Expectations vs. Reality Post-Boundary Expansion

DKRA’s August 2025 report on Ho Chi Minh City’s housing market and its periphery reveals a 3% uptick in primary supply compared to the same period last year, totaling over 12,000 units—a staggering 96.3% of the market’s primary supply. August alone saw nearly 3,000 new units launched, a 5.1-fold increase from August 2024. Demand surged even more dramatically, rising 5.7 times year-over-year, primarily concentrated in HCMC projects.

Grade A apartments accounted for 41.6% of the primary supply, predominantly in the city center, while Grades B and C were mostly in outlying areas. Primary sale prices rose 2–6% month-over-month. Secondary market prices and liquidity also climbed, with transactions favoring projects offering seamless central connectivity, robust legal frameworks, completed units, and swift construction progress.

Soaring Prices, Stagnant Incomes

The Ministry of Construction reports Q2 2025 prices in HCMC and Hanoi hit near-decade highs. HCMC’s average apartment price reached 89 million VND/m², up 36% year-over-year. Batdongsan.com.vn data shows secondary market averages hit 82 million VND/m² in Q2 2025, a nearly 30% annual increase.

Savills Vietnam notes central HCMC primary prices surpassed 90 million VND/m² from 2024 to Q1 2025. Satellite provinces like Binh Duong, Dong Nai, and Long An saw sharp rises, ranging 40–65 million VND/m². Nhatot data highlights Q2 2025 price peaks in HCMC and Long An, driven by high-priced project launches.

CBRE Vietnam Director Vo Huynh Tuan Kiet emphasizes chronic supply shortages, especially in mid-range segments. Scarcity inevitably fuels price hikes.

At June’s “Effective Financial Leverage for Young Homeowners” seminar, Ha Quang Hung, Deputy Director of the Housing and Real Estate Market Management Department (Ministry of Construction), highlighted young buyers (ages 22–40) as the market’s core demographic. However, the income-price gap poses significant challenges. Skyrocketing prices outpace earnings, making new homes increasingly inaccessible.

Vietnam Association of Realtors (VARS) Chairman Nguyen Van Dinh notes even high earners (40–50 million VND/month) hesitate to buy due to hefty loans and volatile interest rates. Nguyen Chi Thanh, Vice Chairman of the Vietnam Real Estate Brokers Association, observes improved supply but a persistent focus on high-end projects, leaving mid-range options scarce and out of reach for average earners.

Diverse New Projects, but Not Affordable

Projects like The Flex (Hoa Binh, 40–45 million VND/m²), Phu Dong Sky One (Di An, 38 million VND/m²), and Celesta Rise (South Saigon, 70–80 million VND/m²) remain beyond most buyers’ budgets.

Flexible payment schemes, such as The Privia (Khang Dien, Binh Tan) allowing 30% payment over 30 months until handover, and Akari City Phase 2 (Nam Long, Binh Tan) with staggered payments from 45–50 million VND/m², offer some relief.

TT AVIO’s Orion Tower stands out with prices starting at 33.6 million VND/m², below area averages. Its “negotiated payment” policy lets buyers pay 20% upfront over six months, 10% at contract signing, and 6 million VND/month installments (bank-free) until handover. Alternatively, bank loans require only 20% down, with no further payments for 30 months. For instance, a 65m² two-bedroom unit priced at 2.2 billion VND allows manageable installments instead of high-interest loans.

Buyers prioritize projects with clear legal frameworks and flexible payment plans to ease financial strain.

|

Outlook

According to Dinh Minh Tuan, Southern Regional Director at Batdongsan.com.vn, HCMC’s infrastructure push—including Ring Road 3 and high-speed rail—coupled with strong FDI inflows, bolsters investor and end-user confidence. He sees a selective recovery phase favoring projects with transparent legalities and strong connectivity. “This lays the groundwork for HCMC’s short-term growth and long-term sustainable development,” Tuan asserts.

Experts predict HCMC and satellite area apartment prices will rise through 2025–2026 due to limited land, escalating legal/infrastructure costs, and input prices. Social housing initiatives and reasonably priced commercial projects must be prioritized, with developers focusing on mid-range segments and payment plans aligned with buyers’ realities.

– 06:47 17/09/2025

The Takeover of Four Prime Land Plots in Ho Chi Minh City: Mysterious Evidence Found in Tycoon’s Residence

In addition to the extensive financial evidence, investigators discovered a peculiar item at the residence of the defendant, Đinh Trường Chinh.

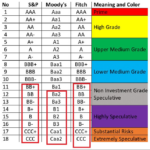

Why Vietnam’s Corporate Credit Ratings Are Capped at International Levels

Recent discussions have highlighted concerns over major Vietnamese companies receiving “junk” or “non-investment” credit ratings from international organizations, sparking negative perceptions. However, a deeper understanding of how global credit rating systems operate reveals that such classifications are not inherently detrimental and do not equate to labeling these businesses as “junk.”

20 Projects in Ho Chi Minh City Under Inspection Scrutiny, 6 Projects Removed from the List

The Government Inspectorate initially planned to directly audit 20 projects in Ho Chi Minh City, identified as problematic and at risk of loss or waste. However, the agency has recently decided to suspend the inspection of 6 of these projects.