FPT Corporation (FPT) has recently announced changes to its business registration, including an increase in its chartered capital from VND 14,813 billion to VND 17,035 billion.

Previously, in July, FPT had announced a share issuance to raise capital from equity. The rights ratio is 20:3 (15%), meaning shareholders holding 20 shares will receive 3 new shares. With over 1.48 billion shares outstanding, FPT is expected to issue an additional 222 million new shares.

The capital raised from the issuance will come from undistributed after-tax profits from equity as of December 31, 2024, as per the audited financial statements of the parent company for 2024.

Following the change, FPT’s chartered capital will be equivalent to 1.7 billion shares, with foreign ownership at 41%, private ownership at 53.4%, and state budget capital at 5.7%.

In the first half of 2025, FPT recorded revenue of VND 32,683 billion and pre-tax profit of VND 6,166 billion, up 11.4% and 18.5% year-on-year, respectively. Net profit attributable to the parent company’s shareholders reached VND 4,432 billion, a 20.7% increase, with EPS (Earnings Per Share) at VND 3,007 per share, up 19.6% compared to the previous year.

The Technology segment (including Domestic IT Services and Overseas IT Services) remained the key driver, contributing 61% of revenue and 46% of pre-tax profit, amounting to VND 20,128 billion and VND 2,834 billion, respectively, with growth rates of 11.3% and 15.4% year-on-year.

Telecommunications Services reported revenue of VND 9,030 billion, a 13.4% increase, and pre-tax profit of VND 2,017 billion, up 18.9%.

FPT’s Education segment saw a 3.3% year-on-year revenue growth, reaching VND 3,537 billion.

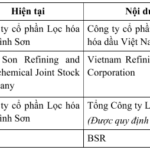

Refinery Binh Son Seeks Name Change and Capital Increase Beyond 50 Trillion Dong

The Binh Son Petroleum and Refinery Joint Stock Company (HOSE: BSR) has unveiled plans to seek shareholder approval for a name change and a significant capital increase.

Why Are Securities Companies Rushing to Increase Their Charter Capital?

The race to raise charter capital is on, with numerous securities companies planning to issue shares to boost their capital. But why this rush to raise funds? What are the driving forces behind this strategic move?