The U.S. Federal Reserve (FED) has officially cut interest rates by 0.25 percentage points, lowering the rate to 4%-4.25%. This marks the first rate cut since December of last year.

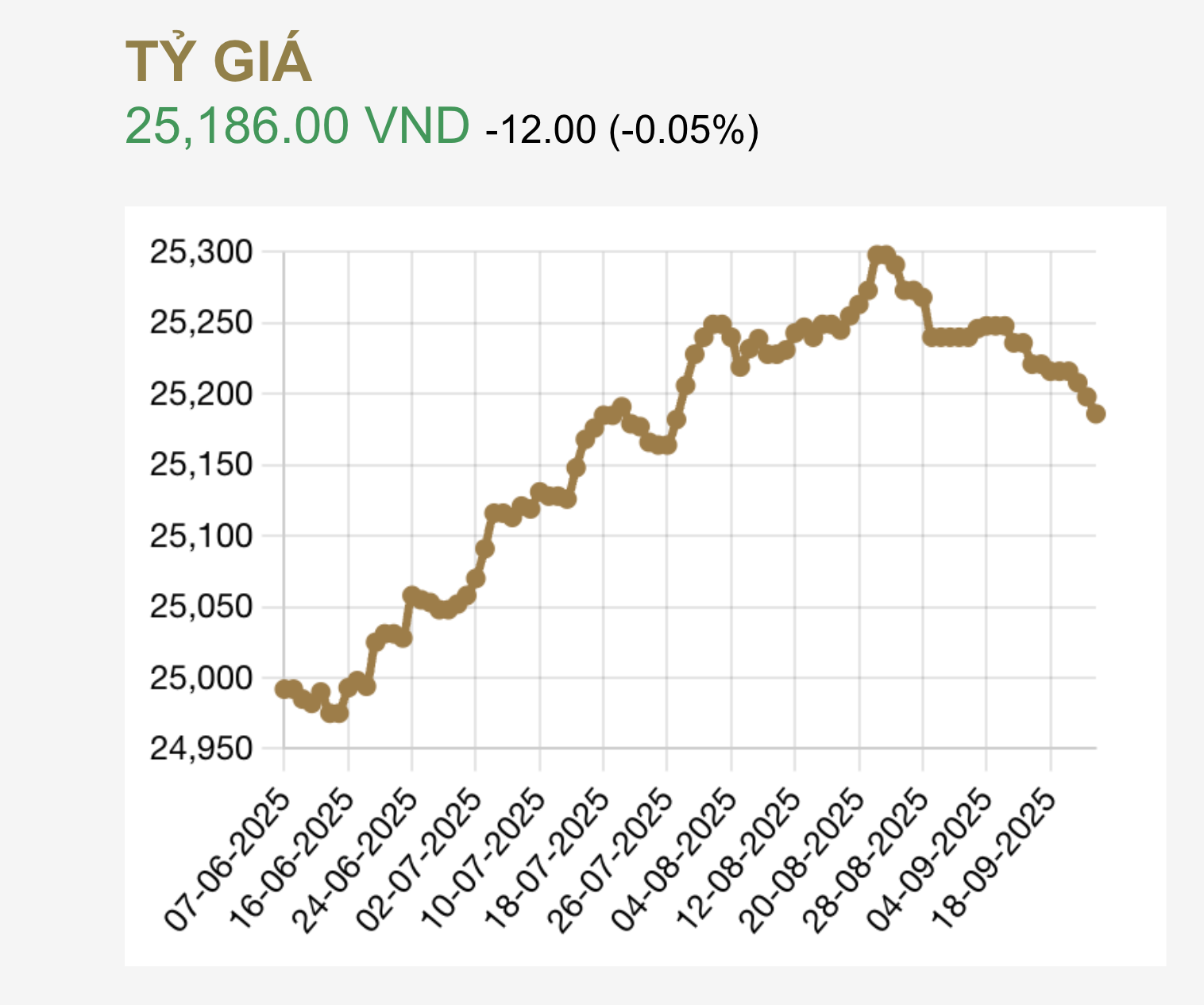

Following this announcement, not only has global gold prices dipped, cooling domestic gold prices, but the USD exchange rate at Vietnamese commercial banks has also continued to decline. This morning, September 18th, the central exchange rate set by the State Bank of Vietnam stands at 25,186 VND/USD, a decrease of 12 VND per USD compared to the previous session.

