FiinRatings’ rating reflects the expectation that the bank’s credit profile will remain stable over the next 12-24 months. This assessment is based on several factors, including the bank’s growth in scale and improving profitability, which support its capital buffer and liquidity, aligning with its operational scale. These factors are evaluated according to FiinRatings’ credit rating methodology and criteria.

FiinRatings assesses Nam A Bank’s business position as “Appropriate,” reflecting significant improvements in scale and diversification in recent years, despite being a mid-sized private bank in Vietnam. As of June 30, 2025, the bank continues to gain market share, with total assets reaching 1.5% (ranked 17th out of 30 banks), customer deposits at 1.4% (15th/30), and loan balances at 1.3% (17th/30). The bank’s business stability is maintained by key factors such as a loyal individual customer base, which plays a primary role in capital mobilization. The high proportion of term deposits from this segment provides a safe capital buffer and reduces reliance on wholesale funding. The compound annual growth rate (CAGR) of customer deposits from 2020–2024 was 8.9%, and in the first half of 2025, it increased by 24.4% compared to the end of 2024, reaching a record high of 196.9 trillion VND.

In terms of network, as of December 31, 2024, Nam A Bank has 148 branches/transaction offices and 125 OneBank automated transaction points nationwide, providing a stable foundation for serving key markets. Additionally, the bank’s credit policy is shifting towards essential and economically resilient sectors such as manufacturing, exports, infrastructure, and startups, thereby reducing cyclical risks.

Nam A Bank is also expanding its credit chain linked to value chains and significantly growing its SME and individual customer segments through specialized credit packages. This is combined with a focus on “Green” and “Digital” initiatives to ensure sustainable credit growth.

Modern transaction space with advanced technology at Nam A Bank

The bank’s diversification is rated as “Appropriate,” with non-interest income accounting for 5.5% of total operating income, slightly below the industry median of 7.6% based on the latest four-quarter data as of Q2 2025.

However, the bank has shown significant improvement since 2022, with non-interest income (including service income) increasing to 15% of total operating income in the first half of 2025 (compared to 12% in 2024 and 13% in 2023). For 2025–2026, Nam A Bank plans to expand aggressively by developing a digital service ecosystem, strengthening partnerships, and cross-selling products like insurance, investments, and financial advisory services to diversify non-credit income sources.

Additionally, the bank aims to expand foreign exchange services, overseas remittance services, and payment services to strengthen long-term growth. However, these efforts will require time to significantly impact the overall income structure.

FiinRatings rates Nam A Bank’s capital profile and profitability as ‘Appropriate,’ indicating an improving capital buffer but with a higher proportion of Tier 2 capital and leverage compared to industry medians. Profitability remains stable above industry medians due to effective cost control, optimized credit portfolios, and enhanced operational efficiency.

The bank’s Capital Adequacy Ratio (CAR) has improved significantly over the past two years, reaching 12.7% by the end of 2024 (above the industry median of 11.8%), with Tier 1 capital accounting for 65% of total eligible capital compared to the system’s 88%. The proportion of Tier 1 capital is expected to improve with the bank’s plan to increase its charter capital from 13.7 trillion VND to over 18 trillion VND in 2025, including issuing over 343 million bonus shares to existing shareholders at a ratio of 100:25 from retained earnings and 85 million ESOP shares.

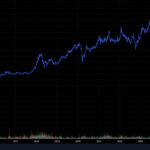

Nam A Bank demonstrates better profitability than the industry average, with net interest margin (NIM) increasing from 3.1% to 3.6% between 2020–2024, compared to the industry’s increase from 2.8% to 3.3%. The bank’s return on assets (ROA) also rose from 0.7% to 1.6%, outperforming the industry’s increase from 0.7% to 1.3% over the same period.

As of the first half of 2025, the bank’s NIM and ROA (based on the latest four-quarter data) are 3.3% and 1.5%, respectively, both higher than the industry medians of 3.2% and 1.4%. Effective cost control has reduced the cost-to-income ratio (CIR) from 47.6% in 2022 to 44% in 2024, with a continued downward trend in Q2 2025.

In the projection scenario, FiinRatings expects Nam A Bank’s CIR to improve and stabilize around 42–43% in 2025–2026 as the bank continues to optimize operations through digital transformation and initial investments yield results. The bank’s NIM is projected to remain around 3.5–3.6%, with ROA stabilizing at 1.5%, driven by credit growth, operational optimization, and expanded non-interest income.

“Eximbank Maintains B+ Rating with Stable Outlook from S&P Global Ratings”

The renowned international credit rating agency, S&P Global Ratings (S&P), has assigned a ‘B+’ long-term issuer credit rating with a stable outlook to the Vietnam Export Import Commercial Joint Stock Bank (Eximbank). This endorsement underscores Eximbank’s strengthened financial foundation, clear business strategy, and notable enhancements in asset quality, even amidst a volatile macroeconomic landscape.

Mrs. Tran Kieu Thuong Purchases 1 Million NAB Shares

With a recent acquisition of 1 million NAB shares, Ms. Tran Kieu Thuong now holds a substantial stake in the company. Her total ownership stands at 1.045 million shares, representing 0.061% of NAB’s capital. This significant investment showcases Ms. Thuong’s confidence in the company’s potential and underscores her active role as a key stakeholder.