Dragon Capital Securities JSC (HOSE: VDS) has officially adopted a private placement plan for 2025, approved during its Annual General Meeting in April.

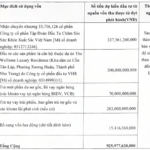

In this offering, the company will issue 48 million shares, representing 17.56% of its current outstanding shares. The offering price is set at VND 18,000 per share, targeting professional securities investors. These investors will be subject to a one-year lock-up period following the completion of the offering. VDS plans to execute this issuance in Q4 2025 and Q1 2026.

The company aims to raise up to VND 864 billion from this offering. Approximately 90% of the proceeds will be allocated to margin lending activities, with the remaining 10% directed toward proprietary trading, underwriting, and bond market participation.

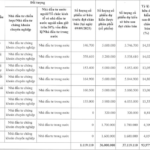

According to the disclosed list, eight investors will participate in this offering. Seven domestic individuals have registered to purchase 46 million shares, while Casco Investment, a foreign entity, will acquire 2 million shares. Post-offering, these investors are expected to collectively hold 16.16% of VDS’s capital.

|

List of Investors Participating in the Offering

Source: VDS

|

During the April AGM, VDS Chairman Nguyễn Miên Tuấn emphasized the need to strengthen the company’s financial capacity through capital increases. With the securities market still holding growth potential, financial conglomerates and banks are actively expanding, intensifying competition in brokerage, lending, and investment advisory services. Many firms have adopted zero-fee structures and low-interest rates.

“We anticipated these challenges but recognize the difficulty in keeping pace. Our focus is on sustainable growth. Our strategy is to target niche markets and prioritize delivering effective investment outcomes for clients over fee-based competition,” stated Mr. Tuấn.

Regarding strategic investors, Mr. Tuấn noted that over the past two years, efforts to attract strategic investors have been ineffective. The strong USD has made foreign investors cautious about investing in Vietnamese enterprises. Additionally, VDS is reluctant to offer shares below market value to protect existing shareholders’ interests. Given last year’s market conditions, any offering would have required discounts, negatively impacting current shareholders. VDS will proceed based on market conditions, with the Chairman hopeful that a market upgrade will enhance liquidity and facilitate issuance efforts.

This private placement is part of VDS’s broader capital increase strategy. The company also plans to issue 24.3 million shares as dividends (10:1 ratio), 4.7 million ESOP shares (1.93% ratio) at VND 10,000 per share, and up to 48 million shares via private placement. If successful, VDS’s chartered capital will rise from VND 2,430 billion to VND 3,200 billion.

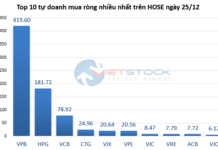

On the stock market, VDS shares are currently trading at VND 22,700. From early July to late August, the stock surged from VND 14,000 to over VND 25,000 before retreating to current levels.

| VDS Share Price Movement |

– 11:06 17/09/2025

Unveiling Chairman Truong Anh Tuan’s Partner in Acquiring Hoang Quan Binh Thuan Shares

ATS Investment Group is set to acquire a 90% stake in Hoang Quan Binh Thuan from three shareholders, including HQC Chairman Truong Anh Tuan.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.

“SCL Equity Offer: 8 Million Shares to Raise $100 Million for Debt Repayment”

“With a successful rights issue, Song Da Cao Cuong Joint Stock Company (UPCoM: SCL) aims to boost its charter capital from VND 224 billion to nearly VND 304 billion. This move comes as the company posted a record first-half performance for 2025, signaling a strategic expansion.”