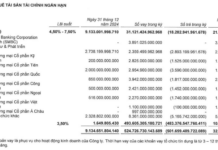

Banks must maintain a minimum capital adequacy ratio of 8% starting September 15th. Image: Source |

The State Bank of Vietnam has issued Circular 14, effective from September 15th, outlining capital adequacy ratio requirements for commercial banks and foreign bank branches, as reported by VNA.

Accordingly, credit institutions must maintain a minimum Capital Adequacy Ratio (CAR) of 8%, with Tier 1 capital not less than 4.5% and Tier 2 capital at a minimum of 6%.

Banks with subsidiaries must meet both individual and consolidated CAR requirements.

A key addition in Circular 14 is the introduction of a Capital Conservation Buffer (CCB) and a Countercyclical Capital Buffer (CCyB).

The CCB will gradually increase from 0.625% in the first year to 2.5% by the fourth year, raising the consolidated CAR (including CCB) from 8.625% to 10.5%.

Consequently, Tier 1 capital (including CCB) will rise from 5.125% to 7%, and Tier 2 capital from 6.625% to 8.5% over four years.

Notably, banks can only distribute cash dividends after meeting the new capital requirements, prioritizing capital strengthening over shareholder payouts.

To comply, many banks have proactively increased their charter capital through share issuances, profit retention, or issuing Tier 2 capital instruments.

Second-quarter 2025 financial data from 29 banks reveals that by June, total system charter capital reached VND 879.352 trillion, a 6.6% increase from 2024. The top five banks – Vietcombank, VPBank, Techcombank, BIDV, and MB – hold 41% of total charter capital.

Binh Duong

– 9:06 PM, September 14, 2025

Enhancing Internal Control, Audit, and Inspection in Credit Institutions

To ensure the safety, sustainability, and legal compliance of the financial system, the State Bank of Vietnam (SBV) regularly issues notifications and warnings to credit institutions through its supervisory, inspection, and monitoring activities. These communications emphasize strict adherence to legal regulations, SBV guidelines, and directives from relevant authorities.

Stable Interest Rates, Credit Growth Projected at 19-20% for 2025

Mr. Dinh Duc Quang, Director of the Currency Business Division at UOB Bank Vietnam, forecasts that with the current interest rate levels, the entire system’s credit growth could reach 19-20% for the year 2025.

CIC Falls Victim to Cyberattack

The Vietnam Computer Emergency Response Team (VNCERT) has recently received a report regarding a cybersecurity incident at the National Credit Information Center (CIC). Preliminary verification indicates signs of a cyberattack aimed at stealing personal data. The extent of the illegally obtained data is currently being assessed and clarified.