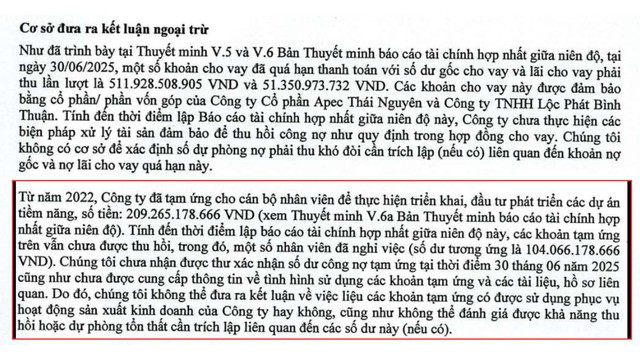

IDJ Vietnam Investment Corporation (HNX: IDJ) has released its 2025 mid-year audited financial report. Notably, A&C Auditing and Consulting LLC issued a qualified opinion regarding IDJ’s advance payments to employees for potential project development and implementation, totaling over 209 billion VND since 2022.

As of the report date, these advances remain unrecovered, with 104 billion VND tied to employees who have resigned.

The auditors stated they lacked confirmation letters for outstanding balances, details on fund usage, and related documentation, preventing them from concluding whether the advances were used for IDJ’s business operations or assessing recoverability or potential loss provisions.

IDJ responded that incomplete project implementation records hindered full compliance with auditor requests. The company is urging employees to finalize reports for reimbursement.

Auditors issue qualified opinion on IDJ.

Another issue prompting a qualified opinion was overdue loans totaling 512 billion VND in principal and 51 billion VND in interest (as of June 30, 2025), secured by shares in Apec Thai Nguyen JSC and Loc Phat Binh Thuan LLC.

IDJ has not yet enforced collateral liquidation to recover debts as per loan agreements, leaving auditors unable to determine necessary bad debt provisions.

IDJ clarified that these loans are secured by shares in companies owning potential projects, and they are evaluating collateral handling options.

Rendering of IDJ’s Apec Mandala Wyndham Mui Ne project.

Financially, IDJ reported 670 billion VND in revenue and 18 billion VND in after-tax profit for H1 2025, up 120% and down 70% year-over-year, respectively. Management attributed the profit decline to negative real estate market impacts on sales and costs.

As of June 2025, total assets were 3,627.8 billion VND (-14% YoY), with inventory at 932 billion VND (-34%), short-term receivables at 1,232 billion VND (+slight), investment properties at 211.7 billion VND (+44%), and cash equivalents at 72.6 billion VND (-32%).

Liabilities decreased to 1,511 billion VND from 2,113 billion VND, primarily short-term (1,400 billion VND). Total loans were 170 billion VND, and short-term customer advances were 665.7 billion VND.

IDJ is part of the Apec Group ecosystem founded by Nguyen Do Lang, focusing on real estate, commercial offices, and environmental solutions.

Its resorts are branded “Apec,” including Apec Mandala Wyndham Mui Ne, Apec Diamond Park Lang Son, Apec Mandala Grand Phu Yen, Apec Dubai Ninh Thuan, Apec Mandala Wyndham Hai Duong, and Apec Eco Lang Son.

“A Sharp Downturn: Duc Long Gia Lai’s Profits Plummet by 39% Post-Review”

The recently published audited consolidated financial statements for the first half of 2025 revealed a significant discrepancy in the profit figures for CTCP Duc Long Gia Lai Group (HOSE: DLG). The audited report showed a net profit of over VND 45 billion, a decline of nearly VND 29 billion, or 39%, compared to the self-prepared financial statements.

The Underperforming Projects: Over 300 Ventures with Zero Public Investment Capital Disbursement Rates Exposed by the Ministry of Finance.

As of April 30th, a staggering 316 central-budget projects and sub-projects across 48 localities have failed to disburse any funds, according to the Ministry of Finance. This concerning figure highlights a standstill in critical sectoral and field-specific initiatives, all funded by domestic capital.