The central exchange rate has been on a downward trend in recent days. Compared to the peak of nearly 25,300 VND in late August, the central rate has dropped by approximately 0.45%.

The USD price at commercial banks has also continued to fall. Banks such as Vietcombank, BIDV, Eximbank, Sacombank, and ACB are currently trading USD at 26,165 VND for buying and 26,445 VND for selling, a decrease of 12 VND per USD from yesterday.

The central exchange rate has been declining consecutively in recent days.

The USD/VND exchange rate has cooled in recent days, aligning with expectations of a FED rate cut. Pressure on Vietnam’s exchange rate is expected to continue easing, with the FED projected to implement two more rate cuts by the end of this year and early next year.

According to VPS Securities, the FED’s rate cut aligns with market expectations. Additionally, the FED is anticipated to lower rates by another 0.5 percentage points by the end of this year and 0.25 percentage points in 2026.

Maybank Securities notes that the FED’s rate cut is a significant factor in alleviating pressure on the exchange rate. Coupled with strong supporting factors such as Vietnam’s sustained trade surplus, which provides a stable supply of foreign currency, and steady growth in FDI disbursements, which significantly bolsters the economy’s foreign currency reserves, these elements are expected to establish a robust foundation for exchange rate stability in the final months of the year.

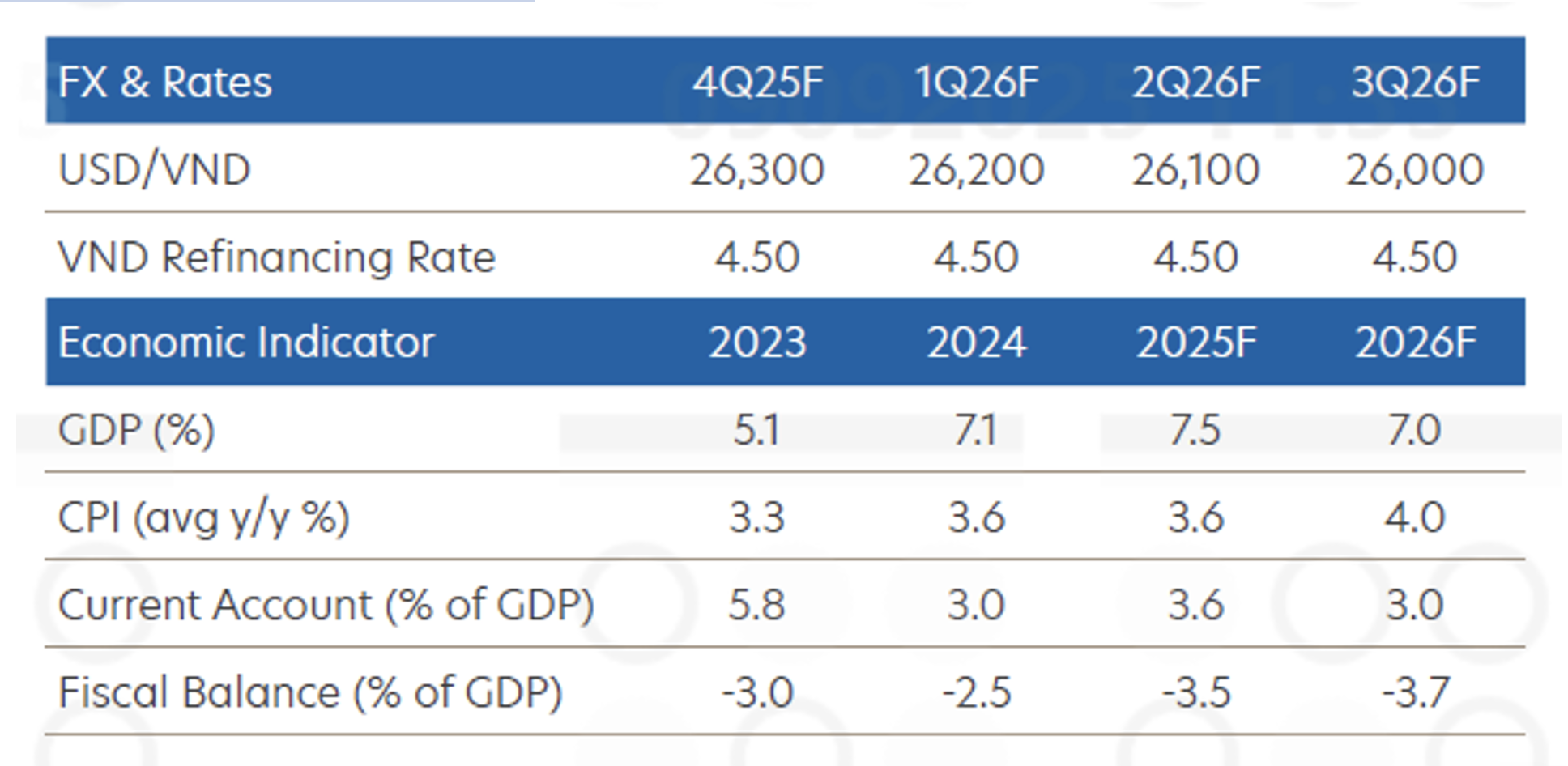

Latest Forecast on USD Prices in Vietnam

Experts from UOB Bank (Singapore) also predict that the FED will implement two more rate cuts, each by 0.25 percentage points, in October and December. They believe that the FED’s shift to a new easing policy phase will narrow the interest rate gap between the USD and major currencies, reinforcing the weakening trend of the greenback.

