Malaysian real estate firm SkyWorld has announced plans to invest 850 billion VND to acquire the Saigon – Thuan An Central commercial apartment complex project in Ho Chi Minh City, Vietnam.

Through its subsidiary, SkyWorld Vietnam, the company signed a Memorandum of Understanding (MoU) with Vina An Thuan Phat Co., Ltd. and its representative, Le Van Phong. SkyWorld aims to acquire the entire charter capital of the Vietnamese company along with associated benefits.

Vina An Thuan Phat Co., Ltd. was previously known as Ham Rong Co., Ltd.

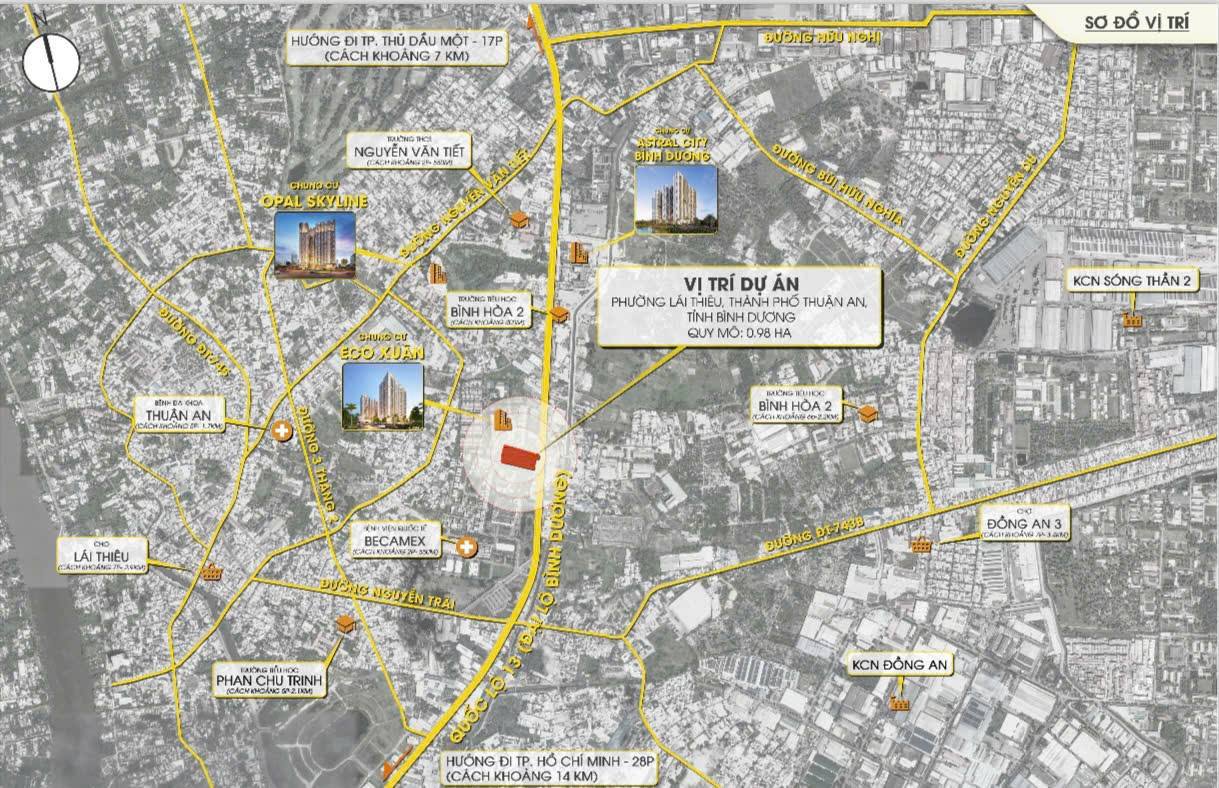

The project, spanning 9,443.5 m² in Lai Thieu Ward (formerly part of Binh Duong Province, now Ho Chi Minh City), is slated for a high-rise development. The proposed structure includes a 40-story building with 3 basement levels, offering 1,241 residential units.

According to SkyWorld, the project aligns with its development strategy and holds the advantage of a potential swift launch, as the 1:500 scale plan has already been approved.

In June 2025, the project was reportedly listed for sale at 900 billion VND, as per the Investment Newspaper. Several prominent companies, including Ha Do Group, Phu Dong Group, MIK Group, and Khai Hoan Land, expressed initial interest. However, upon learning of the price, they withdrew, citing that comparable land plots in the area were valued at approximately 300 billion VND.

At this price point, coupled with land use fees, construction costs, and other expenses, the new developer would need to sell units at 85 million VND per square meter to turn a profit. This contrasts sharply with the current market rate of around 45 million VND per square meter in the area.

Prior to this venture, SkyWorld made headlines in Vietnam with its September 2023 acquisition of 100% of the shares (1.7 million shares) in Thuan Thanh Commercial Production and Real Estate Business Corporation for 350 billion VND. At the time, Thuan Thanh was the sole legal user of a 2,060 m² plot in Ho Chi Minh City, which was mortgaged with LienvietPostBank – Ho Chi Minh City.

Where Will the New “Hotspot” of the Real Estate Market Be Post-Merger?

“According to the Vietnam Real Estate Brokers Association (VARS), Hai Phong, Da Nang, and Ho Chi Minh City are the three standout performers in the real estate market post-merger. These cities have witnessed a surge in property values and transaction activities, outpacing the broader market and attracting investors seeking lucrative opportunities.”

The New Heart of District 12: Unlocking the Potential of Northwest Ho Chi Minh City’s Infrastructure

In the evolving infrastructure landscape of Ho Chi Minh City, the northwestern region is emerging as the “new focal point.” Once considered peripheral, District 12, Hoc Mon, and Cu Chi are now reaping the benefits of strategic transportation infrastructure projects.