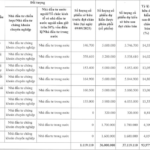

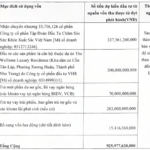

ATS Investment Group Joint Stock Company (Atesco – stock code: ATS) has approved a private placement plan to issue 36 million shares to nine individual investors. The offering price is set at VND 10,000 per share, half of the market price, expected to raise VND 360 billion and increase the charter capital from VND 350 billion to VND 710 billion.

Post-issuance, the group of nine shareholders is projected to hold nearly 94% of ATS’s capital, primarily consisting of long-term investors. The proceeds are earmarked for acquiring a 90% stake in Hoang Quan Binh Thuan Real Estate Consulting and Trading Services Joint Stock Company.

Among the key transactions, Mr. Truong Anh Tuan, Chairman of Hoang Quan Binh Thuan’s Board of Directors and also Chairman of Hoang Quan Real Estate Consulting and Trading Services Joint Stock Company (stock code: HQC), will transfer 21 million shares, equivalent to 52.5% of the charter capital. Two other shareholders, Ms. Phan Le Thuy Trang and Ms. Nguyen Tran Thuy Trang, will sell 29.4% and 8% of Hoang Quan Binh Thuan’s capital to ATS, respectively.

Mr. Truong Anh Tuan, Chairman of Hoang Quan Real Estate Consulting and Trading Services Joint Stock Company, divests 52.5% of the charter capital in its subsidiary.

Established in 2004 with an initial charter capital of VND 30 billion, Hoang Quan Binh Thuan was founded by two brothers, Mr. Truong Duc Hieu and Mr. Truong Manh Hung. Today, its charter capital has grown to VND 400 billion, focusing on real estate development.

Hoang Quan Binh Thuan has undertaken several projects, including a social housing complex in Thanh Hai (former Phan Rang – Thap Cham City) with over 1,300 apartments and a total investment of approximately VND 1.1 trillion. The company is also the developer of the 13.5-hectare Nam Phan Thiet Urban Area with an investment of VND 905 billion and the Ham Kiem 1 Industrial Park (132 hectares, VND 273 billion investment).

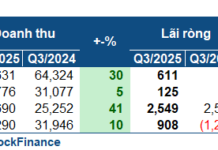

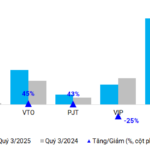

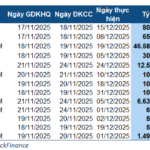

In Q2/2025, HQC reported sales revenue and service provision of VND 22 billion, but revenue deductions reached nearly VND 33 billion. Consequently, Hoang Quan Real Estate recorded a net revenue loss of nearly VND 11 billion and a post-tax profit of VND 4.9 billion, a 54% decline year-over-year.

For the first half of 2025, Hoang Quan Real Estate achieved revenue of over VND 38 billion (up nearly 5% year-over-year) and a post-tax profit of over VND 10 billion (down 35% year-over-year). The company also reported a negative operating cash flow of nearly VND 11 billion for the period.

Unveiling Chairman Truong Anh Tuan’s Partner in Acquiring Hoang Quan Binh Thuan Shares

ATS Investment Group is set to acquire a 90% stake in Hoang Quan Binh Thuan from three shareholders, including HQC Chairman Truong Anh Tuan.

Nam Long (NLG): Pioneering Sustainable Development and Visionary Integrated Urban Creation

With over 30 years of establishment and growth, Nam Long Group (HOSE:NLG) has consistently crafted living environments and value-driven products for the community, committing to sustainable development (ESG) while contributing to the national economy and aligning with Vietnam’s strategic development vision through the creation of integrated urban areas.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.

The Stock Market’s Volatile Week: What’s Next?

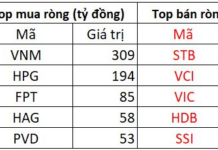

Today (September 12th) marks the fourth consecutive session of stock market gains, propelled by Vingroup stocks, real estate, and steel sectors. While the market extended its positive momentum, trading liquidity weakened as foreign investors continued to offload holdings. Amid this upbeat performance, the market also received a boost from positive news on potential upgrades.