Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.1 billion shares, equivalent to a value of more than 34.2 trillion VND; the HNX-Index reached over 101 million shares, equivalent to a value of more than 2.2 trillion VND.

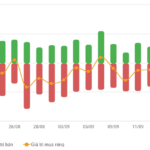

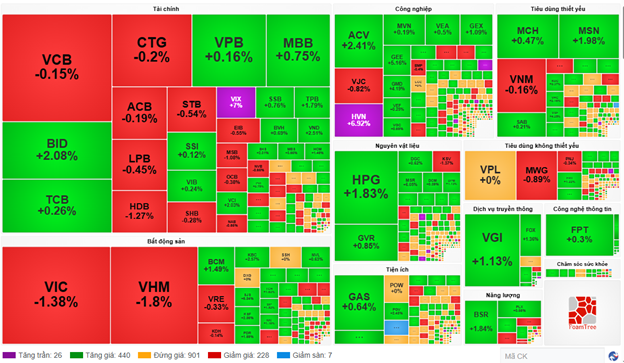

The VN-Index opened the afternoon session on a less favorable note as selling pressure continued to dominate, causing the index to adjust near the reference level. However, buyers quickly regained control, helping the VN-Index surge and close in optimistic green territory. In terms of influence, BID, CTG, HVN, and VIX were the most positively impactful stocks on the VN-Index, contributing over 5.7 points of growth. Conversely, VHM, HDB, VPB, and MSB faced selling pressure, reducing the index by more than 1.2 points.

| Top 10 Stocks Impacting VN-Index on September 15, 2025 (Calculated in Points) |

Similarly, the HNX-Index showed positive momentum, influenced by stocks such as HUT (+8.65%), KSF (+3.64%), MBS (+3.93%), and SHS (+2.31%).

|

Source: VietstockFinance

|

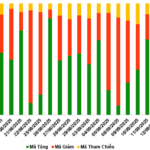

At the close, green dominated all sectors. The communication services sector led the market with a 2.56% increase, primarily driven by VGI (+2.97%), FOX (+1.52%), CTR (+3.82%), and YEG (+1.78%). The industrial and energy sectors followed with gains of 2.44% and 1.6%, respectively.

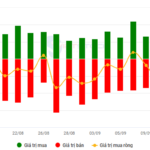

Foreign investors continued to net sell over 1.318 trillion VND on the HOSE, focusing on stocks like FPT (622.59 billion), HPG (178.13 billion), STB (123.44 billion), and SSI (119.22 billion). On the HNX, they net sold over 53 billion VND, concentrated in SHS (67.58 billion), IDC (26.9 billion), MBS (19.41 billion), and VFS (4.74 billion).

| Foreign Investors’ Net Buying and Selling Activity |

Morning Session: Maintaining Positive Momentum

While the Large Cap group showed mixed performance, strong demand in the Mid Cap group kept the market positive. The VN-Index paused at 1,674.13 points, up 0.41%; the HNX-Index rose 0.83% to 278.81 points. Market breadth favored buyers with 466 gainers (26 at the upper limit) and 235 decliners (7 at the lower limit).

BID and HVN were the most influential stocks on the VN-Index, contributing a combined 2.7 points of growth. Conversely, VIC and VHM exerted significant pressure, each reducing the index by approximately 1.7 points.

Green dominated most sectors. The industrial sector led with a 1.6% gain, driven by strong performances in transportation and construction stocks. HVN and CTD hit their upper limits, alongside accelerating stocks like GMD (+4.19%), VSC (+2.48%), HAH (+2.29%), ACV (+2.41%), VOS (+3.25%), HHV (+1.98%), and HBC (+2.56%).

The materials sector also attracted strong demand, with notable performances from HPG (+1.83%), NKG (+2.04%), HSG (+1.71%), MSR (+6.05%), DDV (+5.54%), NTP (+2.31%), HT1 (+4.11%), TVN (+6.98%), and KSB and SMC reaching their upper limits.

The financial sector showed mixed performance. While securities stocks traded positively, with VIX at its upper limit and VND, SHS, MBS, VCI, VDS, and BVS all up over 2%, most banking stocks remained flat or slightly down, preventing the sector index from breaking out. The real estate sector also faced challenges in the morning session due to significant pressure from Vingroup’s trio.

