In total, the fund group sold over 3.26 million shares of MWG, reducing their ownership stake in the multi-industry retail conglomerate from 5.21% to 4.99%, effectively ceasing to be a major shareholder in the company.

The transaction date that altered the ownership ratio was September 12th. Prominent entities associated with Dragon Capital that significantly sold shares during this period include Amersham Industries Limited, Hanoi Investments Holdings Limited, Norges Bank, and Vietnam Enterprise Investments Limited.

A The Gioi Di Dong store, part of the multi-industry retail conglomerate MWG‘s electronics retail chain.

|

The fund group’s sell-off occurred after MWG shares surged to a record high in mid-September. The retailer, led by Mr. Nguyễn Đức Tài, also reported record-breaking revenue and profit for Q2/2025, with its Bach Hoa Xanh grocery chain turning profitable. Meanwhile, its electronics and appliance chains have completed restructuring, resumed growth, and are gearing up for an IPO.

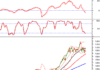

Year-to-date, MWG shares have risen 28.7% as of 10:09 AM on September 18th, while the VN-Index has increased by 32.1%.

Set against the broader market context, Dragon Capital’s divestment aligns with foreign investors’ robust net selling trend. On the HOSE exchange alone, foreign investors recorded a record net sell of VND 29.6 trillion in stocks via order matching in August.

While the foreign investor withdrawal wave hasn’t halted the market’s advance—with the VN-Index climbing steadily on domestic investor inflows—the scale of capital outflows has sparked concerns.

This foreign capital “cooling” occurs as Vietnam’s market nears FTSE Russell’s Secondary Emerging Market upgrade. This upgrade, eagerly anticipated by market participants and domestic experts, is expected to attract additional foreign investment.

– 10:45 18/09/2025

Which Sectors Stand to Gain if Vietnam’s Stock Market is Upgraded in October?

Should FTSE Russell upgrade Vietnam’s stock market to “Emerging Market” status in October 2025, the outlook would be exceptionally positive.

Bank Stocks and the Calm Before the Rating Upgrade Storm

Banking stocks, the backbone of the VN-Index, are entering a consolidation phase following a heated rally. Over 60% of banking codes have officially corrected from their peaks, yet several key players continue to buoy the market. This resilience is particularly notable as investors anxiously await the Fed’s interest rate decision and FTSE Russell’s market upgrade assessment in October. The contrasting dynamics within banking stocks thus serve as a critical litmus test for overall market sentiment.