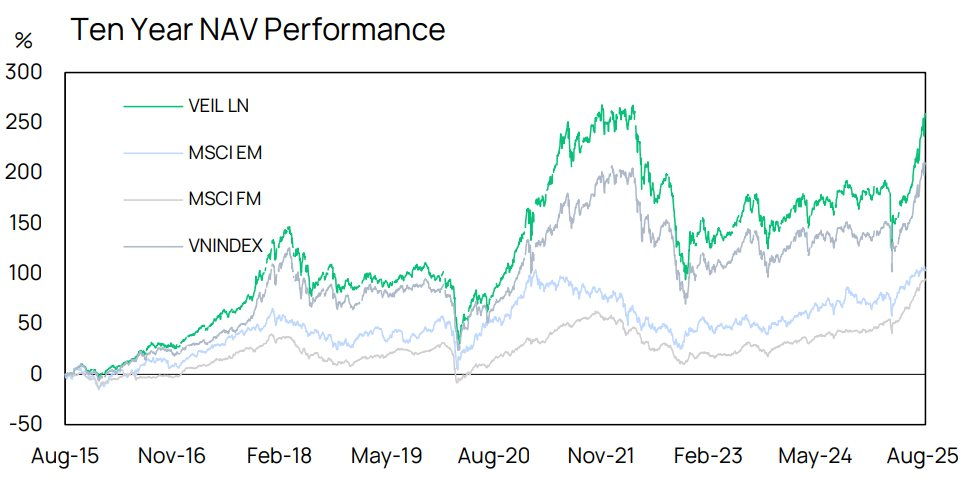

As reported by Vietnam Enterprise Investments Ltd (VEIL), the largest foreign fund in Vietnam’s stock market, as of the end of August 2025, the fund’s net asset value reached over $2.07 billion, marking a 14.6% increase from the previous month and outperforming the VN-Index’s 11.5% growth.

This marks the second consecutive month that VEIL has outperformed the benchmark VN-Index. The fund attributes its positive performance to its focus on sectors benefiting from the credit cycle, real estate recovery, and increased market liquidity.

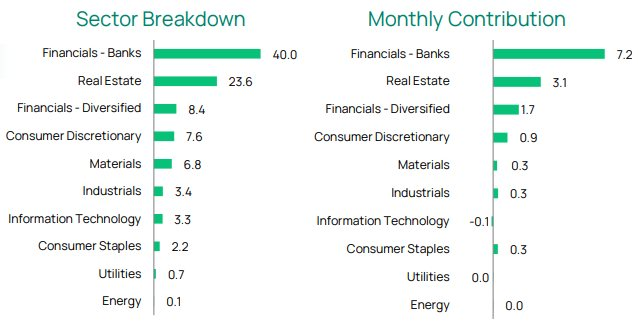

Banking stocks were the primary drivers of VEIL’s performance in August, with VPB leading the charge, surging nearly 35%. This growth is attributed to rapid credit expansion, improved asset quality, and stronger-than-expected Q2 results, alongside anticipation of VP Bank Securities’ potential IPO later this year.

MBB also saw a significant rise of nearly 34%, supported by dividend announcements and substantial improvements in asset quality. VEIL highlights MB’s proactive provisioning in Q2, reducing NPLs (particularly Group 2 loans) and increasing LLR coverage, indicating a cleaner balance sheet and stronger prospects for the second half of 2025. This has led to a robust revaluation, with P/B rising from 1.3x to 1.8x in just one month.

TCB gained 15% in August, reflecting its extensive corporate banking operations, improving fee income, and a rebound in real estate loan demand. Together, these core holdings reinforce VEIL’s confidence in banks as key beneficiaries of Vietnam’s credit cycle and broader financial reforms.

The residential real estate sector was the second-largest contributor to VEIL’s portfolio, rising 3.1%. KDH and DXG led the gains with 32.5% and 14.5% increases, respectively, supported by strong absorption rates in newly launched projects such as DXG’s Prive ($415 million) and KDH’s flagship Gladia ($385 million).

The securities sector also benefited from record-high daily trading volumes and all-time high margin loan balances. VEIL highlights SSI, which rose nearly 23%, as a brokerage well-positioned to capture both retail activity and potential passive inflows linked to market upgrades and crypto asset products.

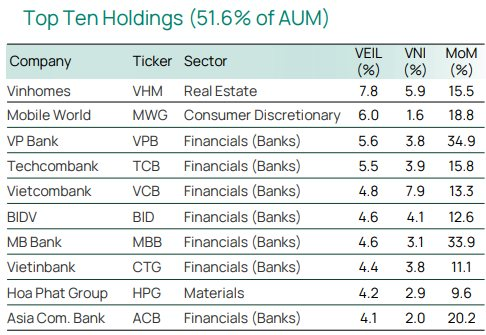

Year-to-date, VEIL’s performance stands at 26.6%, slightly underperforming the VN-Index’s nearly 30% gain in USD terms. As of August, VEIL’s top 10 holdings, including VHM, MWG, VPB, TCB, VCB, BID, MBB, CTG, HPG, and ACB, account for over half of its total assets.

Sector-wise, banks represent 40%, real estate 23.6%, diversified financials 8.4%, consumer discretionary 7.6%, and materials 6.8%.

Confidence in Vietnam’s Stock Market Growth Potential

VEIL forecasts Vietnam’s 2025 GDP growth at 8%, average inflation at 4.2%, lending rates around 8.4%, and the VND/USD exchange rate at approximately 26,500.

The fund expresses strong confidence in the growth potential of Vietnam’s stock market, emphasizing its readiness to capitalize on investment opportunities across three key areas: (1) real estate project launches, (2) market upgrade progress, and (3) upcoming IPOs.

In an earlier report, Dragon Capital noted that the IPO market has rebounded with positive signals. This information fueled a mid-August revaluation of brokerage stocks, reflecting the sector’s sensitivity to major listing events. The fund suggests that upcoming IPOs could serve as catalysts for the market.

Dragon Capital observes that market momentum and liquidity remain robust, though short-term corrections are possible due to factors like profit-taking, trade volatility, geopolitical tensions, or currency risks. Both macro and sector indicators paint a positive picture for the market.

VPBank Securities Experts: Anticipating a Stock Market Surge Following Key Announcement

With the upgrade information, experts believe that the late August and September period has already been factored into the market, tempering the upward momentum. However, as the release date approaches, the impact is expected to intensify.

Market Pulse 15/09: VN-Index Surges Over 17 Points, Extending Positive Momentum

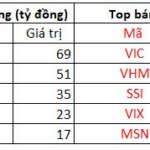

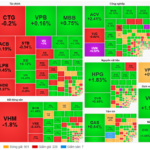

At the close of trading, the VN-Index surged by 17.64 points (+1.06%), reaching 1,684.9 points, while the HNX-Index climbed 4.18 points (+1.51%) to 280.69 points. Market breadth favored the bulls, with 507 gainers outpacing 233 decliners. Similarly, the VN30 basket saw green dominate, as 22 stocks advanced, 6 retreated, and 2 remained unchanged.

Market Pulse 18/09: Late-Session Rally Averts Sharp Decline

Vietnamese stocks concluded a challenging trading session on September 18th, with losses potentially deepening had it not been for late-session efforts to stabilize the market.