SHB Counter Deposit Interest Rates for September 2025

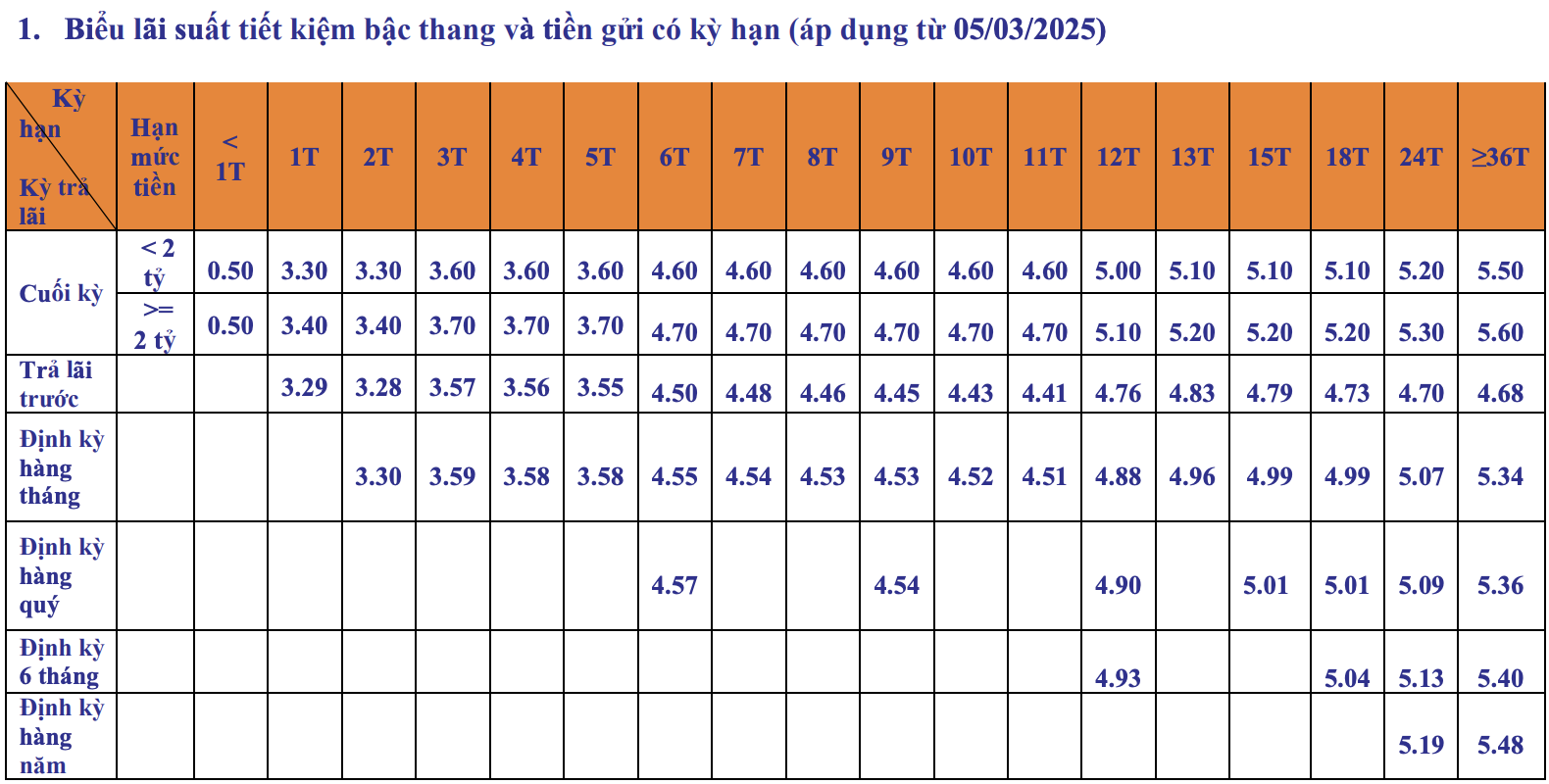

For customers depositing at the counter through the tiered savings program and receiving interest at maturity, SHB offers interest rates based on two deposit tiers: Under 2 billion VND and 2 billion VND or more.

For deposits under 2 billion VND, interest rates range from 0.5% to 5.5% per annum. Specifically, terms under 1 month earn 0.5%/year; 1-2 months 3.3%/year; 3-5 months 3.6%/year; 6-11 months 4.6%/year; 12 months 5.0%/year; 13-18 months 5.1%/year; 24 months 5.2%/year; and terms of 36 months or more offer the highest rate at 5.5%/year.

