When Bottlenecks Hold Back Businesses

On a typical Monday morning, Ms. Hanh, the owner of a small coffee shop in Ho Chi Minh City, is busy preparing to open her doors. Her shop enjoys a steady stream of customers, but expanding to a nearby location remains a distant dream. “I want to lease additional space, but the loan application process is drowning in paperwork. Banks demand proof of income and collateral, leaving me feeling trapped between opportunity and bureaucracy,” Ms. Hanh shares.

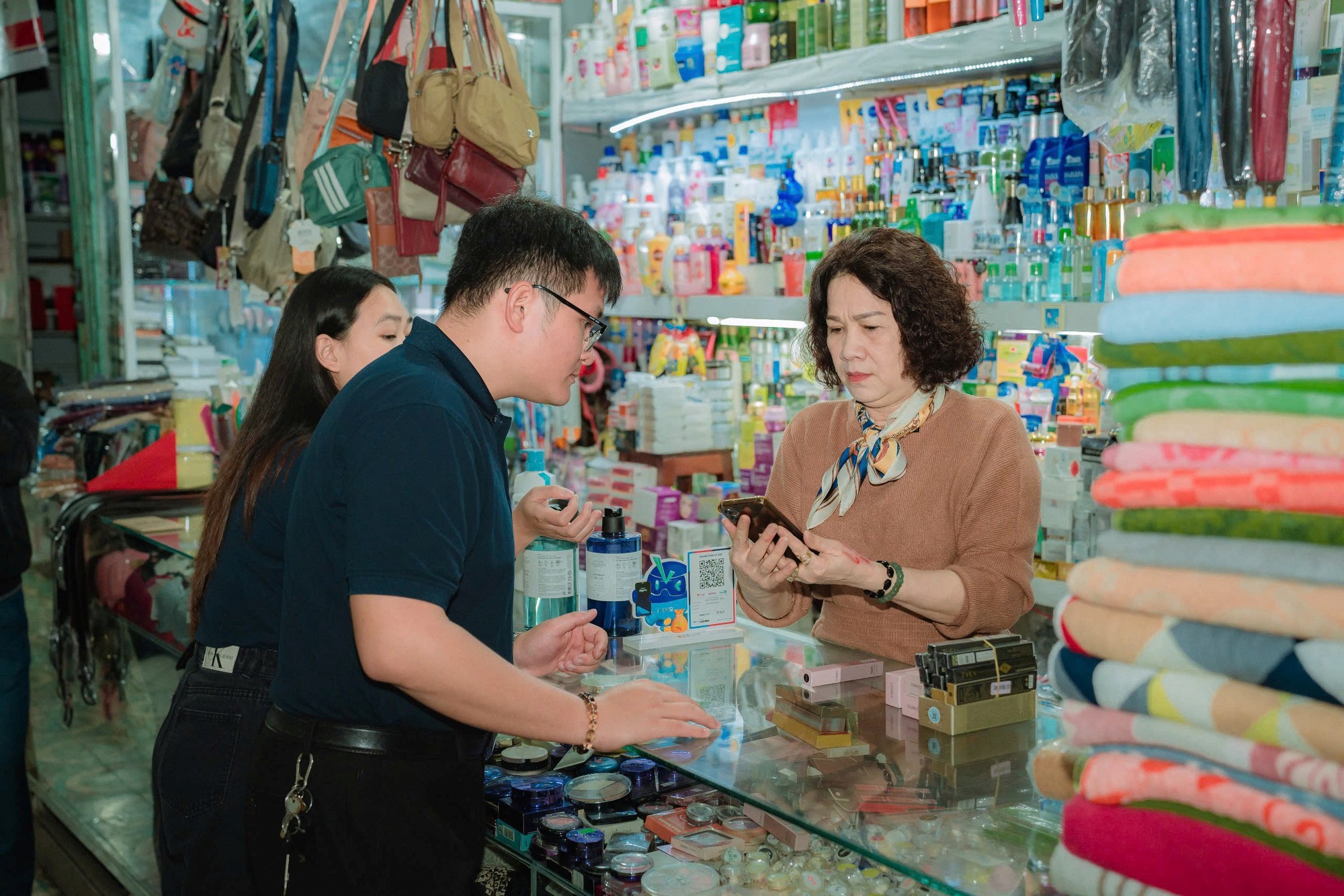

Ms. Hanh’s story isn’t unique. Many small businesses—from traditional market vendors to family-run eateries—face familiar bottlenecks: limited access to capital, tax pressures, electronic invoicing requirements, and a lack of robust cash flow management tools.

Currently, securing bank loans requires navigating complex procedures, particularly stringent income verification and financial reporting—a challenge for most small businesses due to their operational nature. Another hurdle lies in tax obligations and administrative processes. While transitioning to electronic invoices and online declarations enhances transparency, it overwhelms those accustomed to manual record-keeping. Juggling sales, capital turnover, and legal compliance often leads to burnout.

Ms. Hanh recalls a time when she urgently needed inventory but lacked immediate cash flow. “Business opportunities often arise within days. Without quick access to working capital, they’re lost forever,” she notes.

In Hai Phong, Mr. Tuan, owner of a household goods store chain, faces similar expansion challenges. “The market is favorable, and demand is steady, but scaling requires stable long-term financing. Short-term loans or self-funding won’t suffice,” he explains.

Can Banks Unlock These Bottlenecks?

This isn’t just Mr. Tuan or Ms. Hanh’s dilemma. Across cities, countless entrepreneurs face similar crossroads—opportunities are clear, yet access to capital, streamlined processes, and stability remain elusive.

Amid this, new policies spark hope but leave questions unanswered: Who will guide them past these obstacles?

This concern extends beyond businesses to banks eager to support sustainable growth in an increasingly professionalized market.

An upcoming talk show promises insights through candid conversations, addressing real challenges and potential solutions from policymakers, financial experts, and banks. What will emerge, and what paths will be revealed? Answers await in this dialogue.

The talk show “Unblocking Bottlenecks – Seizing Opportunities with Small Businesses”, organized by CafeF and Ban Viet Commercial Joint Stock Bank (BVBank), will convene experts and banks to discuss challenges and opportunities for millions of small businesses. Featuring leading tax specialists and BVBank representatives, it airs tomorrow, September 16, 2025, at 7:30 PM on CafeF and BVBank’s official Fanpages. Watch here.

The Real Estate Renaissance: Unveiling a New Era of Opportunities

In the dynamic world of real estate, a strategic rebranding has become a pivotal move for businesses aiming to thrive in a new era. A simple tweak to a company name or a refreshed logo can be a powerful tool to attract partners and align with evolving goals.

“LPBank Securities Offers 878 Million Shares to Boost Chartered Capital.”

LPBank is set to offer its existing shareholders a lucrative opportunity to invest in its growth journey. The company is offering a rights issue of 878 million shares at an attractive price of VND 10,000 per share, with a subscription ratio of 1000:2258.23. Mark your calendars, as the record date for this offering is September 8, 2025.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

The Ultimate Guide to Investing: Unlocking the Secrets to Financial Freedom

“Former Chairwoman of the Board of Directors of Hong Ha Food Industry Corporation (HOSE: HSL), Ms. Nguyen Thi Tuyet Nhung, has completely divested her 12.44% stake in the company, officially exiting the shareholder registry. This development comes amidst a surge in HSL’s stock price, which has climbed to historic highs, witnessing a remarkable increase of over 275% in just three months.”