On the afternoon of September 18th, during the 2025 Housing Real Estate Forum themed “Satellite Waves,” organized by the Vietnam Real Estate Association (VNREA) in collaboration with the Labor Newspaper and the Real Estate Review Community, Dr. Can Van Luc—a member of the National Financial and Monetary Policy Advisory Council—provided critical recommendations for businesses amidst a volatile market.

According to Dr. Luc, real estate companies must focus on three key strategies. He notably warned against the practice of simultaneously developing multiple projects within the same locality.

In reality, many firms tend to undertake several projects concurrently in one area, leading to capital and cash flow pressures, as well as heightened financial risks. This issue warrants early caution to prevent long-term adverse effects.

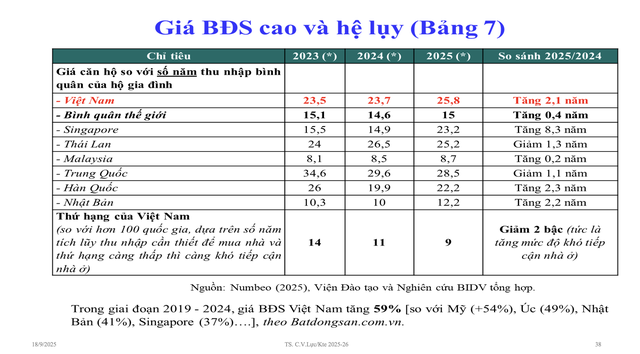

“A Vietnamese public servant currently needs nearly 26 years of work to afford a condominium, compared to the global average of just 15 years, which is disproportionately expensive relative to our income,” Dr. Can Van Luc illustrated.

He noted that this trend is worsening. While in 2023 and 2024, it took approximately 24 years to buy a condo, this figure has risen to 26 years, despite continued improvements in average incomes. This indicates that property prices are outpacing income growth, widening the gap in housing accessibility.

Comparison of average household income years required to purchase a condominium in Vietnam versus other countries

Given these realities, he stressed the need to control housing prices, restore market equilibrium, and foster product and funding diversity. Additionally, businesses must proactively embrace digital and green transformations in construction and real estate. Contributing to the development of land and property databases will also enhance market transparency. Strengthening corporate governance, organizational culture, and standardizing processes, products, and personnel are essential to align with the revised Land Law, Housing Law, and Real Estate Business Law.

According to Dr. Luc, current conditions present more opportunities than challenges. By leveraging these, companies can navigate difficulties and achieve sustainable growth.

From a policy perspective, the government must implement concrete, feasible solutions to stabilize and gradually reduce real estate prices, particularly in the housing segment.

Six major issues require attention: diversifying funding sources and advancing real estate finance—such as reviving corporate bond markets, establishing a National Housing Fund and Real Estate Investment Trusts (REITs), promoting cashless payments, and devising a rational property taxation roadmap.

Simultaneously, rigorously combating waste in land management, public assets, and public investment will both stimulate economic growth and foster a healthy, transparent real estate market.

The government must also vigorously develop land, property, and housing databases, alongside effective management and utilization mechanisms for these resources.

Is the Real Estate Market in Binh Duong (Former) Experiencing a Ripple Effect of Rising Prices?

Following the administrative boundary merger, the real estate market has witnessed a significant population shift from the former Ho Chi Minh City to the emerging “new central hub” of Binh Duong. This region stands out as one of the most prominent areas in the eastern part of Ho Chi Minh City, boasting a robust economy, advanced infrastructure, and exceptional investment appeal.

Van Phu Named Among Vietnam’s Top 10 Most Valuable Real Estate Brands of 2025

In the recently released report by Brand Finance, the world’s leading brand valuation and ranking organization, Van Phu has made its debut in the Top 10 most valuable real estate brands in Vietnam. Additionally, for the second consecutive year, Van Phu has secured its position in the Top 100 most valuable brands in Vietnam for 2025.

Bank Stocks and the Calm Before the Rating Upgrade Storm

Banking stocks, the backbone of the VN-Index, are entering a consolidation phase following a heated rally. Over 60% of banking codes have officially corrected from their peaks, yet several key players continue to buoy the market. This resilience is particularly notable as investors anxiously await the Fed’s interest rate decision and FTSE Russell’s market upgrade assessment in October. The contrasting dynamics within banking stocks thus serve as a critical litmus test for overall market sentiment.

Digital Transformation: The New Growth Lever for Vietnam’s Retail Sector

Amid Vietnam’s robust economic growth, marked by an 8% GDP increase in Q2/2025 and a resurgence in domestic consumption, digital transformation has emerged as a strategic priority for many Vietnamese businesses. For Masan, technology is not merely a supportive tool but a cornerstone that directly drives financial value and enhances operational efficiency in a sustainable manner.