In total, the fund group sold over 3.26 million shares of MWG, reducing their ownership stake in the diversified retail conglomerate from 5.21% to 4.99%, effectively ceasing to be a major shareholder in the company.

The transaction date that altered the ownership ratio was September 12th. Notable entities associated with Dragon Capital that significantly sold off during this period include Amersham Industries Limited, Hanoi Investments Holdings Limited, Norges Bank, and Vietnam Enterprise Investments Limited.

A The Gioi Di Dong store, part of the multi-industry retail conglomerate MWG

|

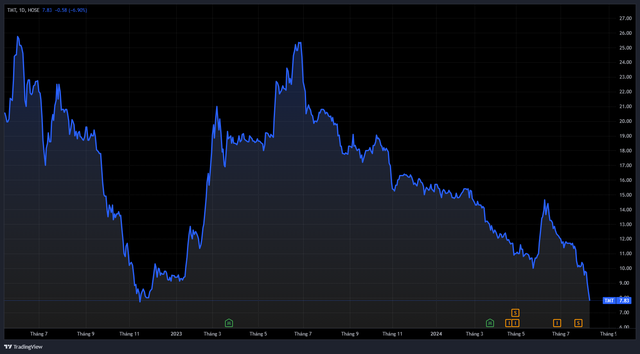

The fund group’s sell-off occurred after MWG shares surged to a record high in mid-September. The retailer, led by Mr. Nguyễn Đức Tài, also reported record-breaking revenue and profit for Q2/2025, with its Bach Hoa Xanh grocery chain turning a profit. Meanwhile, its electronics and appliance chains have completed restructuring, resumed growth, and are gearing up for an IPO.

Year-to-date, MWG shares have risen by 28.7% as of 10:09 AM on September 18th, while the VN-Index has climbed 32.1%.

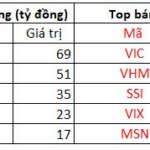

Set against the broader market context, Dragon Capital’s divestment aligns with the robust net selling trend among foreign investors. On the HOSE exchange alone, foreign investors recorded a record net sell of VND 29.6 trillion in stocks via order matching in August.

While the market’s upward trajectory, fueled by domestic investor capital, has not been halted by foreign outflows, the substantial withdrawal of foreign funds has sparked concerns. This cooling of foreign interest comes as Vietnam’s market nears its upgrade to Secondary Emerging Market status by FTSE Russell, an event widely anticipated by market participants and domestic experts to attract additional foreign capital.

– 10:45 AM, September 18, 2025

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

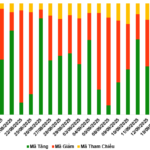

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

September 17, 2025: Warrant Market Shows Mixed Performance

At the close of trading on September 16, 2025, the market saw 140 stocks rise, 87 decline, and 32 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of 3.18 million CW.