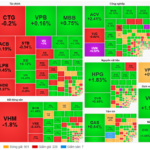

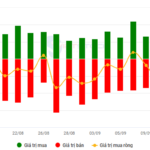

The VN-Index experienced continued volatility, fluctuating around the reference point before selling pressure dominated towards the end of the September 17th session. At close, the VN-Index dropped 9.93 points to 1,670.97. Trading volume also saw a slight decline, with matched orders on HoSE reaching approximately VND 29,511 billion.

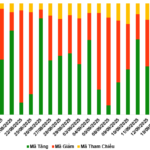

Regarding foreign trading, foreign investors remained net sellers, but the value was only around VND 102 billion across the entire market. Specifically:

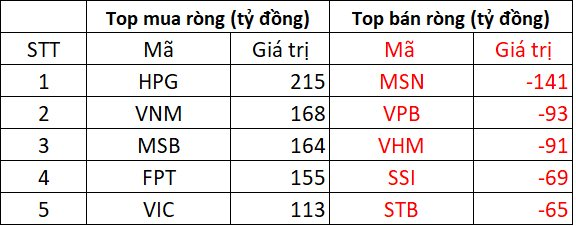

On HoSE, foreign investors net sold approximately VND 123 billion

On the buying side, HPG saw the strongest net buying across the market at VND 215 billion. Following closely, several stocks attracted net inflows of over VND 100 billion each, including: VNM (+VND 168 billion); MSB (+VND 164 billion); FPT (+VND 155 billion); and VIC (+VND 113 billion).

Conversely, foreign investors heavily sold MSN, with a net outflow of approximately VND 141 billion. Additionally, stocks like VPB, VHM, SSI, and STB also experienced net selling ranging from VND 65 billion to VND 93 billion.

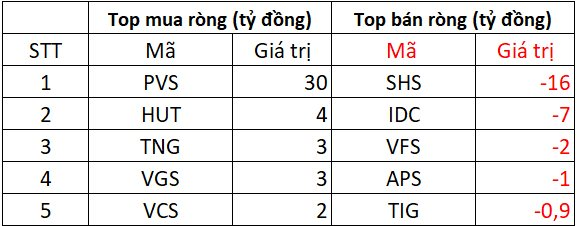

On HNX, foreign investors net bought approximately VND 18 billion

On the buying side, PVS saw strong net inflows of VND 30 billion; followed by HUT, TNG, VGS, and VCS with net inflows of VND 2-4 billion each.

Conversely, SHS experienced significant net selling of VND 16 billion. IDC and VFS also saw net outflows of VND 2-7 billion. Additionally, APS and TIG were net sold at approximately VND 1 billion each.

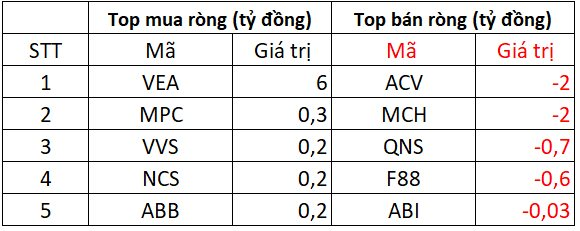

On UPCOM, foreign investors net bought a modest VND 3 billion

On the buying side, VEA saw net buying of VND 6 billion; followed by MPC, VVS, NCS, and ABB with net inflows of a few hundred million dong each.

Conversely, ACV and MCH were net sold at VND 2 billion each, while QNS and F88 saw net outflows of a few hundred million dong.

Market Pulse 15/09: VN-Index Surges Over 17 Points, Extending Positive Momentum

At the close of trading, the VN-Index surged by 17.64 points (+1.06%), reaching 1,684.9 points, while the HNX-Index climbed 4.18 points (+1.51%) to 280.69 points. Market breadth favored the bulls, with 507 gainers outpacing 233 decliners. Similarly, the VN30 basket saw green dominate, as 22 stocks advanced, 6 retreated, and 2 remained unchanged.

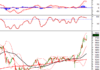

Vietstock Daily 16/09/2025: Accelerating Growth Continues

The VN-Index extended its winning streak to a fifth consecutive session, successfully testing its short-term trendline (equivalent to the 1,630-1,645 point range). The index’s short-term outlook has turned more positive, with the Stochastic Oscillator generating a fresh buy signal. Momentum is expected to strengthen further if trading volume surpasses its 20-day average in upcoming sessions.