As of the closing session on September 18, the VN-Index ended at 1,665.18, marking a decline of 5.79 points. Red dominated the HNX-Index as well, dropping 0.71 points to 276.92, while the UPCoM-Index fell 0.68 points to 111.1.

| Market Recovers in the Final Afternoon Session |

|

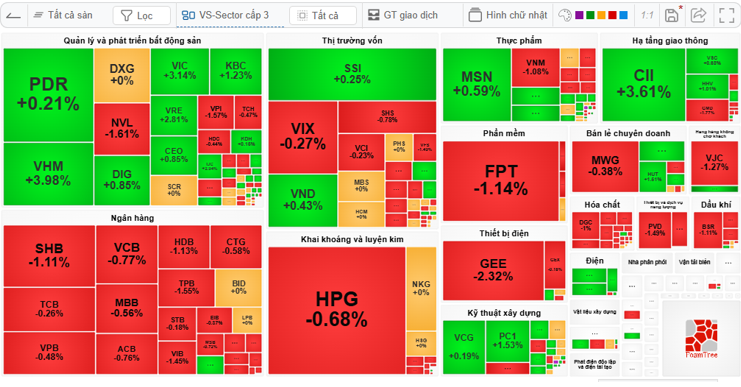

Source: VietstockFinance

|

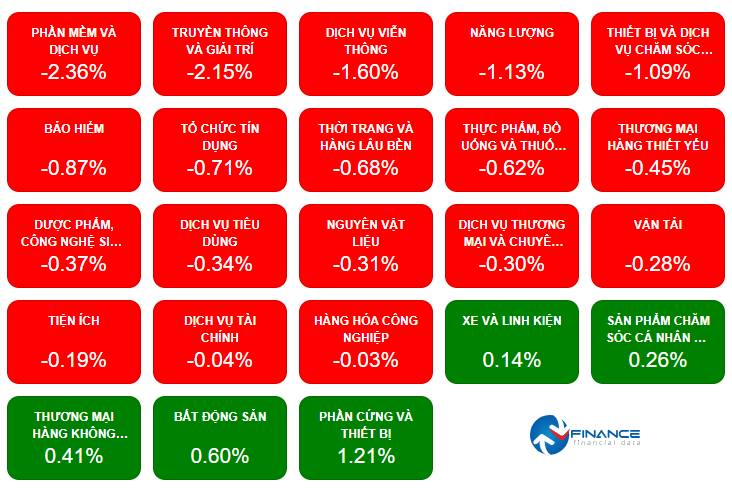

Market breadth favored decliners, with 447 stocks falling (including 11 at the lower limit) compared to 277 gainers (24 at the upper limit), and 877 stocks closing unchanged. The disparity was even more pronounced across sectors, with 18 out of 23 sectors declining. The software and services sector led the losses, down 2.36%, followed by media and entertainment, which fell 2.15%.

In the software and services sector, significant pressure from FPT (down 2.37%) and CMG (down 2.81%) weighed heavily on the sector’s index. For media and entertainment, VNZ (down 3.01%), YEG (down 1.43%), and FOC (down 1.21%) significantly impacted the sector’s negative performance.

Three other sectors also declined by over 1%, including telecommunications services (down 1.6%), energy (down 1.13%), and healthcare equipment and services (down 1.09%).

However, attention was drawn to sectors with smaller declines but larger market capitalizations, amplifying their influence.

Notable among these was the banking sector, down 0.71%, with VCB falling 1.39% and becoming the stock that deducted the most points from the VN-Index (1.73 points). Other banks also saw declines, including BID (down 0.49%), CTG (down 0.39%), MBB (down 0.74%), VPB (down 0.65%), SHB (down 1.11%), ACB (down 2.29%), and TPB (down 2.33%).

Rarer green spots in the sector included TCB (up 0.26%), LPB (up 0.22%), and STB (up 1.42%).

Other large-cap sectors that declined were insurance, materials, food and beverages, and securities.

|

Most Sectors Decline in the September 18 Session

|

By market capitalization, only the Small Cap index rose, up 0.07%. In contrast, the Large Cap index fell 0.36%, the Mid Cap index dropped 0.19%, and the Micro Cap index declined 1%.

In the derivatives market, VN30F1M fell 17.1 points to 1,856.6, creating a Basis of 5.14 points compared to the VN30-Index, which also dropped 7.11 points to 1,861.74. In today’s expiry session, market liquidity plummeted, with trading value reaching only 30.7 trillion VND.

