Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 967 million shares, equivalent to a value of more than 29.5 trillion VND; the HNX-Index reached over 79.4 million shares, equivalent to a value of more than 1.7 trillion VND.

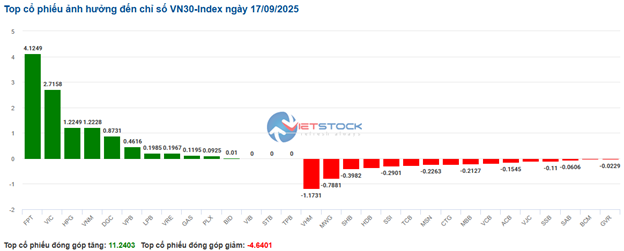

The VN-Index opened the afternoon session continuing its tug-of-war around the reference mark, but selling pressure gradually increased, causing the index to plummet and close in the red. In terms of impact, BID, VCB, CTG, and HPG were the codes with the most negative influence on the VN-Index, with a decrease of over 5.8 points. Conversely, VIC, FPT, GAS, and LPB were the codes that maintained their green status and contributed over 9.5 points to the overall index.

| Stocks with the strongest impact on the VN-Index |

Similarly, the HNX-Index also showed a rather pessimistic trend, with the index negatively affected by codes such as MBS (-2.19%), KSV (0%), NVB (-0.65%), CEO (-2.07%), and others.

| Stocks with the strongest impact on the HNX-Index |

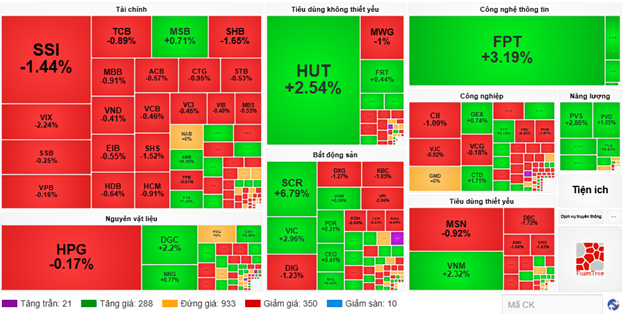

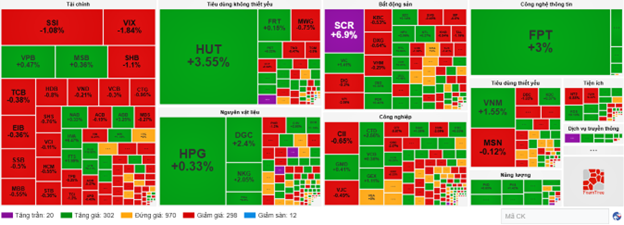

At the close, the market decreased by 0.42% with a mix of green and red across sectors. The materials sector saw the strongest decline at 1.53%, mainly due to codes such as HPG (-2.5%), GVR (-1.87%), DGC (-0.2%), and MSR (-3.57%). Following were the finance and non-essential consumer sectors with declines of 1.43% and 1.22%, respectively. Conversely, the real estate sector maintained its green status with the strongest market increase of 1.96%, primarily driven by codes such as SSH (+14.98%), VIC (+6%), VHM (+0.19%), and BCM (+1.01%).

In terms of foreign trading, foreign investors continued to net sell over 148 billion VND on the HOSE floor, concentrated in codes such as MSN (141.71 billion), VPB (92.81 billion), VHM (90.92 billion), and SSI (69.44 billion). On the HNX floor, foreign investors net bought over 17 billion VND, focused on codes such as PVS (29.55 billion), HUT (3.56 billion), TNG (3.04 billion), and VGS (2.92 billion).

| Foreign investors continue net selling |

11:30 AM: Continued fluctuation around the reference mark

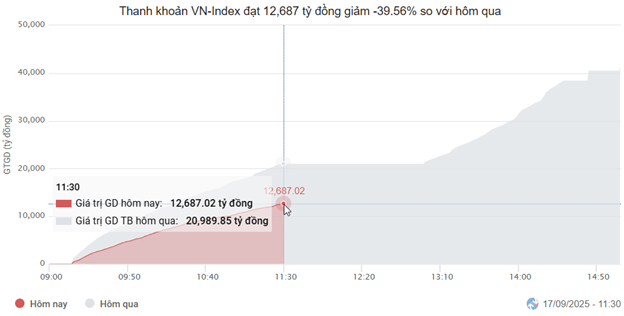

The VN-Index continued its tug-of-war around the reference mark at the end of the morning session. At the midday break, the VN-Index stood at 1,681.99 points, while the HNX-Index reached 279.48 points, up 0.18%. Market breadth favored selling, with 360 declining codes and 209 advancing codes.

Investor sentiment remained cautious, with the HOSE trading volume this morning reaching only over 419 million units, equivalent to 12.7 trillion VND, a nearly 40% decrease compared to the previous session. The HNX recorded a volume of over 88 million units, equivalent to 1.8 trillion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VIC contributed the most with 3.7 points. Following were FPT and VNM, which added over 2 points to the index. Conversely, CTG, VCB, and TCB were the three codes exerting the most significant pressure, collectively reducing the overall index by 1.7 points.

In terms of sectors, information technology continued to lead the market with a remarkable increase of 3.17%, with widespread green across codes such as FPT (+3.19%), CMG (+3.49%), ELC (+1.89%), DLG (+3.38%), VEC (+5.56%), and HPT (+3.82%).