Source: VietstockFinance

|

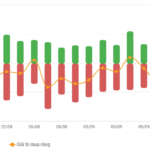

Foreign investors continued to net sell over 397 billion VND across all three exchanges in the morning. FPT and MWG were the most net-sold stocks, with values of 258 billion and 111 billion VND, respectively. Notably, VIX was the only stock with significant net buying, at 197 billion VND.

| Top 10 Stocks with Foreign Investors’ Net Buying/Selling in the Morning Session of September 15, 2025 (Calculated in Points) |

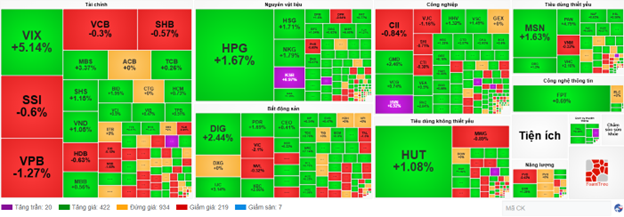

10:30 AM: Selling Pressure Reemerges

Short-term selling pressure emerged, narrowing the gains of major indices and leading to a slight tug-of-war. As of 10:30 AM, the VN-Index rose 3.46 points, trading around 1,670 points. The HNX-Index increased 1.8 points, trading around 278 points.

HPG and MSN positively impacted the VN30, contributing 2.78 points and 1.73 points, respectively. Conversely, VIC, VHM, VPB, and MWG faced selling pressure, reducing the index by 3.43 points, 1.81 points, 1.07 points, and 0.95 points, respectively.

Source: VietstockFinance

|

The industrial sector currently leads the market with a 1.57% gain, though performance remains mixed. Large-cap stocks like ACV (+3.27%), HVN (+6.92%), GEE (+5.63%), and GMD (+2.46%) drove the sector’s growth. Mildly declining stocks like VJC (-1.16%), GEX (-0.18%), and BMP (-0.4%) had minimal negative impact on the sector index.

The materials sector also showed positive momentum, following the industrial sector. Buying focused on steel stocks like HPG (+1.5%), HSG (+1.71%), and NKG (+1.79%); fertilizer stocks like DPM (+1.69%) and DCM (+0.64%); and chemical stocks like GVR (+0.34%) and DGC (+0.62%).

In contrast, the real estate sector faced selling pressure, with VHM (-1.61%), VIC (-2.03%), and NVL (-0.32%) limiting the sector’s growth.

Compared to the opening, buyers maintained control, with 422 gainers and 219 decliners.

Source: VietstockFinance

|

Opening: Positive Start to the Session

At the start of the September 15 session, as of 9:30 AM, the VN-Index rose slightly by 5.8 points to 1,673 points. The HNX-Index also increased by nearly 1.8 points to 278 points.

Green dominated the morning session, with several materials stocks rising from the opening, including HPG (+1%), KSB (+6.97%), and NKG (+2.04%).

Securities stocks also opened positively, with VIX (+5.29%), MBS (+3.93%), and SHS (+2.69%) leading the way.

Large-cap stocks like MBB, MSN, CTG, and VCB drove the index, contributing over 2 points of growth. Conversely, ACB, NVL, VPB, and STB weighed on the market, reducing the index by nearly 2 points.

Essential consumer stocks grew steadily, with green concentrated in large-cap stocks. Notable gainers included MSN (+2.44%), VNM (+0.32%), and VHC (+2.33%).

– 15:20 15/09/2025

Vietstock Daily 16/09/2025: Accelerating Growth Continues

The VN-Index extended its winning streak to a fifth consecutive session, successfully testing its short-term trendline (equivalent to the 1,630-1,645 point range). The index’s short-term outlook has turned more positive, with the Stochastic Oscillator generating a fresh buy signal. Momentum is expected to strengthen further if trading volume surpasses its 20-day average in upcoming sessions.

September 16, 2025: Optimism Spreads Across the Warrant Market

At the close of trading on September 15, 2025, the market saw 147 stocks rise, 79 decline, and 33 remain unchanged. Foreign investors continued their net buying streak, accumulating a total of 1.09 million CW.

Vietstock Daily 17/09/2025: Market Shakes at the 1,700-Point Threshold

The VN-Index retreated after facing profit-taking pressure at its August 2025 peak and early September 2025 highs (around 1,690–1,711 points). Volatility near this resistance zone is likely to persist in the short term. Should selling pressure dominate, the short-term trendline support (approximately 1,635–1,650 points) will be critical for the index.

Vietstock Daily 19/09/2025: Market Volatility Persists – Can Stability Be Regained?

The VN-Index swiftly narrowed its decline and closed just above the Middle Bollinger Band. This indicates that the short-term trendline (ranging between 1,645 and 1,660 points) continues to effectively support the index. However, with trading volume showing no signs of improvement, expectations for a short-term breakout or surge remain low.