Following the resistance at the previous peak of 1,700 points, the market exhibited caution during session 179, characterized by low liquidity. Selling pressure intensified in the afternoon session, leading the VN-Index to close down 9.93 points (-0.59%) at 1,670.97 points. Foreign investors continued to net sell, but the value was modest at approximately 102 billion VND across the market.

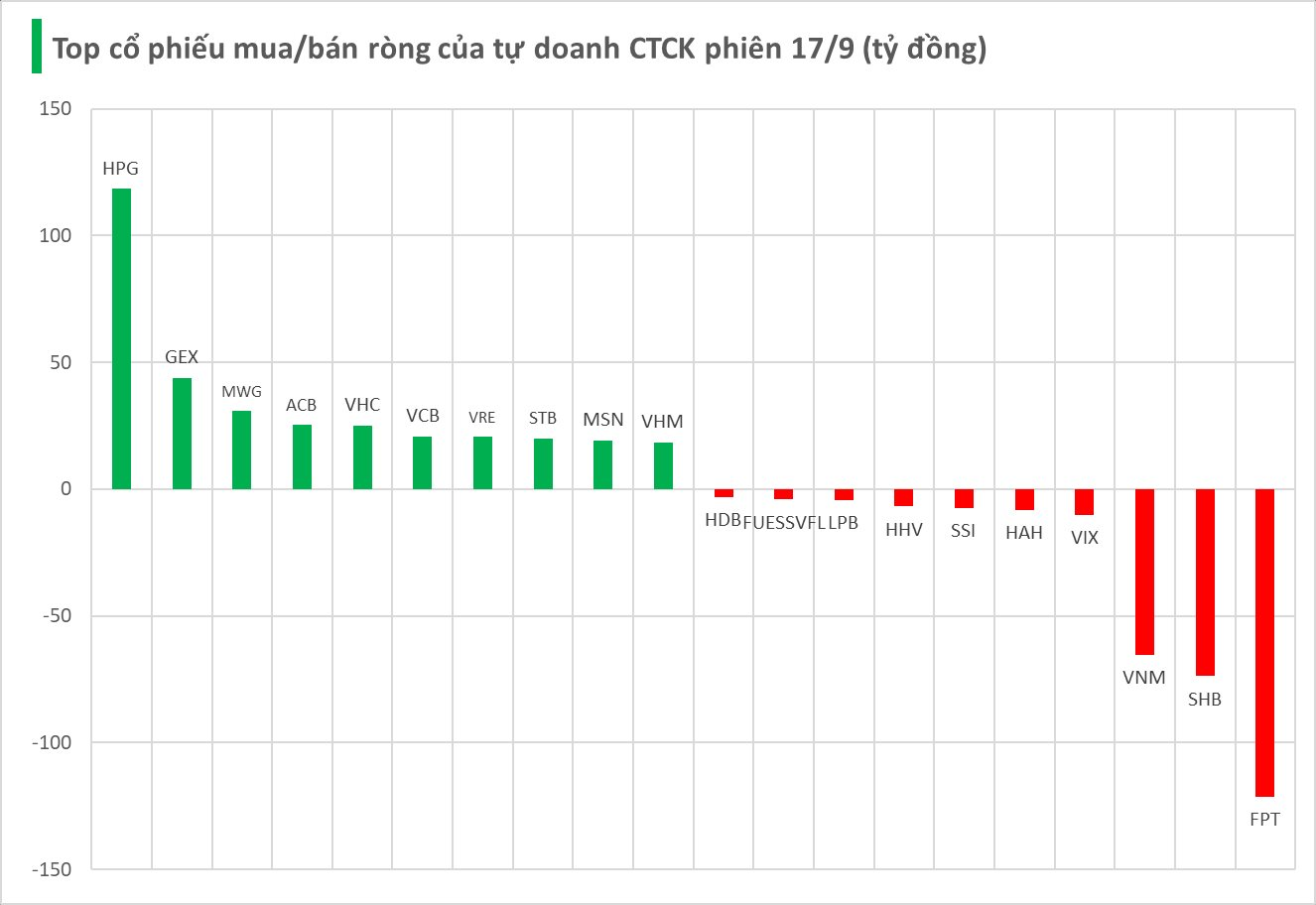

Securities firms’ proprietary trading desks recorded a net purchase of 117 billion VND on HOSE.

Specifically, HPG dominated net purchases with a value of 118 billion VND, far surpassing others. This was followed by GEX (44 billion), MWG (31 billion), ACB (25 billion), VHC (25 billion), VCB (21 billion), VRE (21 billion), STB (20 billion), MSN (19 billion), and VHM (18 billion VND), all of which saw strong buying from securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in FPT, with a value of -121 billion VND, followed by SHB (-74 billion), VNM (-65 billion), VIX (-10 billion), and HAH (-8 billion VND). Other stocks also recorded notable net selling, including SSI (-7 billion), HHV (-7 billion), LPB (-4 billion), FUESSVFL (-4 billion), and HDB (-3 billion VND).

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.

Technical Analysis for the Afternoon Session of September 18: Continued Tug-of-War

The VN-Index experienced a slight decline, setting the stage for a retest of its short-term trendline, which aligns with the 1,645-1,660 point range. Meanwhile, the HNX-Index saw intense volatility, culminating in the formation of a candle pattern closely resembling a Doji.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.