Foreign investors were expected to reduce trading compared to the previous session, but only buying activity shrank to nearly 2.2 trillion VND, while selling increased to nearly 3.9 trillion VND. As a result, foreign investors net sold nearly 1.7 trillion VND today, extending their net selling streak to eight consecutive sessions.

| Foreign Investors Net Sell for Eight Consecutive Sessions |

Morning Session: Red Spreads Widely, VN-Index Closes Below Reference

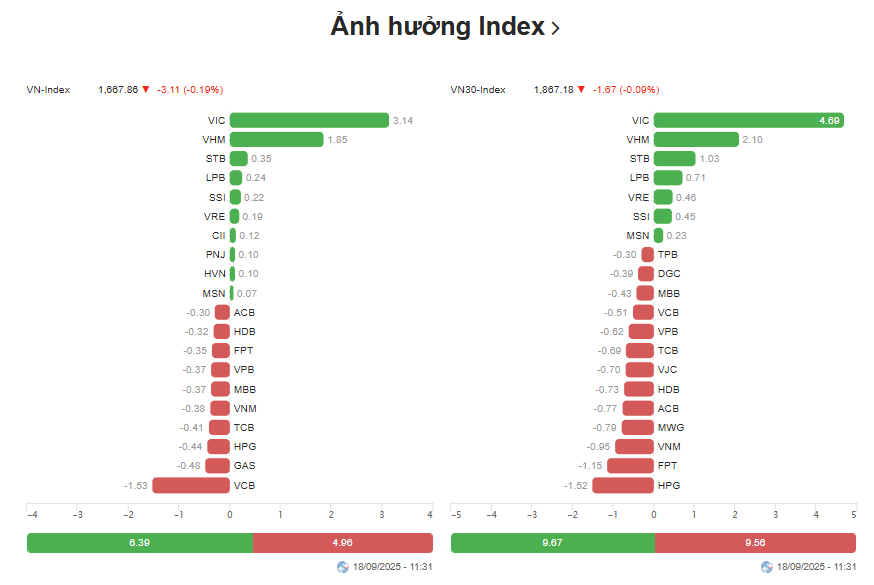

With 20 sectors declining and only 3 sectors rising, the market closed the morning session in the red. The VN-Index fell 3.11 points to 1,667.86, the UPCoM-Index dropped 0.5 points to 111.28, while the HNX-Index edged up slightly by 0.16 points to 227.79.

Among the 20 declining sectors, 6 fell by more than 1%. However, the declines in large-cap sectors like banking (down 0.64%) and securities (down 0.14%) were the primary drivers pushing the market below the reference level.

In the banking sector, red dominated, with notable declines in VCB (down 1.23%), TCB (down 0.65%), VPB (down 0.65%), ACB (down 0.96%), TPB (down 1.55%), EIB (down 1.12%), and MSB (down 1.43%). Rare green spots included LPB (up 0.77%) and STB (up 1.42%).

The securities sector fared slightly better, with SSI rising 1.11%, alongside several stocks closing at the reference level, such as VND and HCM. However, red remained dominant, with VIX (down 0.96%), SHS (down 0.39%), and ORS (down 2%) leading the declines.

Other large-cap stocks under pressure included HPG (down 0.86%), FPT (down 0.85%), VNM (down 1.23%), GEE (down 2.95%), VJC (down 1.27%), and PVD (down 1.7%).

Despite real estate rising 1.25%, it wasn’t enough to keep the market in the green. This was evident in the list of stocks most impacting the VN-Index this morning, with banking stocks deducting significant points, while real estate, specifically VIC and VHM, struggled to maintain gains.

