LPBank Securities Joint Stock Company (LPBS) recently announced Resolution No. 119/2025/NQ-HĐQT regarding the issuance of shares to existing shareholders. This resolution was approved at the Annual General Meeting of Shareholders (AGM) on April 24, 2025, under Resolution No. 04/2025/NQ-ĐHĐCĐ.

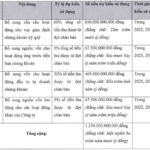

Accordingly, LPBank Securities will offer 878 million shares to its shareholders. The rights issue ratio is 1,000:2,258.23, meaning for every 1,000 shares held, shareholders are entitled to purchase 2,258 new shares.

Screenshot of lpbanks.com.vn

The offering is targeted at shareholders listed in the registry as of September 8, 2025. The subscription and payment period for the shares runs from September 15 to October 15, 2025, at 10:00 AM. Share purchase rights can be transferred from September 15 to October 10, 2025, at 5:00 PM.

Share purchase rights may only be transferred once, and the recipient cannot transfer them to a third party.

With an offering price of 10,000 VND per share, LPBS aims to raise 8,780 billion VND. The funds will be allocated as follows: 60% for investing in securities and deposit certificates, 30% for margin lending activities, and 10% for underwriting and other operations.

The capital utilization is planned from 2025 to 2026. Until the funds are deployed for margin lending, they will be invested in bonds and deposit certificates to ensure efficient capital usage.

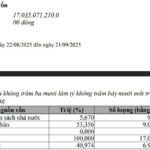

Upon completion of the offering, LPBS’s chartered capital will increase to 12,668 billion VND.

For 2025, LPBS targets revenue of 1,015 billion VND and pre-tax profit of 503 billion VND, both more than five times the 2024 results.

VNDirect Securities Plans to Issue Over 432 Million Shares, Aiming to Boost Capital to Nearly VND 20 Trillion

At the upcoming extraordinary general meeting, VNDirect’s Board of Directors will present to shareholders a revised plan for the private placement of shares, along with an additional proposal for a rights issue to existing shareholders.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.