USD prices at commercial banks continue to drop following the FED’s rate cut.

For the USD/VND exchange rate, after rising approximately 3.4% since the beginning of the year, UOB Bank forecasts that the rate in Vietnam will reach 26,300 VND by Q4/2025, with downward pressure gradually easing in the subsequent period. In the long term, the VND remains stable, with the USD/VND rate increasing by about 14% from 2021 to the present (from 23,000 VND to 26,400 VND), averaging around 3% annually.

“This is a normal fluctuation compared to other regional currencies (over the past five years, Japan’s JPY has depreciated by 30%, South Korea’s KRW by 20%, and Indonesia’s IDR by 15%).

With this level of fluctuation, Vietnam continues to maintain positive major balances such as trade surplus, FDI attraction, and remittances,” said Mr. Dinh Duc Quang, Director of the Currency Trading Division at UOB Bank.

UOB Bank’s forecast for USD prices in Vietnam from now until 2026.

Brighter Consumer Spending Outlook Anticipated by Year-End

The consumer market outlook for the final quarter of the year appears promising. A survey conducted by UOB Bank reveals that Vietnamese consumers are optimistic about purchasing big-ticket items. Representatives from the VCBF Fund anticipate that the appreciating asset market will further boost consumer confidence.

Unlocking the 1,000-to-2 Ratio: Prof. Dr. Mạc Quốc Anh’s Blueprint for Fostering Entrepreneurship

According to Mr. Quốc Anh, Resolution No. 68 has delivered a significant boost by mandating a reduction of over 30% in administrative procedures, thereby creating new space and opportunities for private enterprises to thrive. Additionally, the banking system has committed to providing preferential capital and easing lending conditions to support the private business sector.