Source: VietstockFinance

|

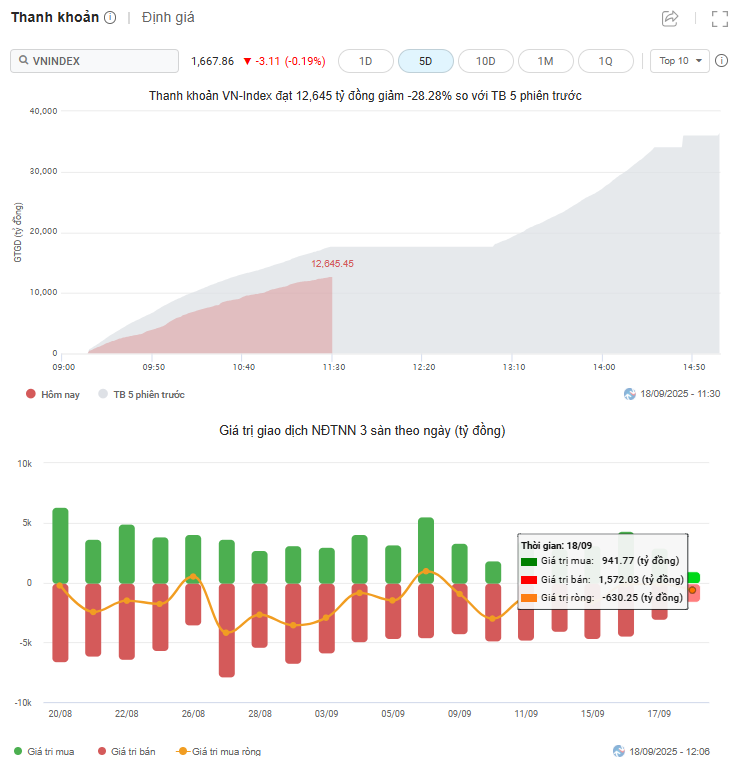

Liquidity saw over 492 million shares traded, corresponding to a transaction value of over 14 trillion VND. On the VN-Index, the 12.6 trillion VND traded was on par with the previous session but lower than recent averages, typical for a derivatives expiry session.

This pattern was also reflected in foreign trading, with buying and selling volumes falling sharply to 942 billion VND and 1.6 trillion VND, respectively, resulting in a net sell of over 630 billion VND.

Source: VietstockFinance

|

10:30 AM: Vingroup Stocks Rally to Support Index

The VN-Index maintained its green despite increasing broader market pressure. Real estate stocks, particularly the Vingroup trio of VIC, VHM, and VRE, provided crucial support to the index.

Source: VietstockFinance

|

As of 10:30 AM, the VN-Index remained green, rising 1.73 points to 1,672.7, despite briefly dipping below the reference level. The HNX-Index rose 0.18 points to 277.81, while the UPCoM-Index struggled, falling 0.28 points to 111.5.

Decliners (338) outnumbered gainers (231), but the real estate sector surged 2.16%, becoming a key support.

The standout performers in real estate were Vingroup stocks, with VHM up 3.98%, VIC up 3.14%, and VRE up 2.81%. These three stocks led in contributing points to the VN-Index, adding 3.74, 4.16, and 0.46 points, respectively, outperforming earlier in the session.

These stocks were also the most bought by foreign investors, with VHM seeing net buying of over 79 billion VND, leading the market. VIC followed with nearly 38 billion VND, and VRE with nearly 11 billion VND. MSN was also net bought, with over 18 billion VND.

Some stocks in food, transportation infrastructure, and retail also provided modest support to the market.

These positives were counterbalanced by declines in banking, securities, and materials sectors.

Opening: Slight Uptick

The September 18 session opened with optimism following the Fed’s rate cut, and green quickly appeared on the VN-Index, mirroring trends across Asian markets.

By 9:30 AM, the VN-Index rose 2.89 points to 1,673.86, slightly less enthusiastic than the opening minutes after the ATO. The HNX-Index also rose 0.28 points to 277.91, while the UPCoM-Index fell 0.25 points to 111.53.

Market-wide, there was a mix of gains and losses, with 16 stocks at the upper limit, 198 green, 200 red, 1 at the lower limit, and 1,186 unchanged.

Real estate led the gains, up 1.75%, with VIC rising 3.91% and VHM up 1.36%, contributing 2.94 and 1.35 points to the VN-Index, respectively.

Early session liquidity was subdued, with over 90 million shares traded, corresponding to nearly 2.4 trillion VND. Liquidity is typically lower on derivatives expiry sessions.

Asian markets also opened positively, with Hong Kong’s Hang Seng up 0.35%, Japan’s Nikkei 225 up 1.22%, and China’s Shanghai Composite up 0.53%.

– 15:50 18/09/2025

Vietstock Daily 16/09/2025: Accelerating Growth Continues

The VN-Index extended its winning streak to a fifth consecutive session, successfully testing its short-term trendline (equivalent to the 1,630-1,645 point range). The index’s short-term outlook has turned more positive, with the Stochastic Oscillator generating a fresh buy signal. Momentum is expected to strengthen further if trading volume surpasses its 20-day average in upcoming sessions.

September 16, 2025: Optimism Spreads Across the Warrant Market

At the close of trading on September 15, 2025, the market saw 147 stocks rise, 79 decline, and 33 remain unchanged. Foreign investors continued their net buying streak, accumulating a total of 1.09 million CW.

Vietstock Daily 17/09/2025: Market Shakes at the 1,700-Point Threshold

The VN-Index retreated after facing profit-taking pressure at its August 2025 peak and early September 2025 highs (around 1,690–1,711 points). Volatility near this resistance zone is likely to persist in the short term. Should selling pressure dominate, the short-term trendline support (approximately 1,635–1,650 points) will be critical for the index.

Vietstock Daily 19/09/2025: Market Volatility Persists – Can Stability Be Regained?

The VN-Index swiftly narrowed its decline and closed just above the Middle Bollinger Band. This indicates that the short-term trendline (ranging between 1,645 and 1,660 points) continues to effectively support the index. However, with trading volume showing no signs of improvement, expectations for a short-term breakout or surge remain low.