Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 863 million shares, equivalent to a value of more than 27.2 trillion VND; the HNX-Index reached over 67.4 million shares, equivalent to a value of more than 1.5 trillion VND.

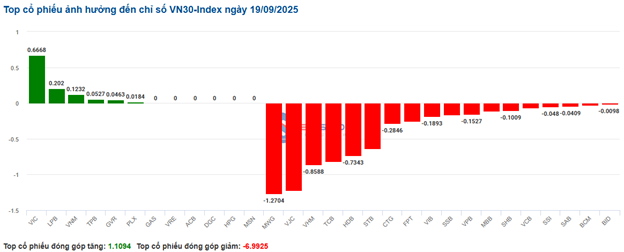

The VN-Index opened the afternoon session, although buying interest at lower prices reappeared, helping the index recover for most of the afternoon session. However, selling pressure still dominated, causing the VN-Index to close in the red. In terms of impact, VCB, VHM, BID, and HVN were the most negatively influential stocks on the VN-Index, with a decrease of over 6 points. Conversely, VIC, LPB, GEE, and NVL were the stocks that maintained their green status and contributed 9.7 points to the overall index.

| Top 10 Stocks Impacting VN-Index on September 19, 2025 (Calculated by Points) |

Similarly, the HNX-Index also showed a rather pessimistic trend, with negative impacts from stocks such as HUT (-5.47%), IDC (2.36%), SHS (-0.79%), VCS (-1.93%), and others.

| Top 10 Stocks Impacting HNX-Index on September 19, 2025 (Calculated by Points) |

At the close, red dominated most industry groups. The energy sector saw the strongest decline, at 1.68%, primarily due to stocks like BSR (-3.17%), PLX (-0.7%), PVS (-0.58%), and PVD (-1.09%). Following were the finance and communication services sectors, with declines of 1.08% and 0.68%, respectively. Conversely, the real estate sector was the only one to maintain its green status, with the strongest market increase of 1.5%, mainly driven by VIC (+5.66%), NVL (+5.63%), KDH (+2.69%), and DXG (+0.44%).

In terms of foreign trading, foreign investors continued to net sell over 2,763 billion VND on the HOSE, concentrated in stocks like VHM (467.37 billion), SSI (295.74 billion), STB (282.86 billion), and VIX (202.08 billion). On the HNX, foreign investors net sold over 211 billion VND, focused on SHS (93.75 billion), HUT (59.8 billion), IDC (28.75 billion), and CEO (14.66 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: VN-Index Retreats to Near 1,650 Points

Increased selling pressure caused major indices to remain in the red by the end of the morning session. At the midday break, the VN-Index dropped sharply by 14 points (-0.84%), to 1,651.14 points; meanwhile, the HNX-Index reached 277.37 points, up slightly by 0.16%. Market breadth favored sellers, with 405 declining stocks and 287 advancing stocks.

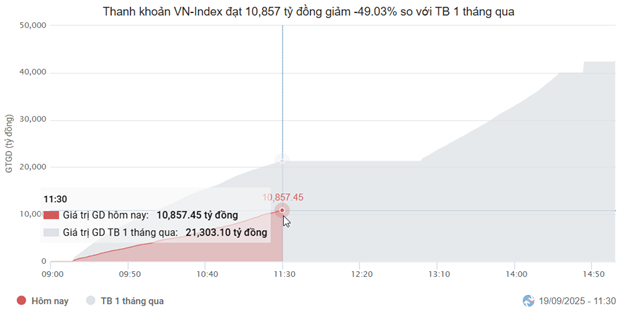

Market liquidity showed no signs of improvement. The trading value of HOSE this morning reached nearly 11 trillion VND, down 14% from the previous session and nearly 50% from the one-month average at the same time. HNX also recorded a volume of over 23 million units, equivalent to over 618 billion VND.

Source: VietstockFinance

|

Among the top 10 stocks influencing the VN-Index, VHM was the most negatively impactful, taking away 2.7 points from the index. Conversely, the total of the 10 most positively influential stocks contributed less than 1 point to the overall index.

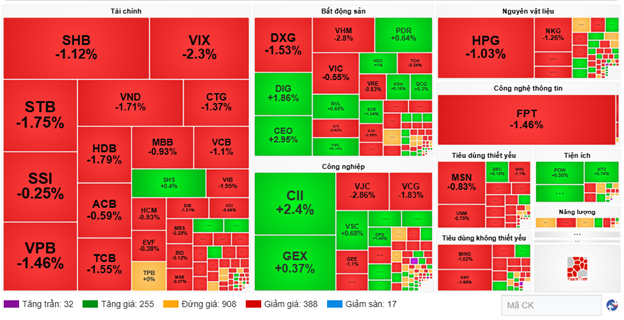

Red dominated most industry groups. The information technology sector saw the strongest decline, with leading stocks FPT and CMG both under strong selling pressure, falling 1.46% and 0.84%, respectively.