Following closely, the communication services and real estate sectors also saw increases of over 1%, with strong buying in stocks such as ICT reaching its ceiling, VGI (+1.94%), FOX (+2.23%), CTR (+0.88%), TTN (+2.34%), SCR (+6.79%), VIC (+2.96%), and LDG reaching its limit.

Conversely, the finance sector recorded the most negative performance this morning, with most stocks covered in red, including SSI (-1.44%), VIX (-2.24%), TCB (-0.89%), MBB (-0.91%), SHB (-1.65%), CTG (-0.95%), and SHS (-1.52%).

Source: VietstockFinance

|

A positive note was the foreign investors’ strong net buying, with a value of nearly 422 billion VND across all three floors, primarily focused on FPT and MSB with values of 159.89 billion and 152.79 billion, respectively. Meanwhile, MSN led the net selling with a value of 105.63 billion VND, far surpassing other stocks.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of 17/09/2025 |

10:30 AM: Buyers and sellers engage in a fierce tug-of-war

Market breadth continued to show strong divergence, with prolonged fluctuations in the main indices. The VN-Index moved sideways around the 1,680-point mark as the two sectors with the largest market capitalization, finance and real estate, remained under selling pressure.

Stocks in the VN30 basket showed a slight dominance of red. Specifically, VHM, MWG, SHB, and HDB collectively reduced the overall index by 1.17 points, 0.78 points, 0.39 points, and 0.36 points, respectively. Conversely, FPT, VIC, HPG, and VNM maintained their green status, contributing over 9.2 points to the VN30-Index.

Source: VietstockFinance

|

The information technology sector maintained its positive momentum, leading the market with strong increases across codes such as FPT (+3.09%), CMG (+3.73%), and ELC (+2.1%).

In contrast, the finance sector exhibited a mix of green and red. On the selling side were VCB (-0.15%), SHB (-1.1%), CTG (-0.76%), and TCB (-0.13%), while a few codes maintained their green status, including BID (+0.12%), VPB (+0.47%), LPB (+0.22%), and BVH (+3.6%).

Similarly, the real estate sector showed strong divergence. Buying concentrated mainly on VIC (+1.93%), VRE (+0.98%), and SSH (+8.77%), while red persisted in VHM (-0.29%), BCM (-0.58%), and KDH (-0.15%).

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 970 codes remaining unchanged. Buyers gained a slight edge, with 302 advancing codes (20 reaching their ceiling) versus 298 declining codes (12 reaching their floor).

Source: VietstockFinance

|

Opening: Market continues to show divergence

At the start of the session on 27/09, as of 9:30 AM, the VN-Index increased slightly by over 1 point, trading around 1,682 points. The HNX-Index rose by 0.78 points, fluctuating around the 279-point mark.

Green dominated most sectors, with leading technology stocks such as FPT (+3.19%), essential consumer stocks like VNM (+1.24%), and materials stocks like HPG (+0.17%) showing increases.

Large-cap stocks such as VHM, VIC, and CTG weighed on the market, collectively reducing the overall index by nearly 1.7 points. Conversely, GAS, MWG, and BID led the upward trend, contributing to support the overall index, albeit weakly, with less than 1 point of lift.

– 12:00 PM, 17/09/2025

Bank Stocks and the Calm Before the Rating Upgrade Storm

Banking stocks, the backbone of the VN-Index, are entering a consolidation phase following a heated rally. Over 60% of banking codes have officially corrected from their peaks, yet several key players continue to buoy the market. This resilience is particularly notable as investors anxiously await the Fed’s interest rate decision and FTSE Russell’s market upgrade assessment in October. The contrasting dynamics within banking stocks thus serve as a critical litmus test for overall market sentiment.

Market Pulse 10/09: VN-Index Rebounds in Afternoon Session as Foreign Investors Ramp Up Net Selling

At the close of trading, the VN-Index rose 5.94 points (+0.36%) to 1,643.26, while the HNX-Index dipped 0.22 points (-0.08%) to 274.6. Market breadth favored the bulls, with 381 gainers outpacing 332 decliners. The VN30 basket showed a near-even split, with 14 advancers, 13 decliners, and 3 unchanged stocks.

Vietstock Daily 11/09/2025: Market Polarization Amid Low Liquidity

The VN-Index swiftly rebounded into positive territory after a volatile trading session. However, trading volume continued to decline, falling below the 20-day average, indicating prevailing caution among investors. In the upcoming sessions, the index must break above the Middle Bollinger Band while accompanied by improved liquidity to solidify its upward trajectory. Should selling pressure return, the short-term trendline (around 1,620–1,630 points) will serve as a critical support level.

Market Pulse 11/09: An Exciting Afternoon Session, VN-Index Rebounds 52 Points from Lows

In stark contrast to the morning session’s struggles, which saw the VN-Index dip below 1,606 points, the afternoon session painted an entirely different picture. The index staged a robust comeback, closing at 1,657.75, marking a significant gain of 14.49 points. The real estate sector, particularly Vingroup-related stocks, emerged as the driving force behind today’s impressive rally.

September 11th Stock Market: Opportunities to Invest in Banking, Retail, and Energy Stocks?

The trading session on September 10th witnessed several stocks attracting robust buying interest, presenting investors with a strategic opportunity to selectively allocate funds during the September 11th session.