Post-peak, over 60% of banking stocks are undergoing adjustments.

The banking sector is in the spotlight as the VN-Index hovers around the 1,670–1,700 point range.

Since the latter half of August 2025, after numerous stocks hit historic highs, a widespread adjustment phenomenon has emerged.

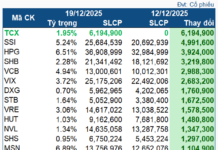

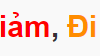

As of the session on September 16, 17 out of 27 banking stocks across three exchanges recorded declines of more than 10% from their peaks. Even stocks that consistently broke records, such as ACB and VPB, have started to adjust.

Several stocks are adjusting among those with the highest number of record breaks in 2025 (as of the session on September 16).

|

Among them, VPB once dropped nearly 22% from its peak, entering a short-term “bear market” state. ACB has also retreated by about 11%, despite setting new highs 21 times in 2025. Stocks like NAB, EIB, VAB, MSB, VIB, and TPB have also recorded double-digit declines.

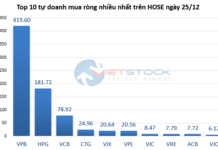

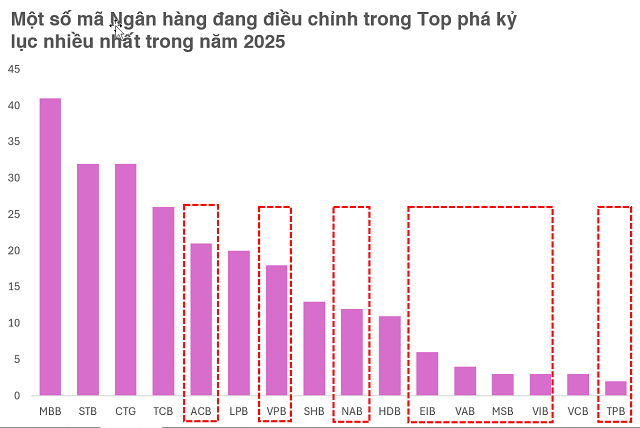

However, the trend is uneven. State-owned banks such as VCB, BID, and CTG have played a supportive role in the market throughout August, with gains of over 10%.

Notably, CTG approached its historic record price during the September 16 session, demonstrating the resilience of the pillar group.

Some joint-stock commercial banks like STB, MBB, and SHB are within 10% of their peak prices. This divergence has caused significant market volatility but maintains a balance, especially as the banking sector dominates market capitalization.

Market Upgrade: “Sell the News” or a New Breakthrough?

The most anticipated event in October 2025 is FTSE Russell’s market upgrade assessment. This is not just a formal milestone but also raises expectations for larger foreign capital inflows into Vietnam.

However, the market faces the common effect: “sell the news.” Many investors fear that after the announcement, profit-taking pressure will increase, especially with many banking stocks trading at high levels.

Mr. Nguyễn Tuấn Anh, Chairman of FinPeace, believes this reaction stems from speculative capital, which often exploits news to realize profits.

“Historically, many markets have experienced short-term volatility around upgrade events. However, after 6–9 months, these markets have developed an upward trend due to long-term capital inflows,” Mr. Tuấn Anh noted.

According to him, domestic demand is currently strong enough to absorb selling pressure from foreign investors. Market liquidity remains at historic highs, especially during uptrend sessions, indicating a solid foundation for a new growth cycle.

From another perspective, Mr. Bùi Văn Huy, Research Director at FIDT, assesses that the short-term upside potential for the banking sector is limited, as valuation levels have approached the five-year average. However, the medium-term outlook remains positive due to fundamental factors: sustained credit growth, low interest rates, and public investment stimulus.

“Banks remain the pillar group supporting the VN-Index. However, the trend will be divergent: banks with high asset quality, improved CASA ratios, and stable NIM will continue to attract capital, while those with weak capital or heavy reliance on real estate will face pressure,” Mr. Huy emphasized.

He also advises investors to avoid a “basket-buying” strategy and instead carefully select based on fundamentals. The current market phase is driven by the “individual stories” of each group, rather than a uniform upward trend as before.

Overall, the market is approaching a lull near its all-time highs. Banking stocks, after a series of surges, have entered an adjustment phase but remain the “anchor” for the VN-Index.

The October 2025 upgrade assessment may cause short-term volatility, but in the long term, growth prospects are reinforced by foreign capital inflows, strong domestic demand, and Vietnam’s increasingly prominent position in the Asian stock market landscape.

– 07:45 18/09/2025

Market Pulse 10/09: VN-Index Rebounds in Afternoon Session as Foreign Investors Ramp Up Net Selling

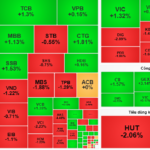

At the close of trading, the VN-Index rose 5.94 points (+0.36%) to 1,643.26, while the HNX-Index dipped 0.22 points (-0.08%) to 274.6. Market breadth favored the bulls, with 381 gainers outpacing 332 decliners. The VN30 basket showed a near-even split, with 14 advancers, 13 decliners, and 3 unchanged stocks.

Vietstock Daily 11/09/2025: Market Polarization Amid Low Liquidity

The VN-Index swiftly rebounded into positive territory after a volatile trading session. However, trading volume continued to decline, falling below the 20-day average, indicating prevailing caution among investors. In the upcoming sessions, the index must break above the Middle Bollinger Band while accompanied by improved liquidity to solidify its upward trajectory. Should selling pressure return, the short-term trendline (around 1,620–1,630 points) will serve as a critical support level.

Market Pulse 11/09: An Exciting Afternoon Session, VN-Index Rebounds 52 Points from Lows

In stark contrast to the morning session’s struggles, which saw the VN-Index dip below 1,606 points, the afternoon session painted an entirely different picture. The index staged a robust comeback, closing at 1,657.75, marking a significant gain of 14.49 points. The real estate sector, particularly Vingroup-related stocks, emerged as the driving force behind today’s impressive rally.