The question, “At what income level is personal income tax (PIT) not required?” is a concern for many employees. According to current regulations, monthly PIT is calculated based on deductions such as insurance, personal deductions, and family circumstance deductions for dependents.

Recently, the Ministry of Finance submitted a draft Resolution to the Ministry of Justice for review, proposing adjustments to the family circumstance deduction for personal income tax. The proposal includes increasing the personal deduction for taxpayers to 15.5 million VND per month, while each dependent would receive a deduction of 6.2 million VND.

The policy to raise the taxable income threshold and family circumstance deduction is undoubtedly beneficial for millions of workers. However, the final figures are still under careful consideration by relevant authorities.

Based on the current proposal from the Ministry of Finance, a key question arises: What income level does not require tax payment, both for individuals with and without dependents?

Below are some basic estimates, considering three factors: personal deduction, social insurance deduction, and dependent deduction (if applicable).

The question of “At what income level is PIT not required?” is a common concern among many employees. (Illustrative image)

1. For instance, with an income of 15 million VND/month, both with and without dependents, the calculation would be as follows:

Mandatory insurance = 10.5% × 15 = 1.575 million VND. Personal deduction = 15.5 million VND. Total deduction = 1.575 + 15.5 = 17.075 million VND. Taxable income = 15 – 17.075 = negative → considered as 0 ➡ PIT payable = 0 VND.

With 1 or more dependents: the total deduction is even higher, certainly exceeding income.➡ PIT payable = 0 VND.

2. Another example, for an individual with an income of 20 million VND per month, both with and without dependents, the calculation would be:

Without dependents: Insurance = 10.5% × 20 = 2.1 million VND. Personal deduction = 15.5 million VND. Total deduction = 17.6 million VND. Taxable income = 20 – 17.6 = 2.4 million VND. Tax calculation: 2.4 × 5% = 120,000 VND ➡ PIT payable = 120,000 VND.

With 1 dependent: Additional deduction = 6.2 million VND. Total deduction = 23.8 million VND.

Taxable income = 20 – 23.8 = negative → considered as 0 ➡ PIT payable = 0 VND.

With 2 or more dependents: the total deduction is higher, also considered as 0.

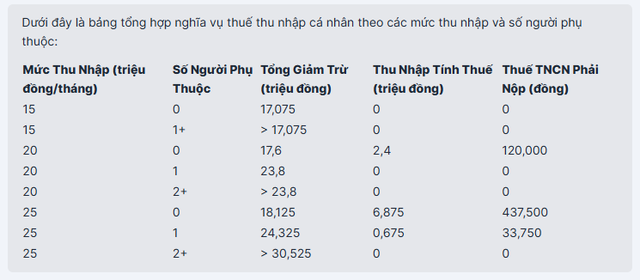

Readers can quickly understand the information by referring to the summary table of PIT obligations for income levels from 15 to 25 million VND and the number of dependents, as proposed by the Ministry of Finance.

Summary table of provisional PIT obligations as proposed by the Ministry of Finance.

From the table and random examples above, it’s clear that the more dependents you support, the higher the deductions. However, the above figures are based on the Ministry of Finance’s draft proposal and are only provisional, considering the three factors mentioned. To ensure accuracy, employees should regularly monitor the latest regulations and tax calculations to comply with the law.

Proposed Gold Sales Tax: Threshold Set at 1 Ounce or More

Experts recommend establishing a clear tax threshold for gold transactions. They propose that only sales of 1 tael or more should be subject to taxation. Smaller transactions, such as the sale of 1-2 tael of accumulated gold, would fall below this threshold and remain tax-exempt.