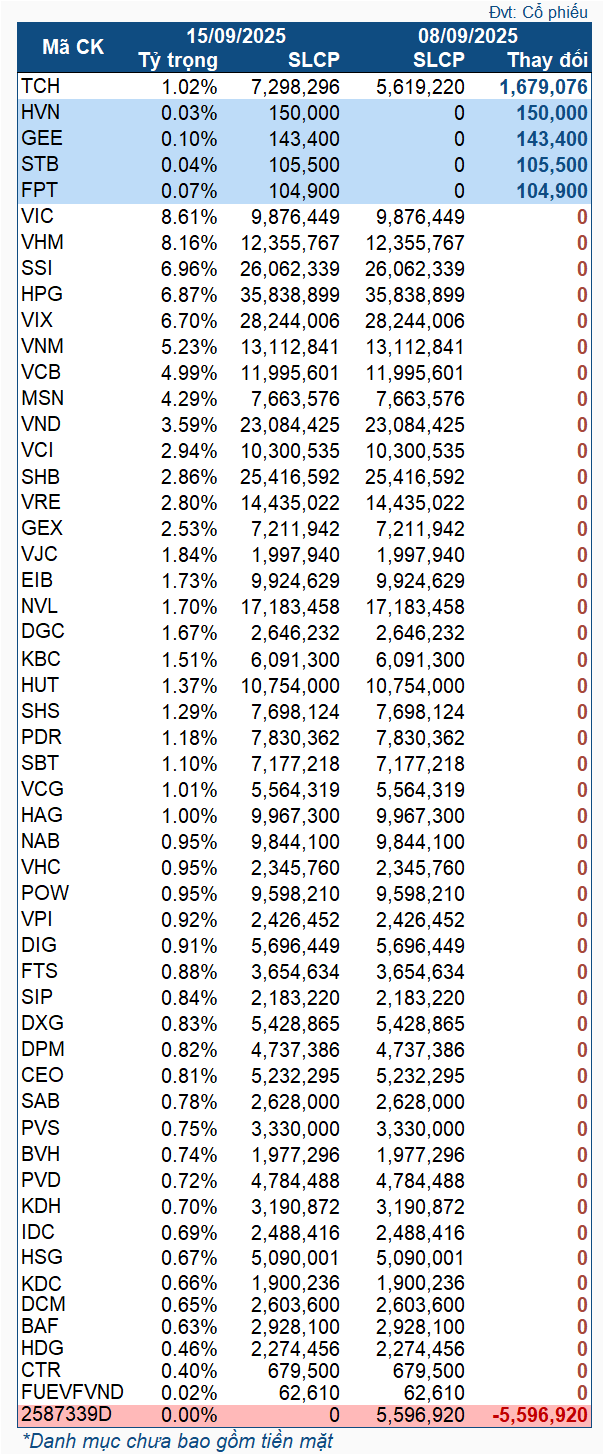

Changes in VNM ETF’s Treasury Shares for the Week of September 8-15

|

Specifically, during this period, the VNM ETF began purchasing HVN, GEE, STB, and FPT. Among these, HVN saw the highest acquisition with 150,000 shares, followed by GEE with 143,300 shares, and both STB and FPT with over 100,000 shares each.

Additionally, TCH also experienced an increase during this period, but this was due to the additional shares from the offering of over 200 million shares to existing TCH shareholders at a ratio of 10:3 (1 share equivalent to 1 right, and 10 rights allowing the purchase of 3 new shares). Given that the warrant (2587339D) is no longer active and the increase in shares, it is likely that the Fund exercised this warrant.

Notably, FPT, HVN, STB, and GEE were the four new stocks added to the MarketVector Vietnam Local Index—the benchmark index of the Fund—during the Q3 2025 portfolio review announced by MarketVector Indexes on the morning of September 13. The estimated purchase values are $13.6 million, $10 million, nearly $7.3 million, and over $5.7 million USD, respectively.

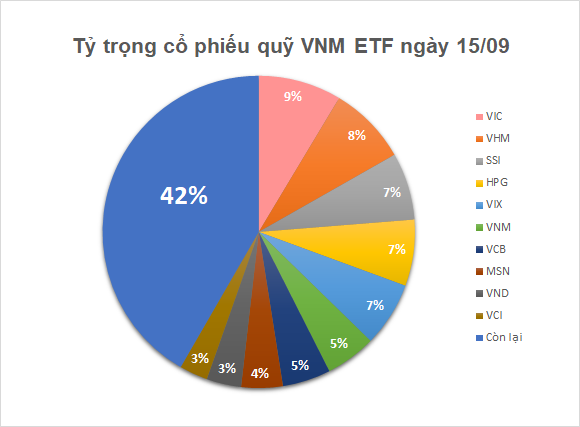

As of September 15, the total asset value of the VNM ETF reached nearly $600 million USD, up from $571 million USD on September 8, allocated across 51 stocks and 1 fund certificate.

– 12:00 17/09/2025

Technical Analysis for the Afternoon Session of September 17: Proceed with Caution Near Previous Peak

The VN-Index has seen a modest uptick, currently trading below its August 2025 and early September 2025 peaks, which align with the 1,690–1,711 point range. Similarly, the HNX-Index is mirroring this trend, finding support at the Middle Bollinger Band.

The Stock Market’s Crystal Ball: Unveiling the VN50 Growth and VNMITECH Portfolios’ Secrets

On August 11, 2025, the Ho Chi Minh Stock Exchange (HOSE) unveiled the construction and management rules for the VNMITECH Index, an index of modern industrial and technology stocks, and the VN50 Growth Index, which tracks the performance of Vietnam’s top 50 growth stocks. This prompted swift speculation from securities firms about the potential constituents of these newly unveiled indices.

The Future is Bright: Revamping the FTSE Vietnam Index

On September 5, 2025, FTSE Russell, a leading global index provider, announced the constituent stocks for the third-quarter review of two prominent Vietnamese stock indices: the FTSE Vietnam Index and the FTSE Vietnam All-Share Index.