SHB Counter Savings Interest Rate Chart for September 2025

For deposits under 2 billion VND, interest rates range from 0.5% to 5.6% per annum. Specifically, terms under 1 month earn 0.5%/year; 1-2 months 3.4%/year; 3-5 months 3.7%/year; 6-11 months 4.7%/year; 12 months 5.1%/year; 13-18 months 5.2%/year; 24 months 5.3%/year; and terms of 36 months or more offer the highest rate at 5.6%/year.

In addition to interest paid at maturity, customers can choose from various payout options: Interest paid in advance; Monthly interest payments; Quarterly interest payments; Semi-annual interest payments; Annual interest payments.

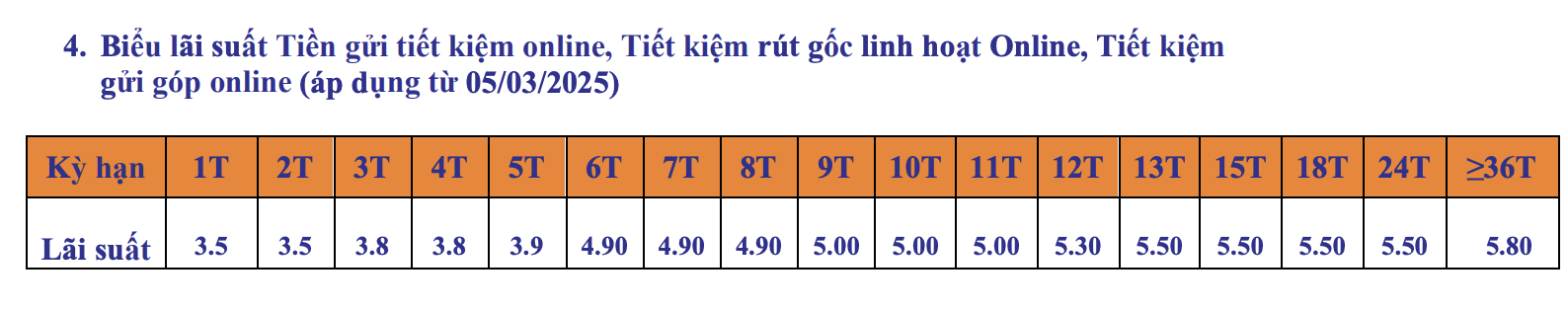

SHB Online Deposit Interest Rates for September 2025

For online deposits, SHB offers interest rates 0.1% higher than counter deposits for terms of 1 month or more, ranging from 3.5% to 5.8% per annum.

Specifically, 1-2 month terms earn 3.5%/year; 3-4 months 3.8%/year; 5 months 3.9%/year; 6-8 months 4.9%/year; 9-11 months 5.0%/year; 12 months 5.3%/year; 13-24 months 5.5%/year; and terms of 36 months or more offer the highest rate at 5.8%/year.

SHB Online Savings Interest Rate Chart for September 2025

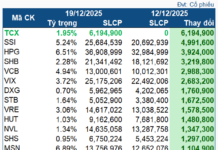

The Top Movers and Shakers in the Stock Market Today

The stock market is a dynamic and ever-changing landscape, and keeping track of the biggest movers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the stocks that have been making the most significant gains and losses in recent sessions. This information is pivotal for savvy investors looking to make informed decisions and stay ahead in the game.

[Infographic] A Mid-Year Review: Banking Sector Performance in 2025

In the first half of 2025, banks ramped up their digital transformation efforts and implemented supportive business policies, which drove credit growth. As a result, non-performing loans stabilized, and bank profits rose. With a host of economic stimulus policies coming into effect in the latter half of the year, a robust recovery is expected for the banking sector.

The Power of Compounding: Maximizing Your Savings with Strategic Deposit Rates in September 2025

“Savings accounts are a popular way to grow your money, and with interest rates on the rise, it’s an opportune time to explore your options. As of September 2025, Vietnamese banks are offering attractive rates on VND savings accounts, with interest rates ranging from 3.0%-6.0% p.a. This wide range of rates across different tenure options empowers customers to make informed choices and maximize their savings potential.”

![[Infographic] A Mid-Year Review: Banking Sector Performance in 2025](https://xe.today/wp-content/uploads/2025/09/info-ngan-hang-quy-2-150x150.jpg)