Additionally, large-cap sectors like real estate and finance weighed heavily on the overall index, declining 1.03% and 0.92%, respectively. Most stocks were in the red, including VHM (-2.8%), BCM (-1.16%), VRE (-0.83%), DXG (-1.53%), SJS (-3.55%), VPI (-3.42%); VCB (-1.1%), TCB (-1.55%), CTG (-1.37%), VPB (-1.46%), STB (-1.75%), and HDB (-1.79%).

On the other hand, utilities were the only sector to maintain a faint green, thanks mainly to contributions from stocks like POW (+0.98%), HDG (+0.95%), DTK (+0.84%), TDM (+1.53%), and NT2 (+3.74%). Meanwhile, most other stocks were either at the reference price or under strong profit-taking pressure, such as GAS (-0.32%), HND (-0.86%), SBH (-2.63%), BGE (-3.51%), and HPW, which hit the floor.

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of nearly 1.2 trillion VND across all three exchanges. Selling pressure was concentrated in FPT, with a value of 201.07 billion VND. Meanwhile, leading the net buying list were HVN and DIG, with values of 25.54 billion and 23.21 billion, respectively.

| Top 10 Stocks Net Bought/Sold by Foreign Investors in the Morning Session of September 19, 2025 |

10:40 AM: Finance Sector Remains Weak, VN-Index Struggles at 1,660 Points

As of 10:30 AM, green dominated the market, but low liquidity persisted, causing continued divergence and mixed movements in the two main indices. Specifically, the VN-Index continued to hover around the reference point, down more than 2 points. The HNX-Index also fluctuated, up nearly 1 point. Positive contributions to the overall rise were still seen in the materials and energy sectors.

The breadth within the VN30-Index was dominated by red. Notably, on the negative side, MWG, VJC, VHM, and TCB took away 1.27 points, 1.22 points, 0.85 points, and 0.81 points from the VN30 index, respectively. Conversely, stocks like VIC, LPB, VNM, and TPB were among the few to maintain green and contribute over 1 point to the overall index.

Source: VietstockFinance

|

Compared to the opening, the finance sector continued to turn negative, putting pressure on the overall market, with red appearing in most stocks like VCB (-0.16%), BID (-0.25%), TCB (-0.77%), VPB (-0.16%), MBB (-0.37%), ACB (-0.2%), and others. However, some stocks still maintained green, such as LPB (+0.22%), TPB (+0.53%), VCI (+0.23%), SHS (+1.19%), and others.

Conversely, the industrial sector continued to support the index with positive green in several stocks. Notable gainers included GVR (+0.52%), MSR (+1.86%), DCM (+1.05%), and DPM (+0.75%).

Additionally, the energy sector, though still showing strong divergence, saw buying interest dominate. Specifically, buying was concentrated in PLX (+0.14%), PVS (+0.58%), PVD (+0.22%), PVT (+0.82%), and others.

Compared to the opening, buyers continued to dominate, with 310 advancing stocks and 256 declining stocks.

Opening: Blue Chips Curb VN-Index Rally

At the start of the session on September 19, as of 9:30 AM, the VN-Index continued to hover around 1,665 points. The HNX-Index rose slightly to 277 points. Notably, the VN30 basket of stocks showed a gradual shift toward red, simultaneously curbing the overall market.

The opening was not very favorable, as the two large sectors, finance and real estate, continued to show divergence, with selling pressure dominating in large-cap stocks like SSI (-0.12%), TCB (-0.52%), VPB (-0.49%), DXG (-0.87%), VIC (-0.83%), VHM (-0.58%), and others.

The materials sector was among the top performers in the opening session, with HPG (+0.17%), GVR (+0.69%), DGC (+0.2%), DPM (+0.75%), DCM (+0.65%), and others.

The communication services sector also contributed significantly, with major players in green, including VGI (+0.56%), CTR (+0.22%), YEG (+0.72%), SGT (+0.85%), and others.

– 15:20 19/09/2025

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

VN-Index Projected to Reach 1,854 Points by Year-End, Yet Volatility Remains Inevitable

The broader domestic and global macroeconomic landscape, coupled with the impending stock market upgrade narrative, serves as a powerful catalyst fueling the market’s upward trajectory.