|

Source: VietstockFinance

|

The primary pressure came from the real estate stock group. Among them, VIC and VHM were the leading codes weighing down the index. Alongside these were large-cap stocks such as HPG, MSN, VJC, BSR, GVR, and several bank stocks like VIB and VCB, which also contributed to the market’s decline.

However, the banking sector still played a crucial role in the index’s upward momentum. Stocks like MBB, CTG, TCB, SHB, and VPB were among the top performers driving the index higher.

Toward the end of the session, the financial sector lost its dominant green hue, giving way to mixed movements. While VPB, VIX, TCB, CTG, MBB, and SHB gained, SSI, VND, SHS, VCI, VIB, and VCB declined. The downturn in securities stocks dragged the financial sector lower compared to the start of the session.

A notable highlight in this group was the stock KLB, which hit its ceiling price today. Trading on the UPCoM floor, this stock surged by nearly 15%.

The materials and energy sectors were also among the hardest-hit today, with the decline primarily concentrated in steel and oil & gas stocks.

The total trading value across the market reached over 44.4 billion VND today. Liquidity showed a slight improvement compared to previous sessions, suggesting that capital may be returning after a period of caution.

Morning Session: Back to Tug-of-War

Toward the end of the morning session, the upward momentum significantly weakened. Market breadth was relatively balanced but tilted toward the selling side, with over 340 declining stocks and nearly 320 advancing stocks. The VN-Index closed the morning at 1,687.7 points (up nearly 3 points), while the HNX-Index dipped slightly by 0.2 points to 280.47.

The number of advancing and declining sectors was also quite balanced, with 12 sectors declining versus 11 advancing. Liquidity improved, with trading value exceeding 22.6 trillion VND.

Source: VietstockFinance

|

The essential consumer goods sector showed notable improvement. VNM demonstrated strong growth of over 3%, while HAG, VHC, and DBC also performed positively. DBC has seen an uptrend from 58,000 VND/share since late August.

In the technology sector, FPT, CMG, and ELC posted slight gains.

Real estate was the most negatively impactful sector on the index. Stocks like VIC, VHM, BCM, KDH, KBC, and VPI declined, exerting significant pressure. However, the sector still had bright spots, such as NVL, IJC, NLG, and VRE, which provided support. Overall, the sector’s trend leaned more toward mixed movements rather than a one-sided decline.

Foreign investors recorded a slight net sell of nearly 230 billion VND. During the morning, VIX saw net buying of 310 billion VND, while VPB faced the strongest net selling at nearly 163 billion VND.

10:40 AM: Financial Stocks Cool Down, VN-Index Narrows Gains

By mid-morning, the momentum from financial stocks had cooled. Pressure from other sectors narrowed the index’s gains. As of 10:35 AM, the VN-Index recorded an increase of only about 5 points.

Banking stocks remained the primary drivers of the index’s upward movement. MBB, CTG, TCB, VPB, VCB, and BID were among the top contributors, boosting the index by nearly 8 points.

The real estate sector showed mixed movements. Stocks like DIG, PDR, NVL, and IJC advanced, while KBC, DXG, SJS, KDH, and VIC declined.

In terms of sectors, red dominated over green. Sectors such as automotive & components, real estate, consumer services, insurance, and materials saw slight declines. The positive note was that no sector dropped more than 1%. The banking sector’s 1.2% increase, along with the broader green trend, was the main force keeping the HOSE index in positive territory.

Opening: Financial Stocks Lead, VN-Index Approaches 1,700

The market opened with a positive tone, and the VN-Index once again approached the 1,700-point mark. By 9:30 AM, the VN-Index maintained a 10-point increase, reaching 1,696.

The financial sector was the primary driver of the index’s gains, with green dominating. Stocks like VPB, VIX, CTG, SHS, MBB, TCB, and SSI led the charge, with gains ranging from 2% to 3%. VIX stood out with an impressive increase of over 5%.

According to the latest developments, a delegation from the Ministry of Finance held a meeting with the London Stock Exchange (LSE) on the morning of September 15, 2025 (local time), in London, UK. Minister of Finance Nguyen Van Thang stated that Vietnam has met all the criteria for an upgrade by FTSE Russell. This new information in the upgrade process is likely the main catalyst for the financial stocks’ upward trend.

The industrial, real estate, and materials sectors continued to show mixed movements, with real estate experiencing the largest decline among the sectors.

– 15:40 16/09/2025

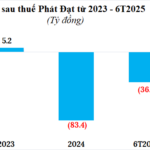

Phat Dat Corporation Reports Continued Losses in H1 2025, Debt Surpasses 11 Trillion VND

Real estate businesses continued to report losses in the first half of 2025, pushing accumulated deficits close to 115 billion VND. Meanwhile, their debt burden has ballooned, surpassing 11 trillion VND.

HQC Chairman Truong Anh Tuan to Transfer Hoang Quan Binh Thuan Shares to Atesco

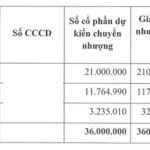

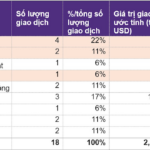

The Board of Directors of ATS Investment Group Corporation (Atesco, HNX: ATS) has approved a private placement plan to issue 36 million shares to nine individual investors. The offering price is set at VND 10,000 per share, half of the current market price, expected to raise VND 360 billion and increase the charter capital from VND 350 billion to VND 710 billion.

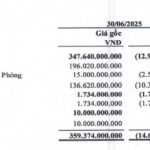

Becamex IJC Offers 251 Million Shares: Strategic Infrastructure Investment Amid Stable Economic Conditions

Becamex IJC’s offering of 251 million shares successfully raised over VND 2.5 trillion, fueling strategic infrastructure investments, strengthening financial resilience, and expanding growth opportunities as the economy stabilizes.